Exchanges expect to widen their offerings next year for each institutional and retail shoppers.

The rise of PoS cryptoassets comes with the potential to feature new services.

DeFi-based services may also gain a lot of traction, since they provide the potential for higher returns.

We’re doubtless to examine a lot of exchanges list internet three.0-related tokens.

Exchanges fair in compliance could notice themselves progressively isolated.

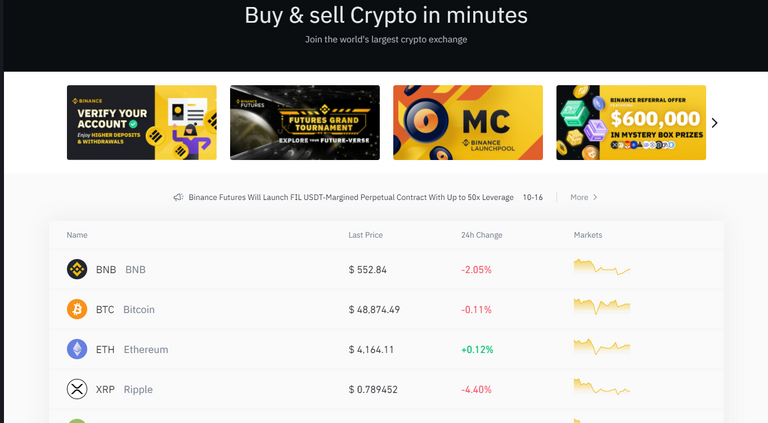

For many folks, exchanges square measure just about the core of the crypto market and business. They facilitate the all-important trades within the world’s virtual currencies, and by doing thus, they reveal that square measure doubtless to become the largest within the future.

As such, it’s invariably instructive to find out what crypto exchanges have lined up for the approaching months and years, if solely to achieve associate degree early insight into what crypto can sooner or later appear as if.

At an equivalent time, exchanges also will progressively have to be compelled to build themselves compliant with the rules that emerge next year, also as build themselves a lot of accessible to a growing audience. However, most square measure assured that 2022 and succeeding years gift a massive chance for them and therefore the wider business.

New services, a lot of comprehensive options

Exchanges expect to widen their offerings next year, so as to accommodate the very fact that crypto continues to evolve apace. this is often essentially what additionally happened this year, however commercialism platforms expect to ramp things up even any in 2022.

Oleksandr Lutskevych, the CEO and founding father of CEX.IO says that the corporate can devolve on its growth this year by providing a lot of services tailored to businesses and establishments, that probably represent an even bigger chance than retail.

“Debuting in solar calendar month, Prime Liquidity is our institutional liquidity answer, serving and managers, family offices, hedge funds, unlisted (over-the-counter) desks, and banks. Over time, we’ll continue increasing the suite of enterprise-grade product,” he told Cryptonews.com.

While viewing adding any business-to-business services, this and different exchanges can focus on movement shopper services to its platform.

For example, in 2022 we have a tendency to tend to decide to roll out the CEX.IO identification, which might any alter shoppers to use their crypto holdings to everyday purchases,” he said.

Likewise, Bybit head of communications Igneus Terrenus affirms that the exchange ar going to widen its vary of product in 2022, from new airdrops to increasing its pocketbook 3.0’s compatibility with assets.

In sequential few months, we'll be rolling out ETH and BTC decisions, and a great deal of widespread tokens ar created on the market in USDC perpetuals [...] we'll be increasing our margin offerings, grid mercantilism and institutional services,” he told Cryptonews.com.

One different service we’ll {increasingly|progressively|more and a great deal of} see additional of in 2022 is staking, with many mercantilism platforms probably to provide staking services for compatible coins to their users. this could be heightened by the particular proven fact that Ethereum is anticipated to transition to a proof-of-stake (PoS) agreement mechanism in 2022.

The rise of PoS cryptocurrencies comes with the potential to feature new services and attract a great deal of shoppers, movement solutions to the tons that ar otherwise too technical and inaccessible for the everyday shopper. This dynamic ar a catalyst for growth getting into 2022,” same Oleksandr Lutskevych.

Basically, as we have a tendency to tend to saw in 2021, exchanges will continue listing new coins, launchnig new mercantilism services (margin, derivatives, options), what is more as new shopper product (cards, payments). Not only will this facilitate them persevere with the dynamic world of crypto, but it'd in addition facilitate them see off rivals at intervals the emergent fintech sector.

