Drift Protocol is an open-sourced, decentralised exchange built on the Solana blockchain, enabling transparent and non-custodial trading on cryptocurrencies.

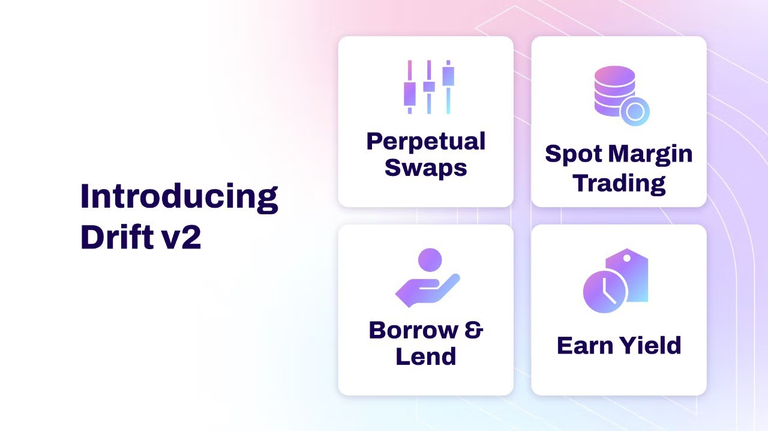

By depositing collateral into Drift Protocol, users can:

- trade perpetual swaps with up to 10x leverage,

- borrow or lend at variable rate yields,

- stake / provide liquidity,

- swap spot tokens

The full suite of DeFi tools within the protocol are powered by Drift's robust cross-margined risk engine, designed to give traders a balance of both capital efficiency and protection (more details of the cross-margin engine design are detailed throughout "Technical Explanations").

Under the cross-margin engine, each tool extends functionality within the protocol without over-extending risk. For instance:

- the borrow / lend markets also enable cross-collateral on perpetual futures and more efficient margin trading on spot assets

- every deposited token is eligible for yield on deposits from borrows and provides margin for perpetual swaps

- borrowers are only able eligible to borrow from depositors in an over-collateralised fashion while passing multiple safety measures

The protocol's orderbook, liquidity, and liquidation layer is powered by a validator-like Keeper Network. Keepers are a network of agents and market-makers incentivized to provide the best order execution (i.e. Just-In-Time (JIT) liquidity, order matching, etc.) to traders on Drift. The Keepers can route orders throughout the multi-sourced liquidity mechanisms that are designed to effectively scale and offer competitive pricing even with larger order sizes.

Based on fast and cheap network capability of Solana, users and investors could do non-custodial derivatives and spot trading. It is worth to try and enjoy.

Source: Drift Protocol