Cryptocurrency futures trading has emerged as a popular method for investors to speculate on the price movements of digital assets without owning them outright. Understanding margin and leverage is crucial for navigating this complex financial instrument effectively.

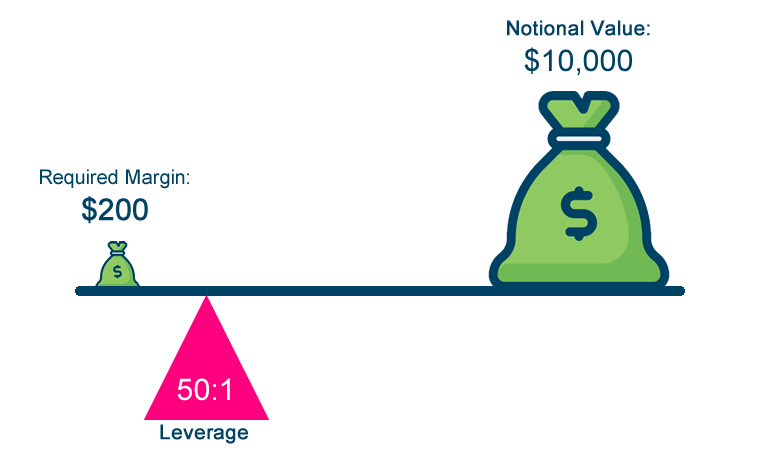

Margin refers to the collateral that traders must deposit to open a futures position. It acts as a security deposit, ensuring that traders have sufficient funds to cover potential losses. When trading cryptocurrency futures, traders can utilize leverage, which allows them to control positions larger than their initial margin. Leverage amplifies both potential profits and losses, making it a powerful tool but also increasing risk.

For example, with 10x leverage, a trader can control a position size ten times larger than their margin deposit. If the price moves in their favor, they can potentially realize significant gains. However, if the market moves against them, losses are also magnified. It's essential for traders to manage their leverage carefully and use risk management strategies to protect their capital.

One common risk management technique is setting stop-loss orders to automatically close positions if losses exceed a certain threshold. Additionally, maintaining sufficient margin to cover potential losses and avoiding excessive leverage can help mitigate risk. Traders should also conduct thorough research and analysis before entering trades, considering factors such as market trends, technical indicators, and fundamental developments.

While cryptocurrency futures trading offers opportunities for profit, it's important to recognize the inherent volatility and risks involved. Prices can fluctuate rapidly, leading to substantial gains or losses in a short period. Therefore, traders should approach futures trading with caution and only risk capital they can afford to lose.

In summary, understanding margin and leverage is essential for success in cryptocurrency futures trading. By carefully managing risk, conducting thorough analysis, and using risk management techniques, traders can navigate this market effectively and capitalize on opportunities while minimizing potential losses.

Upvoted. Thank You for sending some of your rewards to @null. Read my last posts to make sure that BLURT burning is profitable for you. Before using this bot please make sure your account has at least 100 BP. Get more BLURT:

@ mariuszkarowski/how-to-get-automatic-upvote-from-my-accounts@ blurtbooster/blurt-booster-introduction-rules-and-guidelines-1699999662965@ nalexadre/blurt-nexus-creating-an-affiliate-account-1700008765859@ kryptodenno - win BLURT POWER delegationNote: This bot will not vote on AI-generated content