The rise of Non-fungible token (NFT) lending has been a game-changer for decentralized finance (DeFi). In fact, it can be argued that the NFT x DeFi cross-pollination from NFT lending has united two very different parts of the Solana blockchain community for the better.

In this Kamino DeFi Basics article, Solana NFT lending and how NFT lending works will be explained for beginners. Users who would like to lend NFTs should err on the side of caution when participating in DeFi, since this is an extremely nascent sector and involves several risks beyond holding an NFT.

Why NFT Collectors Leverage NFT Collateral

NFTs are different from other kinds of tokens in that they can represent a unique piece of art. Ownership of NFTs not only provides users with an interesting profile picture (PFP) to feature along with their online identity, but it also bestows owners with status and access within the crypto community.

nft-lending-solana-nft-lending-nft-liquidity-lend-degods-nft-loan-solana-nft-loan-nft-collateral-lend-nfts-lend-smb

Some NFT examples of utility include staking for fungible tokens or the ability to enter certain Discord channels that are off-limits to non-holders. So, in addition to parting with a part of their identity, NFT collectors are also faced with losing utility when shoring up capital by selling their prized possessions at the collection's floor price (FP).

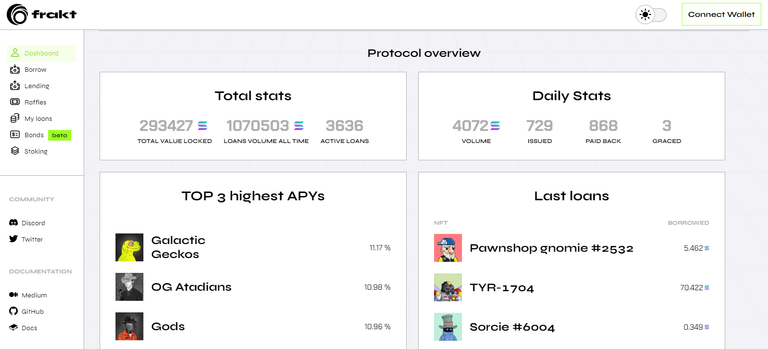

Instead of putting an NFT up for sale, a collector can take out a Solana NFT loan on protocols like FRAKT and SharkyFi and maintain the rights to their NFT while obtaining short-term liquidity. Most users would rather lend DeGods, lend SMB, or lend y00ts instead of selling their PFP, selling their access to a community, and selling against their friends.

How Does NFT Lending Work?

NFT lending, like all of DeFi, relies on smart contracts. Users who want to take an NFT loan can borrow against NFTs by locking their NFT into a lending smart contract and waiting for a lending offer from another user. Then, the peer-to-peer loan is handled in a trustless manner through code.

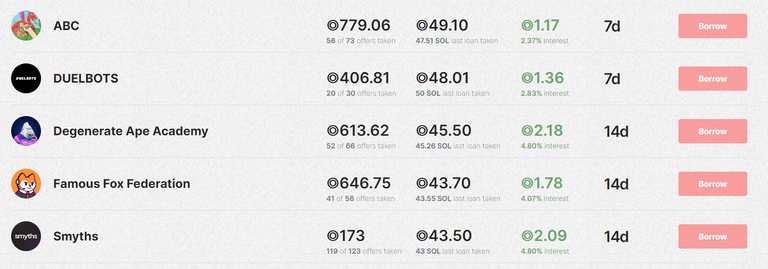

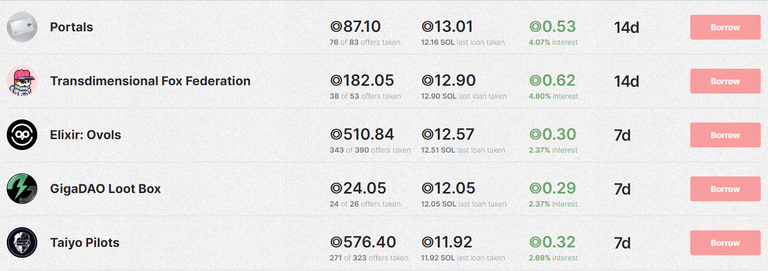

The more popular the collection, the more offers an NFT might receive, and this can fluctuate with the current state of the market. For instance, the pool to lend ABC might have 75 offers, while the Claynosaurz NFT project receives over 300 offers during the same period.

NFT lenders can decide how much SOL they are willing to lend, for how long, and at what APR, and then borrowers can choose to accept the offer. For example, if a user lends Ovols (current FP 15.5 SOL) on SharkyFi at the time of writing, the best offer is:

- 12.57 SOL

- 7 days

- 2.3% interest

The NFT remains in the borrower's wallet for the duration of the NFT collateral loan. But, if the borrower does not repay the lender with interest by the expiration of the NFT loan, then the lender can repossess the NFT, which would equate to purchasing the NFT at a discount to its current FP.

What's the Future of NFT Lending?

NFT lending pools on Solana have grown over the last year, and the Solana NFT loan ecosystem is starting to catch up with Ethereum, where NFTfi has facilitated over 30,000 loans and over $350 million in volume. It's probably safe to say that NFT lending is becoming something of a big deal on Solana.

While NFT mortgages have not yet become a thing, the ability to borrow against NFTs has become an innovative and active area of DeFi that was once thought impossible. The proliferation of NFT collateral loans has also come about during a time when NFT liquidity through the NFT AMM (automated market maker) is also strengthening.

There is plenty of room for development in the NFT x DeFi space, and it will be very interesting to see what utilities and innovations projects come up with next. Until then, read about other innovations in DeFi lending on Solana in the Kamino DeFi Basics series.

Source: Kamino Finance