Hello everyone and welcome to my blog.

The trend is your friend is a common saying in cryptocurrency trading and this is because following trend gives traders the chance to minimize losses while trading against the trend otherwise known as counter-trading increases the chances of making losses.

In as much as the above statement is true, most traders especially new ones still end up making losses while following trends and this is due to their inability to spot divergences.

The word divergence in trading occurs when a trend through price action gives out signal contrary to what is seen on the momentum indicator. This usually happens when the trend is forming lower low or high high thus indicating a trend continuation while the indicator on the other hand is signaling a trend reversal by showing loss of momentum on the direction of the current trend.

Divergences are usually spotted using momentum indicators such as RSI which explains why it easily indicates when a current trend has lost momentum thus siganlling a trader on a possible trend reversal.

There are two types of divergences and they are;

- Regular divergences.

- Hidden divergences.

Regular divergences are the most common types of divergences which are usually used to spot out trend reversals. It is seen on the RSI when it forms a low higher than the previous low which is what is contrary to the price chart. This indicates that the current trend is weak and prone to a possible reversal.

- Regular bullish divergence

From the above we will see that the price was forming a lower low while the momentum indicator indicated a loss in bearish momentum by forming a lower high. This indicates that the momentum on the bearish side is currently weak and a bearish-to-bullish reversal is highly expected.

In other to make an entry using the type of reversal, we will wait for a reversal candle to form before taking a buy position.

- Regular bearish divergence

From the above, we will see an obvious uptrend which is healthy enough to mislead a trader who is ignorance of divergence. Looking at the momentum indicator, we will see that there was a loss in bullish momentum which led to a price reversal.

Also, before taking an extra we will have to wait for a reversal candle but in the absence of a candle huge enough to be regarded as a reversal candle, we will wait for subsequent candles to be formed in the opposite direction before taking a sell position just as seen above.

Hidden divergence are the type of divergences which are more advisable for new traders to use with reason being that it goes together in direction of the trend. And we already know that the number one rule of trading is that "the trend is your friend".

Simply put, hidden divergences are a type of divergence which indicates a trend continuation unlike the regular divergences that indicates trend reversal.

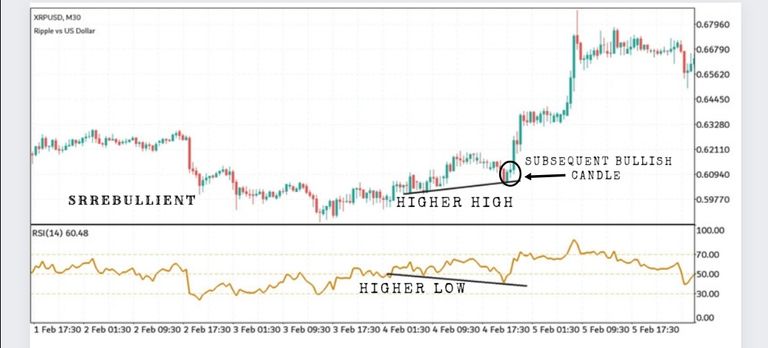

- Hidden bullish divergence

From the above we will see that the price was forming a healthy higher high while the divergence formed a higher low but in forming a higher low it indicated that the price is now more oversold thus signaling a continuous uptrend.

In other to make an entry using the hidden bullish divergence, we will have to wait for the formation of subsequent bullish candles before making an entry.

- Hidden bearish divergence

The hidden bearish divergence is similar to the hidden bullish divergence but opposite. It happens when the price is healthy lower low and the same time the RSI formed a lower high but became more overbought thus signaling a continuous downtrend.

An entry is made using the bearish divergence when there's a formation of subsequent bearish candles which serves to provide confluence to the divergence signals.

Divergence trading is one very important thj g to know in trading because it helps to guide traders away from weak trends and also help them know when a trend is still healthy enough to continue.

Trading using divergence is quite enough to keep traders consistently profitable when combined with other signal confirmations such as formation of subsequent bullish and bearish candles before making an entry.

Congratulations, your post has been upvoted by @r2cornell, which is the curating account for @R2cornell's Discord Community.

Thank you so much @bestkizito