Greetings everyone.

Cryptocurrency is a very wide ocean of it's own, and today we have the crypto Trading on our table.

What's your understanding of Cryptocurrency Trading? What are the platforms used for trading cryptocurrency? Explain one (Hint: Centralized and Decentralized exchange).

Cryptocurrency trading simply refers to the exchange of digital currencies for Fiat money or for another Cryptocurrency. Cryptocurrency trading can take place on centralized exchanges and decentralized exchanges.

Platforms used for trading Cryptocurrency.

- Centralized Exchanges.

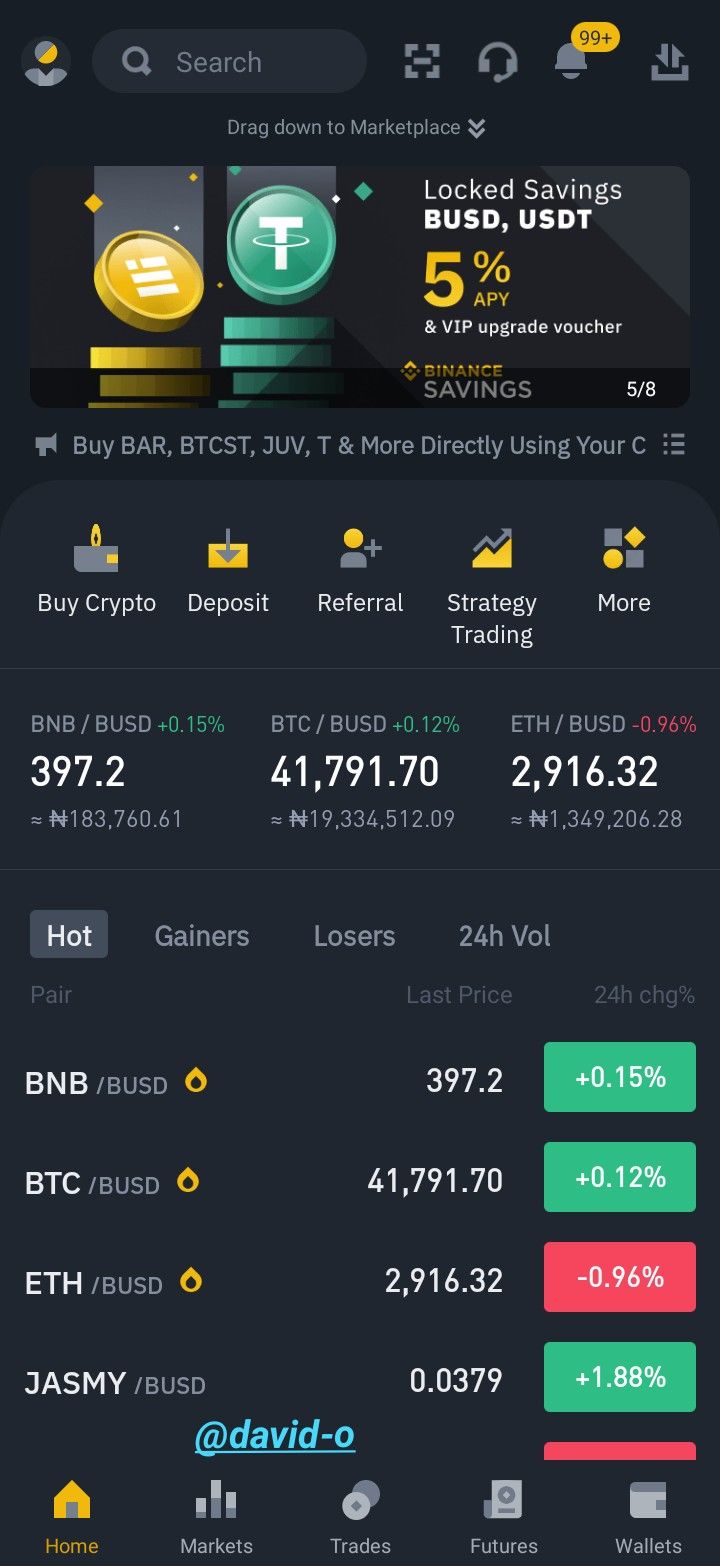

- Binance.

