To some people, and countries alike, debt is something that goes up but hardly comes down. Incurring debt is an addiction to many people while paying it off is a different ball game.

I know that many individuals, households, organisations, and countries are ready to do anything to become debt-free. Anyone that fits into this criteria can read on - I'm about to show you a way.

The way to be debt-free (Some Call it a bluff)

- Decide to never take up loans

- Decide to never take up a mortgage

- Decide to never use a credit card - After all, your debit card is there for a reason.

- Decide to never use the overdraft offer from Banks.

- You can also decide to never make credit purchases

It's as simple as that! Anyone that wants to be debt-free, need to make a decision and stick to it.

You've already seen the list of decisions you need to make but sticking to them is the hard part.

Truth is, you and l know this. We also know that it's not an easy thing to do so, l won't be surprised if you choose to disregard it.

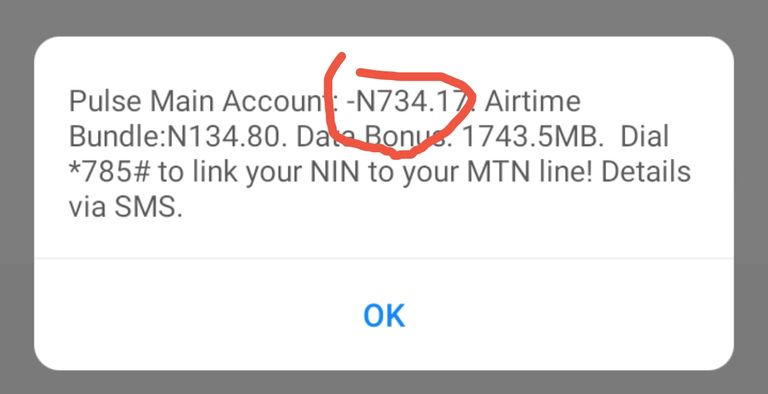

Some time ago, I also appeared in the debt book of MTN, one of the network providers in my country.

This happened because my internet subscription was about to finish so, l needed to do another one but I didn't have enough airtime for that. Without thinking twice, I opened my mobile app which is connected to my bank account. This usually takes a simple process of click, click, click, and Boom! - for my sim card to be funded with the amount that l need.

Unfortunately for me, my mobile app was throwing a fit. It didn't respond to my clicks and was already at the point of getting under my skin when I decided to improvise.

Guess what?

- I borrowed #750 from my network provider.

- They took a ridiculous 15% charge on the amount l asked for.

- I used whatever they left behind to bring my internet back to life.

I felt like screaming "I-Got-Ripped-Off"

Do you get the gist?

I know how much l dislike being in the debt book of anyone but l still became a debtor despite having a surplus of the amount l needed. Now, how would someone be able to avoid incurring debt whenever he is in urgent need of something.

It's just not easy to live day in day out without either taking up a mortgage, or loan or making use of a credit card or, anyother facility that leads to indebtedness.

Seriously, the complexities surrounding debt makes it hard for anyone, household, organisation, or country to have zero debt in a whole year.

Perhaps, we can now overlook the initial bluff about being debt-free and look into more realistic and practical ways of reducing our debt balance. Shall We?

Don't miss the next part of this post.

Thanks For Not Missing Any Full-stop Or Comma

Crossposted from LeoFinance Beta

I enjoyed reading this article. If you can avoid going into debt, that is obviously the ideal situation.

I think there are two scenarios when applying for debt.

When someone is in desperate need of capital and just doesn't have it. In this case, it is often also difficult to be successful in getting the credit, and you can't help thinking how it is easier to get credit when you have money or another form of security. Which makes you think..."If I had the money, I would not have applied for credit in the first place".

From the bank or credit provider's point of view, you are a risk to them. Because you already don't have money. Where are you going to get the money from to repay them?

Applying for credit to have something you would like to have, but you don't want to spend your own money.

It then normally becomes easier to obtain the credit, but it comes at an expensive price...which makes you think whether it's really worth it...

This is it. In real sense, during that is never a good thing even if it's meant to be used for an investment.

In business world, they don't have problem getting into debt in order to restock their inventory and co. But this never looks good whenever it backfires. Heheh.

Happy Sunday to you.

Good to see you getting started on Blurt

Thank you, @makeitrain4ever.

You can delegate blurt power to @blurttribe to support curation.

Peace

We are happy you posted in #blurtconnect.

This post has been upvoted manually by @oadissin

You can delegate any amount of Blurt power to @blurtconnect-ng to support this curation.