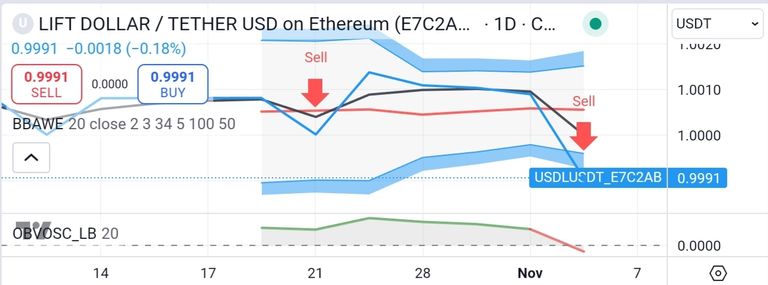

(Chart by TradingView)

Lift Dollar (USDL): A Pioneering Yield-Bearing Stablecoin

Lift Dollar (USDL) is a groundbreaking stablecoin, setting a new standard with its innovative yield-bearing mechanism. While recent market fluctuations, indicated by a declining OBV Oscillator, may have temporarily impacted its stability, its core value proposition remains strong.

Despite current technical indicators like Bollinger Band squeezing and sell signals, USDL's continued development and regulatory compliance position it as a promising investment for those seeking exposure to the burgeoning stablecoin market.

By combining a yield-generating model with regulatory oversight, USDL presents a compelling investment opportunity. As USDL continues to mature and the stablecoin market expands, investors who stay informed and capitalize on emerging trends may unlock significant financial rewards.

About Lift Dollar (USDL)

Lift Dollar (USDL) is a unique yield-bearing stablecoin issued by Paxos, a regulated financial institution. Unlike traditional stablecoins like USDT or USDC, which maintain a 1:1 peg with the US dollar, USDL offers additional value by generating interest on its reserves. This means that by holding USDL, users can earn a return on their investment, similar to a high-yield savings account.

One of the key advantages of USDL is its regulatory compliance. Paxos operates under strict regulatory frameworks, ensuring the safety and security of user funds. This regulatory oversight provides a higher level of trust and confidence compared to some other stablecoins that may operate in less regulated environments.

Another distinguishing feature of USDL is its integration with various blockchain platforms. This cross-chain compatibility allows users to access and utilize USDL on different blockchains, expanding its potential applications and reach.

However, it's important to note that while USDL offers attractive yield potential, it's not without risks. Like any investment, the value of USDL can fluctuate, and there's always the risk of losing money. Additionally, the interest rates offered on USDL may change over time, affecting the overall return on investment.

In conclusion, Lift Dollar (USDL) stands out as a unique stablecoin that offers both stability and yield. Its regulatory compliance, cross-chain compatibility, and interest-bearing features make it an appealing option for users seeking a stable store of value with the potential for additional returns. However, as with any investment, it's crucial to conduct thorough research and understand the associated risks before making any decisions.

Assisted by https://gemini.google.com/.

** Your post has been upvoted (39.64 %) **

Curation Trail is Open!

Join Trail Here

Delegate more BP for bigger Upvote + Daily BLURT 😉

Delegate BP Here

Upvote

https://blurtblock.herokuapp.com/blurt/upvote

Thank you 🙂 @tomoyan