- Kucoin

- Houbi Global.

- Decentralized Exchanges.

- Pancake swap.

- Sushiswap.

- Uniswap.

Explain one.

Centralized.

Binance: This is a centralized exchange which allows users to buy and sell virtual currencies for Fiat money or for another Cryptocurrency.Decentralized.

Pancakeswap: This is a Decentralized finance (Defi) which permits users to swap virtual currencies. Pancakeswap is also known to be an Automated Market Maker (AMM).

What is Spot Cryptocurrency Trading? List and Explain the Order types discussed in the lecture. What is an Order Book?

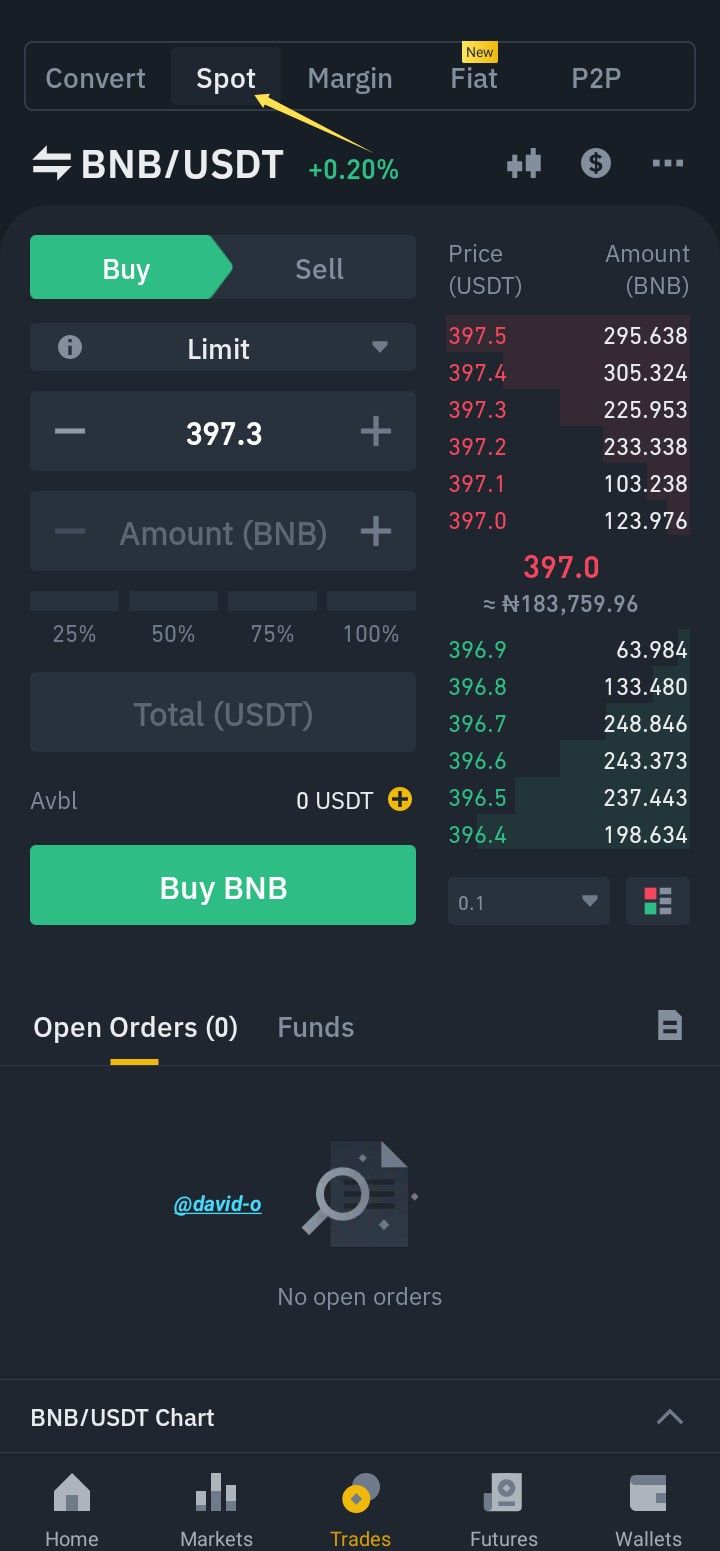

Spot trading can simply be defined as the process of buying and selling of virtual currencies at current price and the trade is executed or completed almost immediately. Just as the name implies, spot trading takes place instantly.

