I understand that in order to feel comfortable when investing, its important to understand what youre investing your hard earned fiat in. So, with that said, im going to try to compile a basic, yet comprehensive guid on the benefits and importance of diversifying some of your portfolio into precious metals. When investing in precious metals, there are lots of market terms to understand, many products to assess and multiple ways to invest. In a few short posts, ill try to help you gain an informed understanding of this increasingly popular area of investment. As these blogs progress, ill attempt to enlighten and inform anyone wanting to expand their knowledge and to help you build a fuller understanding of precious metals investment. From the off, this is just the ramblings of an uneducated, unvaxed slob, who wishes to try and dispense what little experience hes gained over the years - this is not to be intended as financial advice. Before investing your capital, remember that prices can go up as well as down.

Lets kick this off by reminding you that precious metals have been sought-after through the ages. They have been used as symbols of status and wealth in many civilisations, across ALL continents, since they were first discovered millenia ago.

The chemical symbol for gold, Au, comes from the Latin word ‘aurum’, meaning ‘glowing dawn’. The ancient Greeks thought gold was a compound of water and sunlight, while the Egyptians believed gold was the flesh of gods, particularly of the Sun god, Ra, and they used it as currency as early as 1500BC. Let that sink in.... For over 3,500 years GOLD has been used as not only a store of wealth, but as a method of transferring value. Its outlasted sea shells, coloured rocks, tullips, beads, salt, cocoa beans and everything else that has been used as "money" since humans first started trading commodities

The chemical symbol for silver, Ag, comes from the Latin word ‘argentum’, which means ‘grey’ or ‘shining’. It has been valued as an elegant and precious metal for thousands of years. First used to produce coins circa 700BC, silver is valued for its quality, longevity and strength. Because of its comparative scarcity, brilliant white colour, malleability, ductility, and resistance to atmospheric oxidation, silver has long been used in the manufacture of coins, ornaments, and jewelry.

Precious?

SOURCE

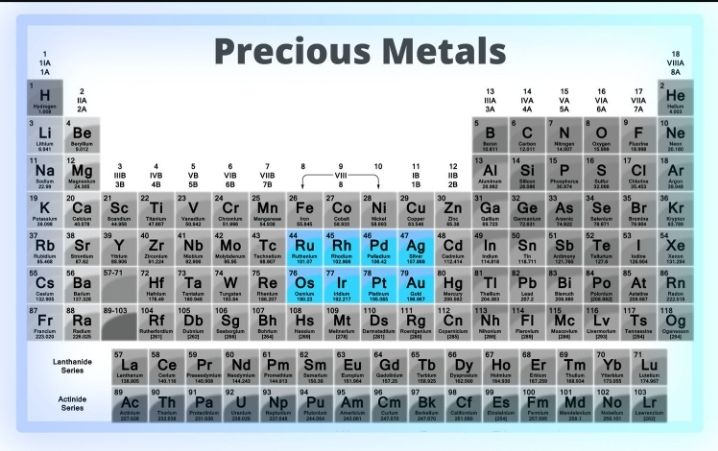

Everyone has heard of gold and silver, which have both been used as currency and turned in to objects of art since before recorded history began. However, there are lesser known precious metals that should be considered and potentially added to a diverse precious metals portfolio. The platinum group of elements (platinum itself, palladium, iridium, osmium, rhodium and ruthenium) are also important precious metals. But what makes all of these metals special? Is it simply their rarity, beauty and utility?

DEFINITION- Precious metals are defined as rare, naturally occurring metals that are highly sought after for economic reasons.

It might be better to say that a precious metal is one that is considered valuable and desirable not only because it serves as a universally recognised unit of wealth, but also as a material whose value can be increased further by being made into art, jewellery or even coins, such as gold bullion.

When defining precious metals, there are three main areas that are often referenced when discussing what actually constitutes a precious metals:

- It must be a naturally occurring metallic element

- It must be rare

- It must be considered valuable

SOURCE

The most expensive are at once very rare and very useful. Gold and platinum definitely count as contenders for the number one spot. Silver may be more useful industrially, but it is somewhat less rare, so less precious. There is also no direct correlation between scarcity and price.... for example, silver comes out of the ground, at a rate of 9:1 to gold mined- 9 times more silver is mined per year than gold, yet the current price ratio for an ounce of gold to silver is 76:1. Meaning that gold is currently valued at approximately 76X that the proce of silver(per ounce).

