SOURCE

In a world increasingly defined by unpredictability, individuals and seasoned investors are constantly seeking ways to protect and grow their wealth. As we find ourselves in a time of escalating global tensions and economic uncertainty, the spotlight is turning towards precious metals as a potential safe haven. The factors driving this trend are complex and multifaceted, with far-reaching implications for both the global economy and individual investment strategies.

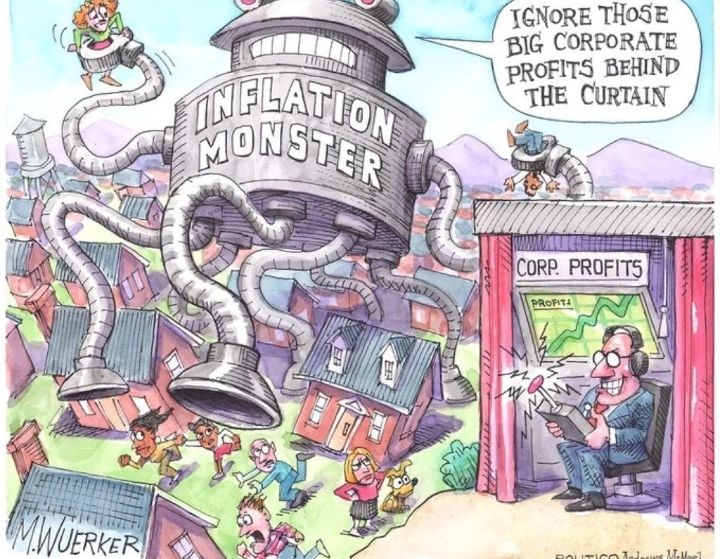

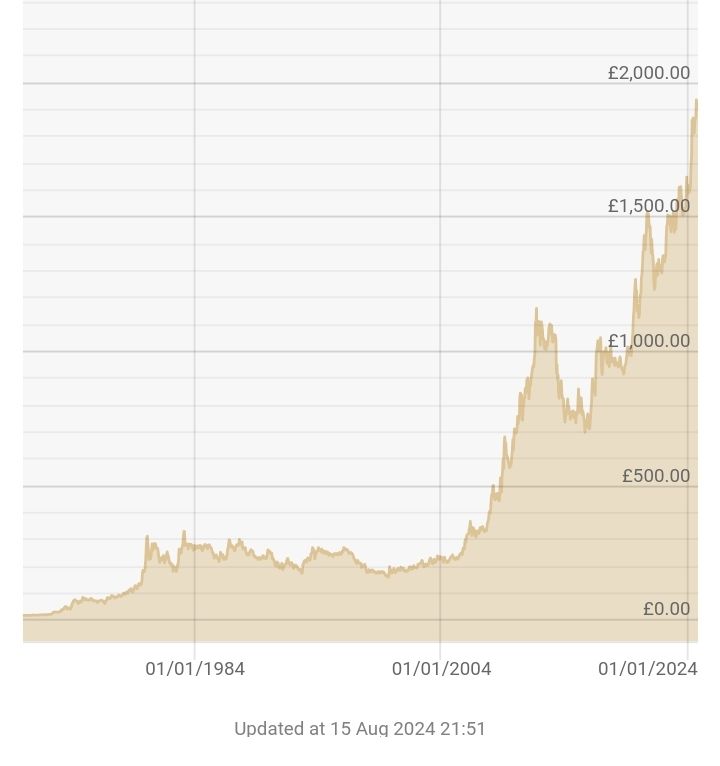

One of the primary concerns on the economic horizon is the rising tide of inflation. In the UK, inflation has recently surged to 2.2%, surpassing the Bank of England’s target. This uptick is more than just a number—it signals underlying pressures in the economy that could lead to further increases in the coming months. For investors, inflation erodes the purchasing power of money, making assets like precious metals, which traditionally hold their value over time, an attractive option. As inflation climbs, the appeal of gold and silver as a store of value becomes more pronounced.

SOURCE

Across the Atlantic, a similar story is unfolding. Inflation in the United States has also exceeded the Federal Reserve's 2% target, raising questions about the future direction of interest rates. Economic data released today will likely be scrutinized by the Federal Reserve as it considers its next move in September. The relationship between interest rates and precious metals is well-documented: when interest rates are low, the opportunity cost of holding non-yielding assets like gold decreases, often leading to increased demand for these metals.

But monetary policy isn’t the only factor influencing the precious metals market. The political landscape in the United States is another crucial element to consider. The race for the White House has entered a decisive phase, with both major parties having officially nominated their candidates. A change in leadership could bring shifts in economic policy, trade relations, and fiscal priorities, all of which could impact the prices of precious metals. For example, if a new administration adopts a more protectionist stance or increases government spending, it could lead to higher inflation and, consequently, a greater demand for gold and silver.

PRICE OF GOLD

In addition to these macroeconomic and political factors, the psychological aspect of investing cannot be overlooked. In times of uncertainty, there is a natural human tendency to seek security. Precious metals, with their historical reputation as a safe haven, often benefit from this instinct. When the future seems uncertain, the tangible, enduring value of gold and silver can provide a sense of stability that other investments may lack.

Given the confluence of these factors, many investors are asking whether now is the right time to increase their exposure to precious metals. While there is no one-size-fits-all answer, the current environment certainly makes a compelling case for considering precious metals as part of a diversified portfolio. Whether through direct ownership of physical metals, exchange-traded funds, or mining stocks, there are various ways to gain exposure to this asset class.

SOURCE

The world is navigating through a period of heightened uncertainty, characterized by rising inflation, volatile markets, and political change. These dynamics are driving renewed interest in precious metals as investors seek to protect their wealth and hedge against potential risks. While no investment is without risk, the enduring appeal of gold and silver in times of turmoil makes them a valuable consideration for those looking to safeguard their financial future.

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If your struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

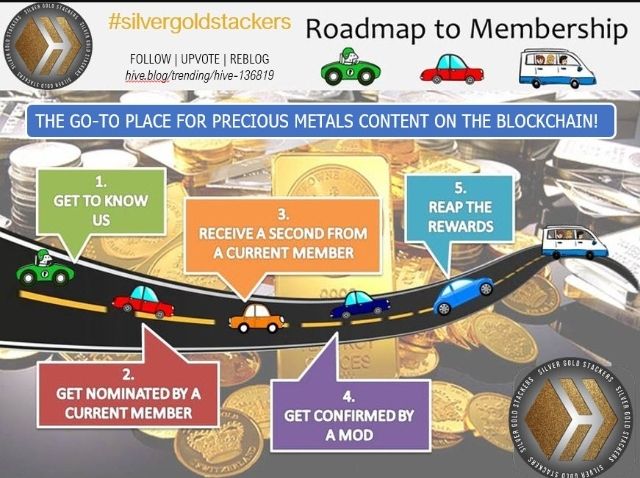

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.