Order Types.

Market Order: Anyone who fills a market order is said to be a market taker as they take the market just as it is without trying to alter the price of the asset. They trade assets at the present price and their order is executed immediately.

Limit Order: A trader who places a limit order is said to be a market maker as they try to alter the current market price of an asset by adding the price at which they would love to buy or sell their asset. Market makers add liquidity to the market. Limit orders are not executed until the price of the asset Tally's with the traders fixed price.

Order Book.

source.

An order Book can simply be defined as a comprehensive record of all orders (buy and sell orders). The order Book displays the price at which Cryptocurrency traders must have placed their orders.

Trading pair can simply be seen as a combination of assets that can be traded for each other. For example the TRX/BTC, this means that you can exchange Bitcoin for Trons and Trons for Bitcoin.

Steps to perform spot trading.

- First of all we visit the binance wallet using this Link.

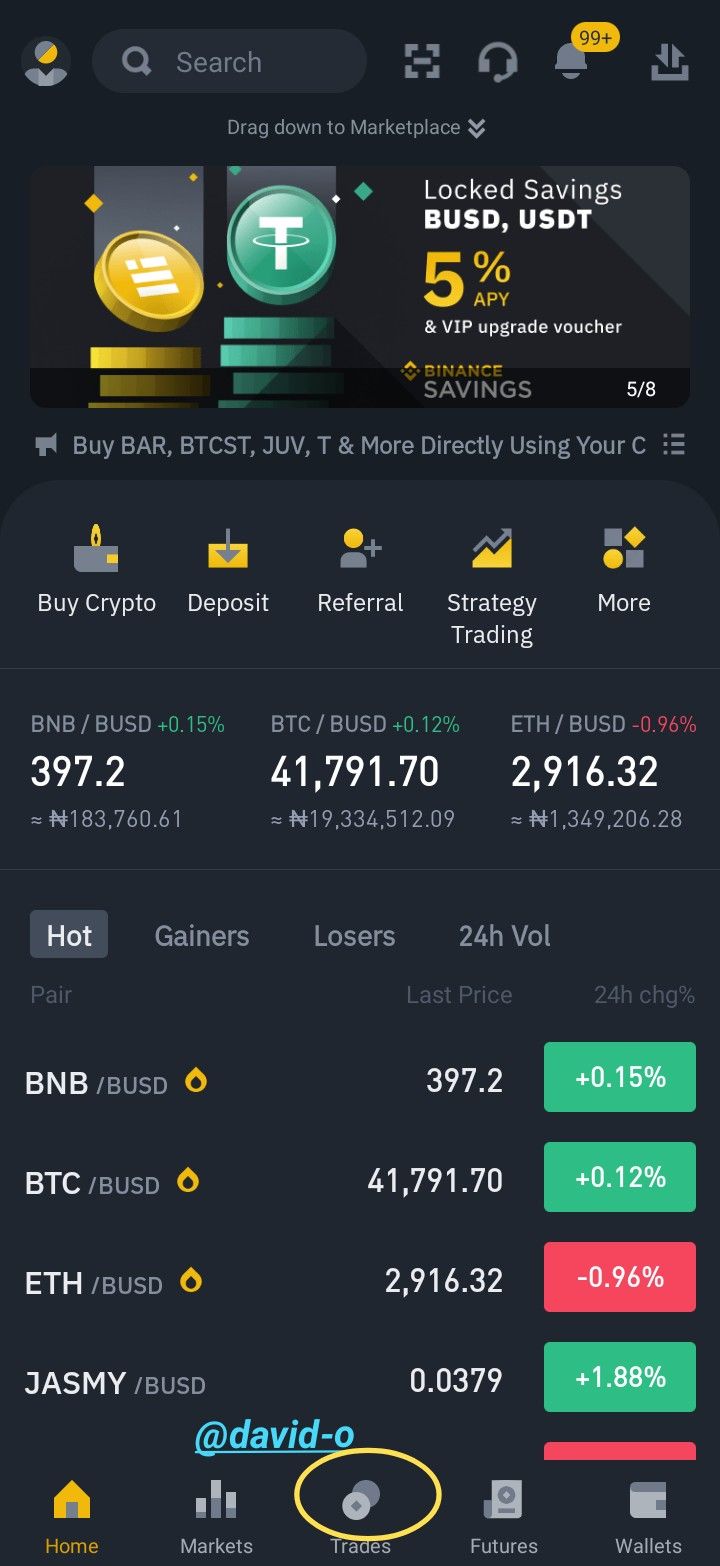

- Afterwards click on trade and you see spot, click on it.

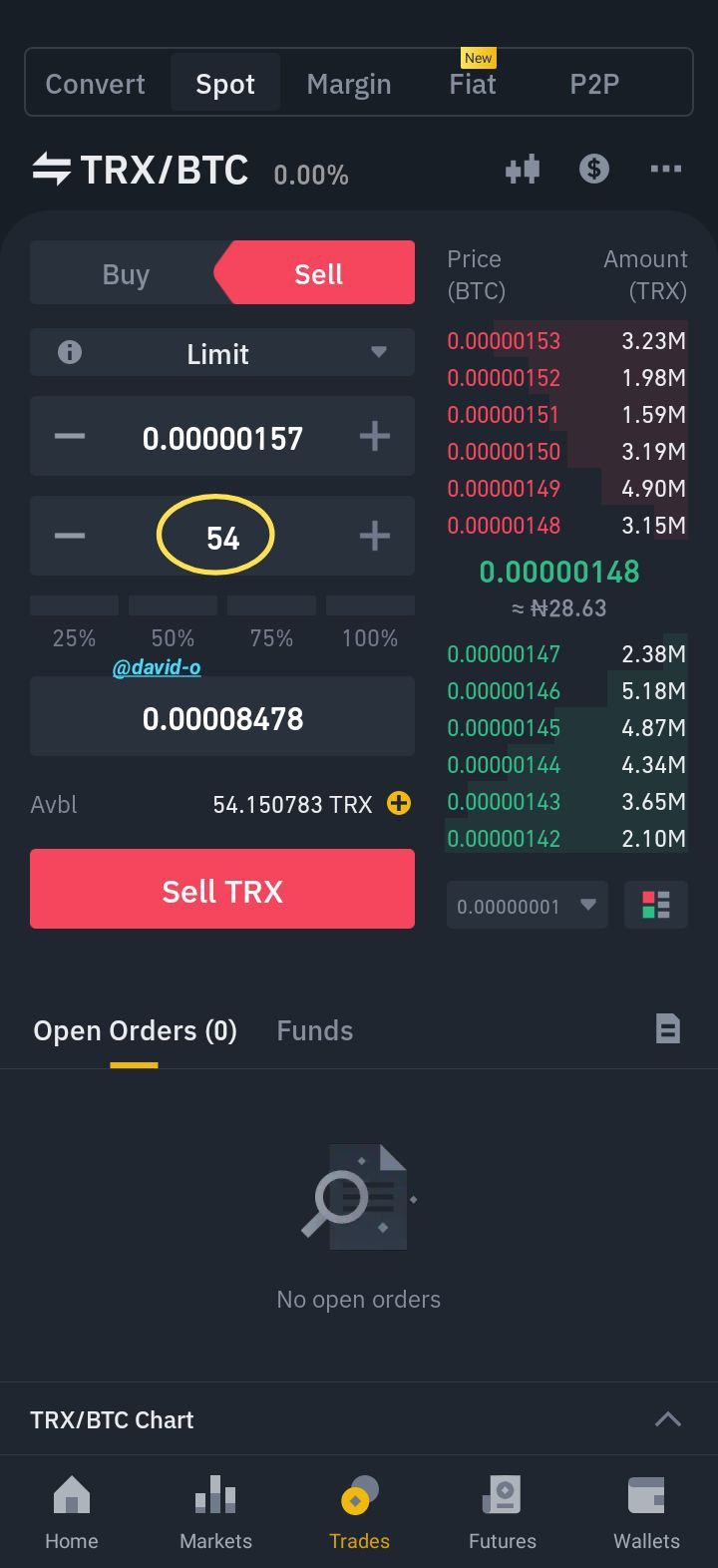

- I made sure I was on spot trade and I selected the pair I wanted to trade which is TRX/BTC.

