The Hammer is a bullish reversal pattern, which signals that a stock is nearing the bottom in a downtrend.

The body of the candle is short with a longer lower shadow. This is a sign of sellers driving prices lower during the trading session, only to be followed by strong buying pressure to end the session on a higher close.

Before we jump in on the bullish reversal action, however, we must confirm the upward trend by watching it closely for the next few days.

The reversal must also be validated through the rise in the trading volume.

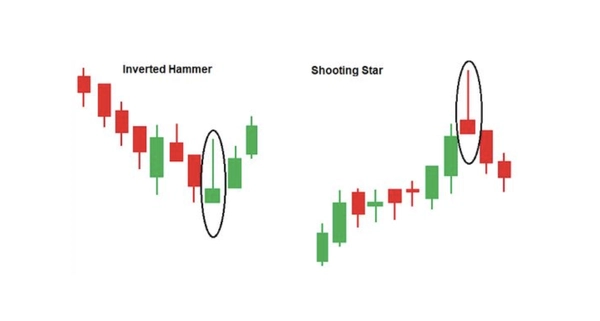

The Inverted Hammer also forms in a downtrend and represents a likely trend reversal or support.

It’s identical to the Hammer except for the longer upper shadow, which indicates buying pressure after the opening price.

This is followed by considerable selling pressure, which wasn’t enough to bring the price down below its opening value.

Again, bullish confirmation is required, and it can come in the form of a long hollow candlestick or a gap up, accompanied by a heavy trading volume.

Source: Investopidia

Harry Potter Library (HPL) Community

Please join the HPL community. I will upvote all members' posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: 해리포터의 도서관 (Harry Potter Library, HPL)

Let's build our community together. I will support you.

- HPL Community on Blurt:

Just add the "hpl" tag and I will vote for a small amount