SushiSwap emerged very controversially as a fork of Uniswap. About half a year later, the project stands as one of the top 10 DeFi protocols and the second-best decentralized exchange in the Ethereum network, competing head-to-head with its big brother.

SushiSwap is a platform that incorporates different DeFi tools. It originally launched as a decentralized exchange. Instead of using the classic order book, it works thanks to an automated market maker (AMM).

It has a SUSHI token that gives governance rights over the development of the platform to its holders. In addition, SUSHI owners can deposit their tokens in staking. They receive rewards for it with the profits obtained from the commissions charged for each transaction.

SushiSwap uses several decentralized oracles to report pricing, including SushiSwap TWAP, Compound’s Open Price Power Oracle, and Chainlink-created oracles.

Vampiric origins

SushiSwap emerged amid the 2020 DeFi summer hype from a fork of Uniswap. Uniswap is the largest decentralized exchange in the ecosystem, as well as the most popular.

The project was started by a person operating under the pseudonym Chef Nomi. They were soon joined by another collaborator, also anonymous, calling themself 0xMaki.

To add the initial liquidity to the platform, a plan was devised that was both ingenious and controversial.

This plan was called “vampire attack,” or “vampire mining.” This name comes from the fact that initial liquidity was not extracted organically but rather from one platform to transfer it to another.

SushiSwap strongly incentivized Uniswap’s liquidity providers to stake their liquidity provider (LP) tokens using additional rewards paid in SUSHI.

Many of Uniswap’s liquidity providers went and staked their LP tokens on SushiSwap and earned rewards.

During the first two weeks, liquidity providers earned 1,000 SUSHI tokens for each block. Once around a billion dollars in LP tokens had been staked, the SushiSwap team began their vampire attack.

On September 9, 2020, thanks to all the Uniswap LPs deposited with SushiSwap, the team migrated a total of $840 million in liquidity from Uniswap to SushiSwap.

The summer’s trending topic

Just two weeks later, the DeFi protocol suffered a severe setback and nearly lost a lot of its early success.

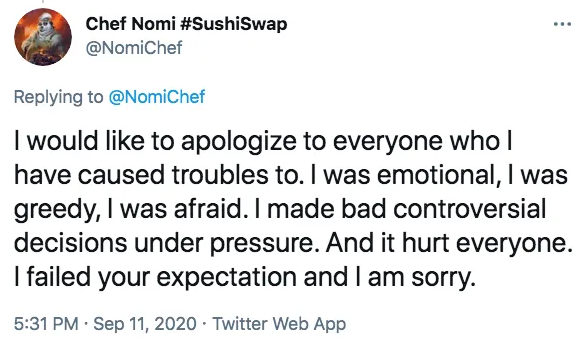

A few days before the final migration, when the SUSHI token broke new all-time highs, its founder Chef Nomi decided to sell all of their SUSHIs.

They were worth around $14 million. This led to a precipitous drop in the token price, which fell by almost 50%.

At the time, 10% of the SUSHI minted had been allocated to a fund for its development, and Chef Nomi was the only one controlling those funds.

The tokens were legitimately Chef Nomi’s, so they decided to sell them all at once. This caused not only the price drop but anger from the entire community.

After an initial effort to justify their actions as positive for the project, the community lost faith in Chef Nomi, and they were eventually forced to leave the project.

Before leaving, Chef Nomi transferred control of the project to Sam Bankman-Fried, CEO of the FTX exchange and Alameda Research fund.

Source: Twitter

After completing the migration of all liquidity, Bankman-Fried moved control of the administrator key to a multi-signature (multi-sig) wallet managed by nine people chosen by the community.

Days after the successful migration, Chef Nomi returned, bought the same amount of SUSHI that they had sold, returned them to the fund for platform development, and apologized to the community.

Still, no one wanted to touch the protocol for months. Only after the new developers started working on SushiSwap was the platform able to regain the trust of the community.

Source: Twitter

SUSHI token

SushiSwap introduced several elements that Uniswap lacked at the time. The first and foremost was its SUSHI token. Notably, just days after the liquidity migration from Uniswap to SushiSwap, Uniswap launched its own UNI token.

People were demanding a Uniswap token for a long time. As such, the whole incident with SushiSwap accelerated, or perhaps even forced, Uniswap to launch its own.

The SushiSwap token represents the value of the platform. In addition, it also offers the possibility to participate in the governance of the project. In this way, the platform is a project by the community.

SushiSwap allows the purchase and sale of different cryptocurrencies between users. For each exchange made between two tokens, the platform charges a 0.3% commission. 0.25% goes to liquidity providers. The remaining 0.05% is converted to SUSHI and distributed to users who have the SUSHI token.

Profits in the Sushi Bar

The SushiSwap token acts as a mechanism to distribute the profits of the protocol among those who have bet on the platform’s success.