Gold and SilverInvestment!

Gold and silver coins and bars are collected by many as a way of investing and protecting their wealth. The ownership of physical gold and the ability to touch it, to hold it, and even the freedom to protect it or move it from place to place, never seems to lose its appeal. Although people will have their own reasons to invest in gold and/or silver, for most, precious metals investment is about preserving and protecting your wealth.

With inflation "officially" reaching 40yr highs (unofficially much higher), in terms of wealth preservation, around £200 would have bought you an ounce of gold towards the end of 1990. If you had bought an ounce of gold and kept £200 as fiat under your mattress, the gold would now be worth around 600% more. However, the cash would not have increased in value and, due to inflation, would actually be worth less. In essence precious metals preserve your purchasing power over time better than anything else in history.

Traditionally, gold is seen as a ‘safe-haven’ investment, and with good reasons. When other markets fall, the gold price often rallies, dragging the price of silver up with it. In times of market volatility where stocks and shares plummet, part of this decrease is due to investors moving away from ‘riskier’ assets into the safe haven of gold.

SOURCE

There are a multitude of ways to add gold and other precious metals to your portfolio. Traditionally, gold and silver may have only been available in coins, bars or jewellery, the introduction of digital trading platforms has allowed easier access to precious metal markets. Whilst, even I as a physical holder, can see the benefits of "digital" gold for short term trading, the old adage of "IF YOU DONT HOLD IT, YOU DONT OWN IT" stilll rings true for precious metals as well as cryptocurrency.

Gold and silver coins are available in a wide range of sizes and designs from established precious metal dealers, such as The Royal Mint, the US mint, the Canadian mint, the Mexican mint and the Australian Mint. Purchasing direct from your local mint does offer peace of mind when it comes to quality and purity, second hand markets like Ebay are a little more riskier, but prices are cheaper. You are able to purchase coins and bars either in single quantities or even in tubes of multiples. With multiple sizes(weights) available, some of the smaller coins may prove a lower barrier to entry. The 1/10th ounce gold coins are cheap enough for most, but do carry higher premiums, but are a great way to begin your precious metals journey. Of course, the downside of physical coins and bars over less tangible investments like stocks and shares are that you have to store them somewhere, as you must ensure they are safe from theft or damage.

What is Spot Price -The spot price is the current price in the marketplace at which a given asset—such as a security, commodity, or currency—can be bought or sold for immediate delivery. While spot prices are specific to both time and place, in a global economy the spot price of most securities or commodities tends to be fairly uniform worldwide when accounting for exchange rates.

INVESTOPEDIA

All forms of precious metal investments are priced in a similar way. The price you pay is based on the ‘premium’ of the product plus the spot price of the precious metlas content. The "premium" is the cost which is charged for the product over the gold or silver price of the metal which it contains. Due to economies of scale, smaller products tend to cost slightly more to manufacture, this means that the premium on smaller products tends to be higher. So, even though a 1g gold bar would be far far far cheaper than a 100g gold bar, the actual percentage charged on the smaller bar, over the price of the gold it contains, is slightly higher. Put simply, it would be cheaper to buy a single 100g gold bar than it would be to buy 100 x 1g gold bars.

SOURCE

One of the benefits of gold amd silver bullion is that it doesn’t matter where you are in the world, or which precious metals product you own, there will always be a market for it. Gold is one of the few commodities which is truly universally recognised and prized and, as such, you can sell it anywhere. Get stuck in any foreign country with some paper fiat and a gold ring and watch how quickly you can sell your jewellery, but how youll need to go to a specific location to exchange your fiat.

Selling your precious metals usually involves your local cash-for-gold dealer weighing and authenticating the items, and then offering you a price which is a percentage of the gold price within. Depending on the individual dealer, this percentage will differ (sometimes greatly), so it is important you request a price at multiple locations to ensure you are getting the best possible price. With gold prices bouncing around the $2000/oz, and expected to rise as the realisation of inflation hits the masses, buying now and holding for a few years cant do you any harm, and might even in fact prevent you from becoming completely broke.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or #actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.