The Hidden cost of Bag Holding

In the world of investing, being a "bag holder" refers to clinging to a losing investment, hoping for a recovery that may never come.

It’s the image of someone left holding a metaphorical “bag” of devalued assets, watching opportunity slip away.

Picture this: an investor buys into a hyped cryptocurrency at its peak. Initially, prices surge, but soon after, the market crashes.

Instead of cutting their losses, the investor holds on, believing a rebound is imminent.

Weeks turn into months, and they’re stuck, missing out on profitable opportunities elsewhere.

Bag holding often stems from emotional attachment or an unwillingness to accept losses.

Without tools like stop-loss orders or diversified portfolios, investors can find themselves spiraling into deeper financial setbacks.

Beyond monetary losses, the toll includes missed opportunities and emotional frustration.

To avoid this trap- Set clear exit strategies, diversify your investments, and stay informed about market trends.

If you’re already holding the bag, it might be time to reassess, cut losses, or consult a professional.

Recognizing when to let go can be the difference between a smart investor and a bag holder.

Hong Kong’s Virtual Banks Eye Web3 Expansion Despite Regulatory challenges

Hong Kong's virtual banks, holding just 0.3% of retail banking assets, are ambitiously exploring the Web3 space despite facing significant regulatory challenges.

Legislator Johnny Ng Kit-chong is pushing for greater support for Web3 companies, highlighting the potential benefits for Hong Kong’s financial ecosystem.

Crypto-related businesses face hurdles in opening accounts due to stringent regulations, leading some firms to consider relocating. However, Ng remains optimistic, advocating for a clear government strategy to foster Web3 growth.

Mox Bank is already making strides, launching crypto ETFs and planning further digital investment opportunities.

Additionally, Ng has floated the idea of incorporating Bitcoin into Hong Kong’s financial reserves as a hedge against inflation.

As Hong Kong’s virtual banks navigate these regulatory waters, their efforts to expand into Web3 could signal a new era of digital finance for the city.

Eric Trump Declares Passion for Bitcoin!

Eric Trump revealed his enthusiasm for Bitcoin, calling Michael Saylor a friend and the cryptocurrency his "passion."

🍽 At a meeting in Mar-a-Lago, Trump’s residence, Saylor noted that even the menu featured Bitcoin—a subtle nod to its growing influence.

The intersection of politics, influential figures, and Bitcoin continues to spark intrigue.

Could this signal greater adoption ahead? 🌟

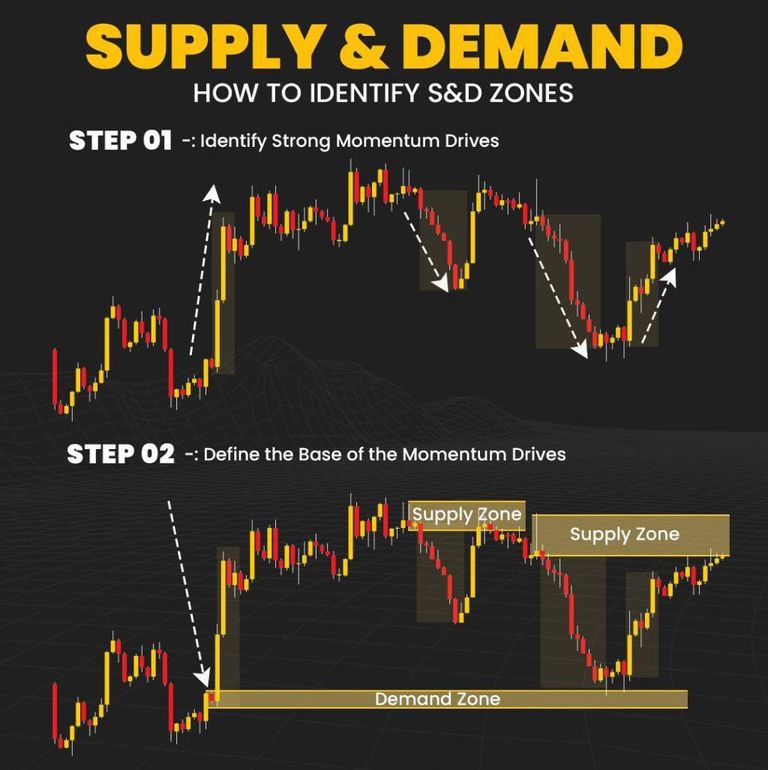

Here’s a simple guide to understanding Supply & Demand Zones in the market

Find strong price moves: Look for areas where the price quickly goes up or down. This shows strong momentum. 👀

Identify the flat area before the move: This is your "zone" or base where the action starts. 🗺️

Supply zones: Where sellers push prices down. 📉

Demand zones: Where buyers push prices up. 📈

Spot these zones to better understand how the market is moving. 🚀

PS: You can read my other related crypto post below

1.MATRIPORT predicts $160k Bitcoin by 2025

2.Tesla shares hot a new all time high since 2021

3.one trader turn $2500 into $200000

4.doge t-shirt from trump are now on sale

5.fart coin blast to new heights

7.uptitwise predicts a bullish 2025 for crypto

9.Crypto Trading and it's impact on investors

10.Bitcoin will recovery above 100k experts weigh in

11.micro strategy boosts Bitcoin holding

12.public key infrastructure the backbone of digital trust

13.market extreme overbought vs oversold congratulations

14.dark pools where big trades stay hidden

15.Bitcoin price prediction for 2025

16.Bitcoin Christmas journey over the years

17.galaxy research crypto prediction for 2025

18.microstrategy eyes $2v to stack more Bitcoin

21.crypto quant CEO predicts longest Bitcoin bull cycle ever

Watch the video below

In as much as I agree with your texts , I some how feel this is something unrealistic especially when it comes to the hong long virtual bank.

My question is , besides regulatory reforms, what specific measures could Hong Kong implement to better support Web3 startups and attract global investment?

To me it all boils down to innovation and accepting it to strive on it own. Fighting against crypto or web3 innovation will lead to chaos.

Yeah, it very under value but most especially they new to get listed on more exchange

We will see in the next 12 months if BLURT is a worthless bag of junk or not.

On average , blurt has been performing for the past few months, I so much believe it could do much better in the coming months judging from the performance in the past months.

The price has been a bit stable and anytime their is a correction it quickly increase back once btc start rising