Users who own SUSHI and want to receive a portion of the commissions generated by transactions within the platform only have to deposit their tokens in the “Sushi Bar.” The rewards will be proportional to the number of SUSHI tokens deposited in staking.

SushiSwap must buy the SUSHI to pay these rewards, which it does with that 0.05% transaction fee.

This creates a buying pressure in the market that can counteract inflation and maintain the price of SushiSwap if the trading volume is high enough. SUSHI has a maximum issuance of 250 million tokens. It is expected to reach this ceilieng by November 2023.

Pieces of the puzzle

SushiSwap’s hallmark has always been constant development and innovation.

Although it began as a DEX, today, the platform has been integrating different pieces to its overall puzzle. These include a deposit and loan platform, launch pads for new projects, and a wide range of yield farming.

Onsen

Onsen is a system to reward users for offering liquidity relatively new tokens. The tokens selected to be on the Onsen “menu” receive a specified number of SUSHI tokens per block to incentivize liquidity provision.

The benefit of being on the Onsen menu is that projects don’t need to incentivize their communities to provide liquidity with their own tokens because Sushi does it for them.

To receive SUSHI rewards, users must deposit the tokens received for providing liquidity in certain token pairs (Sushi Liquidity Provider tokens) in the Onsen menu. These rewards help increase liquidity in new currencies, reducing slippage and attracting more users in search of the best prices.

This increases the volume of operations on SushiSwap. The volume of operations, in turn, increases the commissions per transaction and, therefore, the profits received by SUSHI holders who deposited their tokens in the Sushi Bar.

This entire system also creates synergistic relationships with other projects in DeFi. Onsen has a cap on projects based on their market capitalization.

BentoBox

BentoBox is a token fund that generates returns for liquidity providers. Unlike Onsen, this liquidity is not used for trading between pairs of tokens.

BentoBox uses this liquidity to make loans and use it in different profit generation strategies previously approved by the community.

Users who deposit their tokens in BentoBox get an annualized percentage return. It scales without much effort.

Unlike other protocols, BentoBox creates a source of liquidity that any user can access with minimal approvals, minimal gas usage, and maximum capital efficiency.

This easy-to-scale design allows it to serve as the future infrastructure for upcoming DeFi protocols in SushiSwap, the first of which is Kashi.

Kashi

Kashi is a margin trading lending and trading platform built on top of BentoBox. It enables anyone to create personalized, gas-efficient markets for lending, borrowing a wide variety of DeFi tokens, stablecoins, and synthetic assets.

Unlike traditional DeFi money markets, such as Aave, where high-risk assets can introduce risk throughout the protocol, at Kashi, each market is completely separate from the rest. This means that the risk of assets within one loan market does not affect the other markets.

Lending platforms typically allow users to add liquidity to a pool-based system. In these systems, if one of the assets used as collateral for the loan fell in price so quickly that the loan users did not have time to react, all users and all assets would be negatively affected. In this sense, the total risk of pooled platforms is largely determined by the riskiest asset you use on the platform.

This risk increases with each additional asset added, leading to a minimal choice of assets on most platforms.

Kashi’s unique design allows for a new type of loan and borrowing. As a result, the ability to isolate risks in individual loan markets means that Kashi can allow users to add any token.

Miso

Miso is a set of open-source smart contracts. It facilitates the launch process of a new project on SushiSwap.

Miso’s goal is to bring new capital and new business to its platform by increasing the appeal of SushiSwap.

The goal is to create a launchpad for founders of new projects that allows communities and projects to access all the options they need to launch their tokens. These include tools to distribute tokens, the creation of deposit funds, farming mechanisms.

Sushiswap or Uniswap? The eternal discussion

Overall, SushiSwap and Uniswap at their base are very similar. After all, SushiSwap is literally based on the Uniswap source code.

Still, unlike Uniswap, the SushiSwap team is more versatile and more focused on innovation. SushiSwap works as an “open org,” which means that any developer from anywhere in the world can join the team.

Uniswap has an initial investment by reputable funds such as Andreessen Horowitz or Paradigm Venture Capital, which gives it a much more “traditional” air.

On the other hand, so far, the development of SushiSwap is much bigger and faster than that of Uniswap.

To this day the only thing Uniswap offers its users is the exchange of tokens and the possibility of providing liquidity to these exchanges.

SushiSwap already has other tools and the exchange of tokens. It has become a decentralized multi-chain exchange. This means that the platform can operate with other blockchains apart from Ethereum.

For example, currently, Binance Smart Chain, Polygon, or Fantom users can use SushiSwap. Additionally, SushiSwap has announced the upcoming implementation of the new Layer 2 solution with Arbitrum’s Optimistic rollups.

In summary, SushiSwap is the little brother of Uniswap. As such, it is more experimental, more open, and more flexible, while Uniswap has remained in a more serious, traditional platform profile and with a more structured team.