What Is a Bullish Engulfing Candle?

The bullish engulfing candlestick pattern refers to a bullish trend reversal when preceded by a cluster of red or black candlesticks showing a bearish trend. It is useful for signaling the start of a new uptrend, as the bullish green or white candle body completely surrounds or engulfs the previous day’s red or black candlestick.

When bullish engulfing occurs, it means more buyers entered the market, pushing the price upward, hence resulting in a trend reversal. This candle usually occurs at the bottom of a downtrend.

Characteristics of the Candlestick Formation

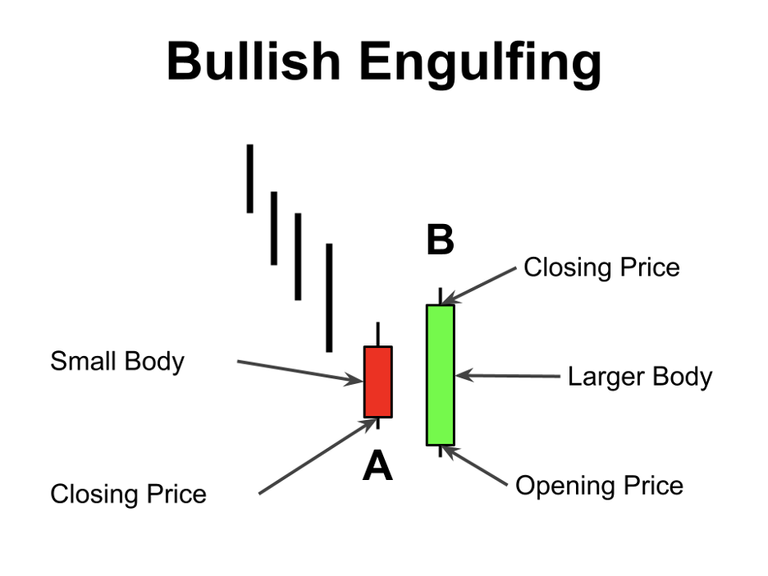

The bullish engulfing candlestick pattern is a two-candle formation (candles A & B below).

The first candle (A) must be a down candle, colored red on most charting packages (or black if using a white/black color scheme). The size of the red candle can be large or small. The key to the pattern is the size of the second candle.

The second candle (B) will need to engulf or overlap the first candle. Technically, this means the opening price for the second candle must be lower than the closing price of the first candle. However, in the crypto markets, there is no opening or closing of a trading period. You can transfer coins 24 hours a day, 7 days a week.

Consequently, the second candle simply needs to overtake and engulf the first candle.

Strengths of the Pattern

Clear reversal signal: The bullish engulfing pattern provides a clear visual signal of a potential trend reversal. When the pattern forms after a downtrend, it suggests that buying pressure has overcome selling pressure, potentially leading to an upward move.

Easy identification: The pattern is relatively easy to identify on price charts, as it consists of two distinct candlesticks. Traders with basic knowledge of candlestick patterns can quickly spot and interpret the bullish engulfing pattern.

Potential for favorable risk-reward ratio: Traders often use the bullish engulfing pattern as an entry signal for long positions. By entering near the bottom of a downtrend, traders can potentially benefit from a favorable risk-reward ratio if the pattern leads to a substantial upward move.

Weaknesses of the Pattern

False signals: Like any technical pattern, the bullish engulfing pattern is not infallible. There are instances where the pattern fails to result in a meaningful reversal, leading to false signals. Traders should exercise caution and consider additional factors before making trading decisions solely based on the pattern.

Confirmation required: While the pattern itself suggests a potential bullish reversal, it is advisable to seek confirmation from other technical indicators or tools. Relying solely on the bullish engulfing pattern may lead to premature or incorrect trading decisions.

Limited timeframe: The bullish engulfing pattern is most effective in shorter timeframes, such as daily or intraday charts. In longer timeframes, its reliability may diminish, and the impact of other fundamental factors may outweigh the significance of the pattern.

Incomplete market information: Candlestick patterns, including the bullish engulfing pattern, only provide information based on price action. They do not take into account other market variables, such as fundamental analysis or news events, which can greatly influence market movements. It's important to consider the broader market context when using the pattern.

Harry Potter Library (HPL) Community

Please join the HPL community. I will upvote all members' posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: 해리포터의 도서관 (Harry Potter Library, HPL)

Let's build our community together. I will support you.

- HPL Community on Blurt:

Just add the "hpl" tag and I will vote for a small amount