Dear Blurters and Investors,

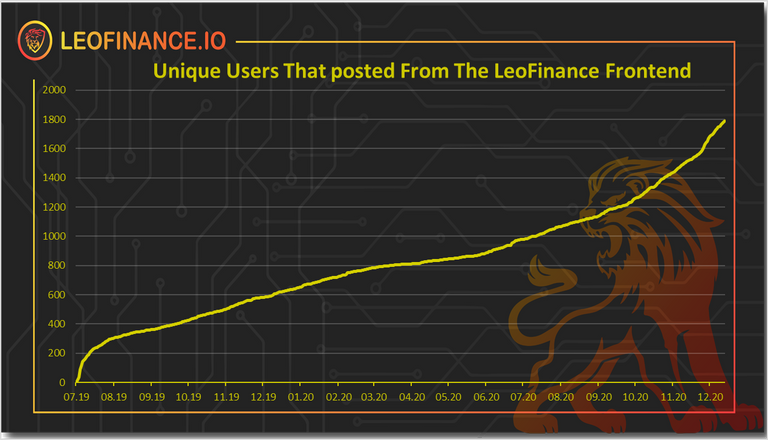

so much is going on in the LeoFinance community, one can hardly keep up! Just have a look at the impressive increase of unique users that post from the LeoFinance frontend:

https://leofinance.io/@leo.stats/leofinance-weekly-stats-12-07-2020-to-12-13-2020

In this post I summarize what I actually did in terms of LEO - as an inspiration for others not yet involved in LEO.

Liquidity Pool (LP)

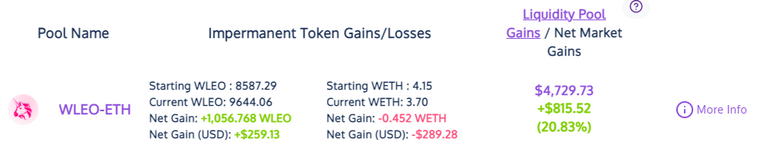

In Nov. I had put in total 8587 WLEO (and 4,15 WETH) in the Uniswap pool, 4034$ at that time, not all at once at the first day as would have been optimal, but (since I started a bit late with powering down) in several tranches. This increased the gas fees needed, but altogether 4,5$ gas fee is quite acceptable😃. By now the stake in the pool is 9644 WLEO and 3,7 WETH (such fluctuation is somewhat expected) and the current value of 4729$ - an almost 21% gain. If you want to know your status of the pool in real time, check out https://apy.vision/#/ and connect it to your Metamask wallet.

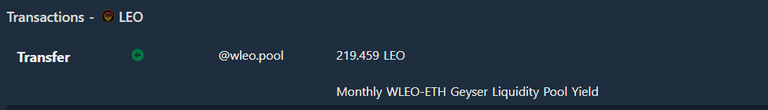

And on Wednesday (after one month, as promised) the Geyser erupted for the first time! The first monthly reward obtained was distributed and what a pleasant surprise - I got more than 219 LEO delivered right into my wallet!

In the Geyser reward post it is calculated an APY of 15,75% however when I did the math, I found a theoretical net APY of 30,7% (219,459/8587x12x100)! Anyway this value will change over time dependent on the %age of the pool my stake has. For now I have no plans whatsoever to remove funds from that pool!

Guess what I did with the reward? Yes, I staked it!

Leo Power

Due to moving some LEO to the Uniswap LP (and buying some LBIs), I have "only" 10450 LEO staked at the moment, but the monthly LP rewards will mostly flow back into Leo Power to increase the stake again over time (like the first 219 did already)! Currently my 100% upvote on leofinance-tagged posts is worth 1.144 LEO, before reward splitting! Not too bad. You need to stake a lot more Hive for a comparable vote value - and only if you vote optimally (vote window, etc.). That shitty non-linear reward curve on Hive still penalizes manual voting, based on good content, but incentivizes "whale voting" - fortunately that is gone on LeoFinance: a vote is a vote, regardless when and to what! So it is for several reasons worth to stake more LEO than Hive, especially for folks who delve primarily in the finance world (I am rather an omnivore vote-wise)!!

