We are in a very interesting and unexpected season with regards to the crypto market. It is clear that, the bears are currently driving the market crazy, and this is very disturbing if you already have accumulated more of your favorite coins with the hope that the market will not dip further like it is doing now, you will end up staring at the lower prices multiple times now without any funds to buy more . The unfortunate thing is that, most of us currently do not know the next possible move of the market. Alts are going crazy as BTC fall below $23000, the last time we experienced this kind price of BTC was December 2021.

Source

Ethereum as the biggest alt coin is also not left out in this plunge. The total marketcap of the crypto market fall below $1trillion. Taking a look at all this happenings, you will realize that, the strong hands are seriously accumulating, this should serve as a lesson to noobs like me who have joined the crypto space just recently.

The first lesson I learnt from the market is to always set targets and be grateful when your targets are achieved. I was taught by my mentors that the market has no mercy for greedy folks, and yeah, we are seeing it now. In the first place, you have to understand yourself as to whether you are a trader or an inventor. Even though you can decide to be both an investor and a trader at the same time, you have to play your cards very well and extra care needs to be taken. Before you go into any trade or investment, you have to set your targets well, which clearly states your entry and exit criteria. For scalpers, always set your target for the day and when the target is achieved, it's better to leave the position and plan your next move.

Long-term holders should also be practicing dollar cost averaging to be able to accumulate more in situations like this.

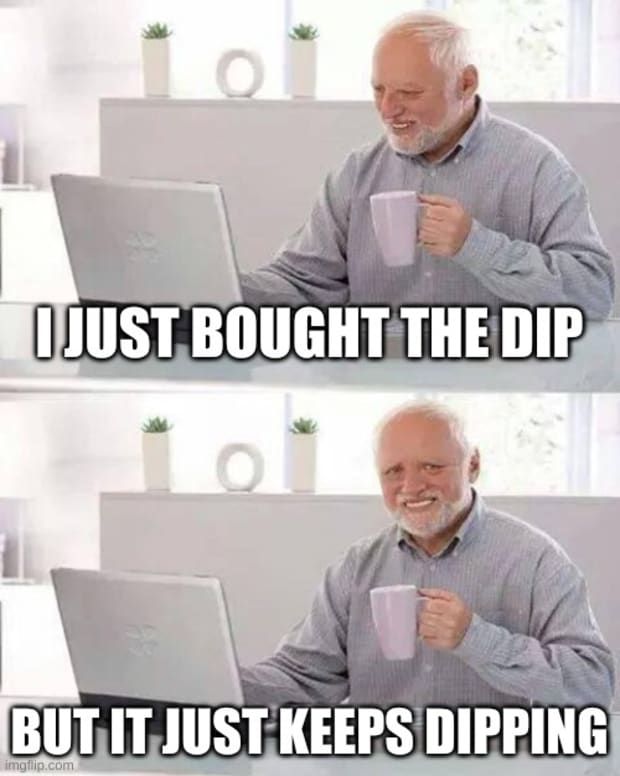

A meme from twitter

Another thing I have realized is that the crypto influencers are not saints. There are a lot of individuals on the various social media platforms, especially crypto twitter and they share their ideas about the crypto space. Some of them turn out the expected way, but in most cases, you will end up at a loss if you depend on them blindly. Hence, to be safe, invest more in your knowledge to the extent that you can do your own research in order to be able to trade or invest with confidence. This will reduce your losses and you will be able to manage your survival in bear markets.

In conclusion, the two important points I have stated in this write-up are that it is all about trading with extreme care and doing your own research. Thanks for reading and have a nice day.