- I placed a sell limit order since I had some TRX.

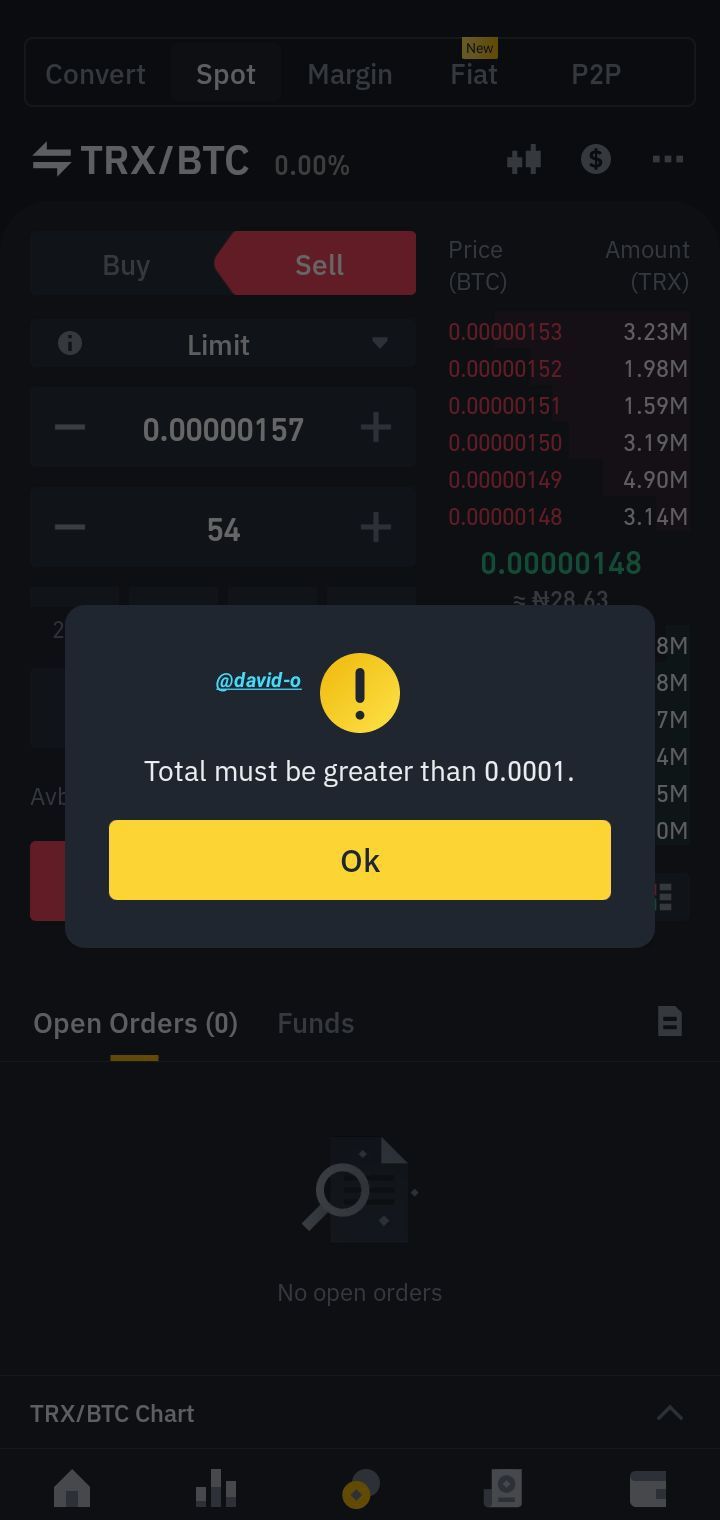

- I tapped on sell but was not a success since I don't have enough TRX.

Conclusion.

Gradually I am getting to know a lot about Cryptocurrency and trading Cryptocurrency has always been one of my biggest fears but I believe that if I stick to the YouTube tutorial videos, I will make great progress.