LBI

The freshly (since 7th Dec) issued LBI token is a sort of spin off to the very successful SPI which had started with 1 Steem per SPI and now is valued app. 5 Hive! OK due to the Hive hard fork the value doubled, but even without it, this is a more than impressive development. The very motivated team around LBI for sure is trying to maximize the return on your invested LEOs in the same way.

Make sure to follow @lbi-token to not miss any news and consider autovoting them and investing some LEOs by sending them directly to @lbi-token or buy them with Hive on Leodex. At a later point (in a few months) for sure you will need to pay more than 1 LEO to get 1LBI. So do your math and decide if you not better get some now. I bought 200 as a start.

Interestingly, the LBI token price on Leodex does not correspond to what one LEO is worth, but it varies a litte, as some weird guys sold their (freshly bought) LBIs at a loss and quite a discount! I have put in a buy order below 2 Hive, just in case someone wants to sell them at a discount, so that I can grab some more.

Delegation

I delegated additional 10000 Hive to @leo.voter, so I have now 20K HP delegated which yields app. 4 LEO per day which is a 14,6% APY - a nice daily LEO passive income. Of course, delegating the same amount of Hive (e.g. via dlease.org) would bring an equivalent (or better) amount in Hive, but with the current momentum for LEO and its token price it seems prudent to produce an increasing percentage of your staked tokens in LEO directly.

Mining LEOs

I still have my 50 LEOM and from time to time some new LEO arrive in my wallet. Since it is hard (for me) to figure out all the different LEOs rewards (author, curating, delegation, mining), I didn´t quantify so far the return of the miners, but I don´t plan to sell them anytime soon. Since they seem to be quite costly now, I am not going to buy more at this point either. For the price I had paid for them (2 Hive each - a steal) I am happy, but before you decide to buy some at current prices, check out this post from @themarkymark where he nicely elaborated on the yield of various mining tokens.

Strategy

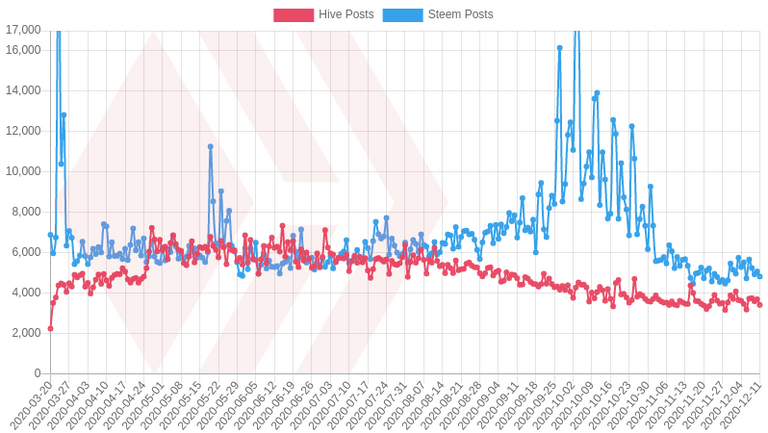

Since Hive is languishing and on the other hand LEO is thriving, I continue to exchange systematically Hive into LEO. OK, in the last weeks the situation improved a little, but the metrics on the e.g. number of posts on Hive (from the daily stats made by @penguinpablo) are not that convincing, compared to the growth at LeoFinance.

https://peakd.com/hive-133987/@penguinpablo/hive-vs-steem-stats-saturday-december-12-2020

Even if you do not power down your HP (what I for now NOT plan to do) there are some ways, apart from delegating to @leo.voter. One is of course to exchange your HBD author rewards to Hive and buy LEOs for it, another one is to lease out your HP at Dlease and change your daily Hive income to LEO. In fact I found recently a lease of 40K HP with a ROI of 15,2% (you won´t find this yield every day, but check out regularly, sometimes (rarely) leases with >16% ROI are offered). Of note, in case you still have some Steem, at https://steem.dlease.io/market you find leases with a ROI of 28%. Really bizarre, isn´t it.

All in all I currently have 141K Hive and app. 20K LEO, so already 22% of total Hive/LEO value is in LEO. I bet this %age will increase in 2021. Target is at least 30% by eoy 21.

So that´s it for now. As you can see, there are multiple ways of earning with LEO and I think this is just the beginning. Check out this video from @khaleelkazi where he gives us also a glimpse on future DeFi-plans for LEO.

Are You going to leave HIVE completely for LEO?

No, not at all.