The Hidden cost of Bag Holding

In the world of investing, being a "bag holder" refers to clinging to a losing investment, hoping for a recovery that may never come.

It’s the image of someone left holding a metaphorical “bag” of devalued assets, watching opportunity slip away.

Picture this: an investor buys into a hyped cryptocurrency at its peak.

Initially, prices surge, but soon after, the market crashes.

Instead of cutting their losses, the investor holds on, believing a rebound is imminent.

Weeks turn into months, and they’re stuck, missing out on profitable opportunities elsewhere.

Bag holding often stems from emotional attachment or an unwillingness to accept losses.

Without tools like stop-loss orders or diversified portfolios, investors can find themselves spiraling into deeper financial setbacks.

Beyond monetary losses, the toll includes missed opportunities and emotional frustration.

To avoid this trap- Set clear exit strategies, diversify your investments, and stay informed about market trends.

If you’re already holding the bag, it might be time to reassess, cut losses, or consult a professional.

Recognizing when to let go can be the difference between a smart investor and a bag holder.

Value at Risk (VaR): A Safety Check for Your Investments

Value-at-Risk (VaR) is a powerful tool that helps investors understand potential losses in their portfolio over a specific timeframe.

Think of it as a financial "seatbelt," offering insights into the risks you face.

Here’s how it works: Suppose you have a $100,000 crypto portfolio. If the 1-day VaR at a 95% confidence level is $5,000, this means there’s a 95% chance your portfolio won’t lose more than $5,000 in a single day.

VaR is important as it manages Risk Helps you prepare for potential losses by Performance Benchmarking Measures risk-adjusted returns and Regulatory Use,Often required by financial institutions.

But it’s not without flaws. VaR is based on historical data and assumes the future will mirror the past something the volatile crypto market doesn’t always guarantee.

It also struggles to predict extreme market events, leaving investors exposed to rare but severe risks.

In the end, VaR is a critical tool for understanding and managing risk.

While it’s not perfect, it provides a structured way to navigate the uncertainties of investing with greater confidence.

🚫 Another security tip: don’t use a VPN when accessing Coinbase (and likely other exchanges).

Because hackers always use VPNs, Coinbase’s protection systems take this as a sign of risk.

A lot of people have had their accounts frozen by doing this, even though they’re legitimately using their own accounts.

Getting accounts unfrozen can be a huge hassle. There are good reasons why you should use a VPN, so just switch it off while you are trading on Coinbase.

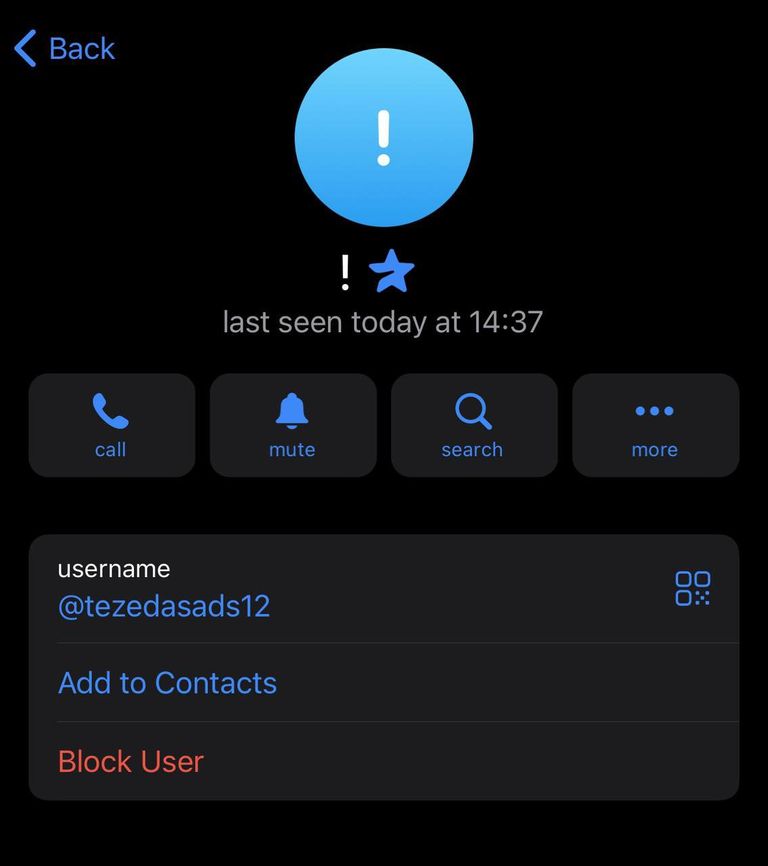

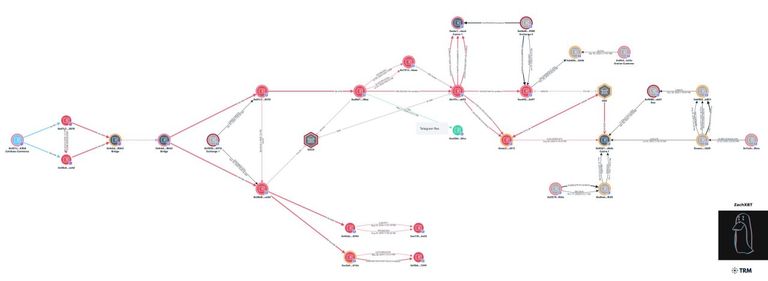

🔎 Another investigation by ZachXBT. In April 2024, the Coinbase Commerce contract showed suspicious outflows totaling $15.9 million on Polygon.

The USDC was then redirected from Polygon to Ethereum, where it was split across three addresses.

In May 2024, an anonymous attacker under the nickname tezedasads12 took responsibility for the theft and began boasting about it in Telegram chats.

On their Instagram profile under the name Excite, the hacker bragged about expensive purchases, including live monkeys.

Most of the funds remained inactive, but some were transferred to eXch & Stake using DEX swaps to a new address in an attempt to obscure the source of the funds.

Although the victim's identity in this case remains unknown, there is clear evidence that could potentially lead to their prosecution.

The attacker is likely located in Denmark.

There is also a high probability that they did not act alone, as the funds were initially split across three addresses.

*PS: You can read other crypto related post below:

1.cryptoquant CEO predicts longest Bitcoin bull cycle ever

2.Bitcoin wobble after trump crypto order

3.the power of uncollateralized loans

5.trump pardon silk road founder Ross Ulbricht

6.Michael Saylor on Forbes cover

9.crypto speaking forking risk

10.supply shocks the hidden forgot driving crypto price

11.day trading vs swing trading

Watch the video below

Actually I personally, i have come to discover that holding is the best option