DeFi, NFTs, and Web 3.0

Another 2021 exchange trend which can be continued into 2022 is DeFi, with centralized exchanges wanting all over again to travel off the challenge from decentralised alternatives like Uniswap.

Analysts at Gartner predict that decentralised finance ar eligible for enterprise adoption next year, unfinished clarity on restrictive guidance. If so, it follows that ancient, centralized financial institutions might embrace maturing applications, human activity them with mixed CeDeFi offerings,” same Lutskevych.

He in addition anticipates that, as customers gain confidence, DeFi-based services will gain a great deal of traction, since they supply the potential for higher returns (with proportionate risks).

Given these circumstances, we have a tendency to tend to anticipate that DeFi /CeDeFi sectors will see a heightened level of customer interest in 2022,” the chief military officer same.

For Igneus Terrenus, DeFi may revolutionize the crypto-based and heritage money systems alike, one thing which is able to build it incumbent upon exchanges to adapt.

Some half-hour of the folks within the world haven't any access to the industry, and also the rather more dire things in developing countries square measure typically unnoticed. DeFi considerably lowers the barrier to entry for the common person, removes the physical restrictions and offers another for the underbanked to require out loans while not a credit score and leverage collaterals,” he said.

Related to DeFi is that the nascent space of internet three.0, wherever DeFi and NFT capabilities square measure controlled by new internet-based applications, platforms, and sites.

For mercantilism platforms, this suggests competitory in areas together with internet three.0 capabilities for DeFi and additional refined institutional integrations,” aforesaid Terrenus.

At the terribly least, we’re doubtless to visualize additional exchanges list internet three.0-related tokens, that have already begun soaring (e.g. PARSIQ (PRQ), acknowledgement (HNS), and close to Protocol (NEAR)) this year.

More regulation and compliance

With 2021 being one in every of crypto’s best years on record, we’re doubtless to visualize new cryptoasset laws and rules finally being introduced in several of the world’s most developed nations. this suggests exchanges can pay a lot of of 2022 guaranteeing their compliance with new regimes.

We’re presently seeing national governments become additional active within the drafting of crypto legislation. These bills square measure forcing market participants to satisfy necessities associated with tax news, follow rules against hiding, adopt truthful, clear promoting electronic messaging, etc.,” aforesaid Oleksandr Lutskevych.

While a number of the principles square measure rather strict, he affirms that they're going to defend investors and establish a legal framework for businesses and customers to figure along. And for exchanges, they're going to ultimately facilitate them grow.

In addition, these rules establish rules of engagement and a path for market participants to additional integrate into international economic activity. Exchanges fair in compliance might notice themselves progressively isolated, with difficulties connecting to the edict world,” he added.

However, before clear rules arrive exchanges can have to be compelled to actively interact with regulators in 2022, to make sure that new rules and pointers square measure balanced.

Meaningful dialogues have to be compelled to happen between regulators and participants, together with crypto exchanges and their customers. And if this might happen within the next year, that may be excellent news for any exchange that really suggests that business,” aforesaid Igneus Terrenus.

In the long-standing time, wise rules square measure necessary and constructive for addressing the growing pains of a booming business, Terrenus acknowledges, thus he anticipates that exchanges can progressively work with regulators next year to create them a reality.

Challenges and opportunities

One of the items that exchanges can progressively work on in 2022 is guaranteeing the power of their platforms to accommodate rising demand and traffic. this is often a problem we have a tendency to saw repeatedly in 2021, with even the likes of Coinbase and Binance (two of the largest exchanges within the world) suffering continual outages. (Learn more: Crypto Exchanges Scale, however Outages doubtless to stay A reality Of Life)

Meanwhile, Bybit plans to produce its platform with upgrades in 2022.

We square measure taking another boost up from a system that presently boasts self-recovery inside seconds and negligible period of time in 2021,” Terrenus aforesaid.

2022 also will amplify another exchange trend evident in 2021: competition with the growing hordes of fintech apps and platforms. Exchanges are progressively wanting to contend with them, particularly if different fintechs follow PayPal’s lead in rolling out cryptocurrency services.

Adding to restrictive challenges square measure the ascent of digital payment systems, like Venmo and PayPal, that square measure getting down to feature crypto-related services. whereas these platforms square measure restricted within the coins and services they provide, they're international with tens of immeasurable combined users,” aforesaid Lutskevych.

Newslink

Your post has been upvoted (23.86 %)

Delegate more BP for better support and daily BLURT reward 😉

Thank you 🙂 @tomoyan

https://blurtblock.herokuapp.com/blurt/upvote