Mastering the Risk-to-Reward Ratio

In trading, balancing risk and reward is crucial for long-term success.

The Risk-to-Reward Ratio (RRR) is a powerful tool to help evaluate whether a trade is worth taking.

By comparing potential losses to possible gains, the RRR helps traders make calculated decisions.

For example, if you buy a cryptocurrency at $100, set a stop-loss at $90(risking $10), and aim to sell at $120 (potential gain of $20) your RRR is 2:1.

This means you're risking $1 for the chance to gain $2—a favorable trade setup.

The RRR is essential for:

Making informed trading decisions

Managing risk effectively

Building consistent profitability

By calculating the RRR before each trade, you can avoid excessive risk and maximize potential rewards, forming a more disciplined and successful trading strategy.

In crypto futures trading, the choice between cross margin and isolated margin determines how funds are managed in your account for each position.

Here's the difference:

- Cross Margin

Your entire available balance in the futures account is shared among all open positions to prevent liquidation.

Risk and Reward

The margin is "crossed" across multiple positions, meaning losses on one position can draw from the profits or balance of others.

It reduces the risk of immediate liquidation but could lead to losing your entire account balance if the market moves against you.

BEST FOR,

Experienced traders managing a portfolio of positions or hedging across trades.

Example,

If you open a BTC/USDT futures position under cross margin and the trade goes into loss, the system will pull funds from your available balance to maintain the position.

- Isolated Margin

Each position has its own dedicated margin. Losses are limited to the margin allocated for that specific trade.

Risk and Reward

Keeps risks confined to individual positions, so losses in one trade do not affect other trades or your overall account balance.

If the position is liquidated, only the margin for that specific position is lost.

BEST FOR,

Beginners or traders who prefer stricter risk control for each position.

Example,

If you allocate $100 margin to an ETH/USDT trade under isolated margin, your maximum loss is $100, regardless of your total balance.

🇺🇸 Trump’s "Made in USA" Bitcoin Promise: Mission Impossible?

Trump wants all Bitcoin mining to happen in the US, but with 95% of BTC already minted and global mining booming in places like Russia, UAE, and Africa, it’s a tall order. 🌍⚡️

US miners like CleanSpark and Riot cheer for his support, hoping for fewer regulations and a competitive edge.

But decentralization, global competition, and cheap energy abroad make it hard to monopolize mining. 🔨

Turns out, Bitcoin doesn’t care about borders—just electricity and efficiency. 🔌💸

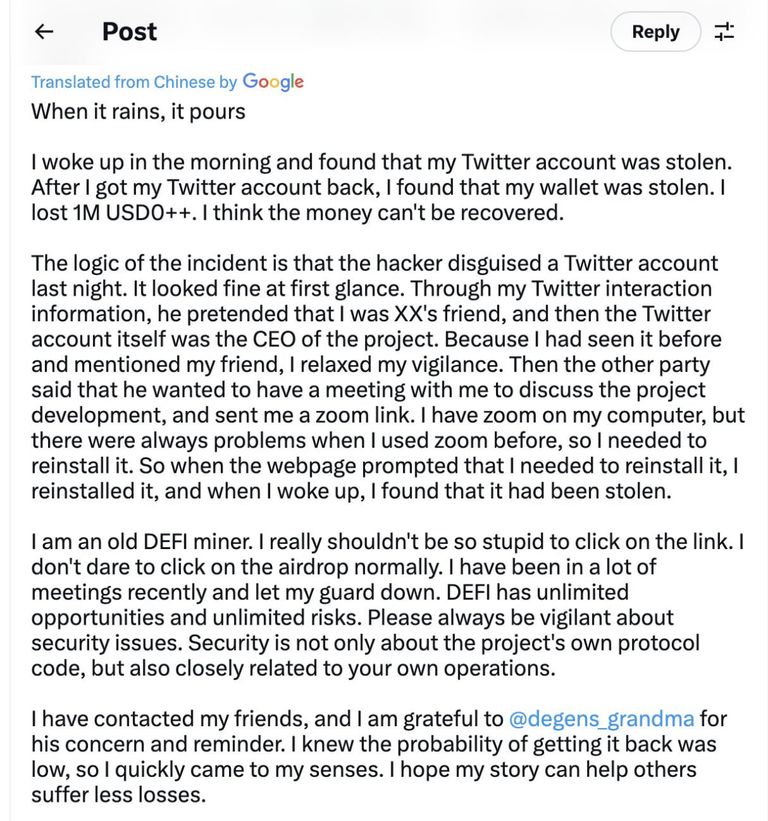

⛔ Another victim lost $1 million due to malware linked to the domain us04-zoom[.]us.

Hackers used fake Zoom links to steal private keys and access crypto wallets.

Cyberattacks are getting more sophisticated, and trusting unofficial sources is risky.

Stay alert, guys. Only download programs from trusted sites and check every step of the installation.

One extra security check could save you from huge losses.

PS: You can read my other related crypto post below

1.MATRIPORT predicts $160k Bitcoin by 2025

2.Tesla shares hot a new all time high since 2021

3.one trader turn $2500 into $200000

4.doge t-shirt from trump are now on sale

5.fart coin blast to new heights

7.uptitwise predicts a bullish 2025 for crypto

9.Crypto Trading and it's impact on investors

10.Bitcoin will recovery above 100k experts weigh in

11.micro strategy boosts Bitcoin holding

12.public key infrastructure the backbone of digital trust

13.market extreme overbought vs oversold congratulations

14.dark pools where big trades stay hidden

15.Bitcoin price prediction for 2025

16.Bitcoin Christmas journey over the years

17.galaxy research crypto prediction for 2025

18.microstrategy eyes $2v to stack more Bitcoin

21.crypto quant CEO predicts longest Bitcoin bull cycle ever

22.the hidden cost of bag holding

Watch the video below