Uhm, did China ban bitcoin again? Well, my country placed a ban on cryptocurrency a few months back, can’t tell how far they’ve gone with implementing that; but who cares? yeah, no one…only the bears! News of cryptocurrency regulation complications are always met with dump actions from holders who feel the world will come to an end following investigations and proceedings into the financial and ethical aspects of their cryptocurrency holdings.

Brad Garlinghouse and the ripple team are still battling it out with the SEC. New chairman; same SEC, cryptocurrency might never sit well with government officials. Shadowy super coders continue releasing those super shady code bits and even Elizabeth Warren isn’t having any more of those overwhelming solutions. Audacious codes suggesting the end of the circus centralized systems ruling the world currently.

Hey, before going further, have you Followed us onTwitter?

Prior to cryptocurrency and blockchain technology, no concept has challenged the political and financial (even religious) system at once. The ‘small’ protests at El Salvador, the ongoing SEC filings, the ‘never ending’ regulations…cryptocurrency has walked through the roughest edges over the years and from all indications, there’s more to come.

Don’t get it twisted; the current cryptospace is filled with irregularities and the need for some amendments and regulations cannot be overemphasized. That being said, regulatory proceedings ignore these aspects that needs regulation and are more focused on tackling super coders and the solutions they develop.

Dread it, run from it, these regulatory moves already have strong attachment with cryptocurrency and are poised to continue until they can’t. Regulations and rejections are thought to impede the growth of cryptocurrency and blockchain technology. According to most, cryptocurrency’s prominence would have been way bigger if these events weren’t destroying its growth path. This is arguable anyways. On a closer look, regulatory moves might have been a catalyst to bitcoin and altcoins’ rise to prominence. If this is not already the case; it will be in the near future.

Cryptocurrency exchanges are the major target of generalized bans on crypto-related activities. Most times this entails a halt in interaction of exchanges with mainstream financial institutions such as banks. To be fair, many exchanges have their excesses and sometimes these regulations on their activities are justifiable. On the brighter side, bans on exchanges steer cryptocurrency users towards peer-to-peer interaction. With custodial exchanges halted, cryptocurrency use is forced towards a more decentralized and secure set-up. Satoshi envisioned a peer-to-peer value exchange system, not sure if exchanges were part of his plans.

Here’s the perfect scenario; with exchanges out of the way and fiat exchange gateways blocked by regulators, cryptocurrency holders and stores are left with two options; accept and hold cryptocurrency or reject cryptocurrency as a medium of exchange. Alright, you’d feel the latter is more realistic, but cryptocurrency appeals to the current generation more than fiat. Little surprise if the former prevails, the former is Satoshi’s vision!

Exchanges are cool, fiat gateways are important since the transition to a crypto world will always be a gradual one, a stern ban might steer things up faster. Wild thoughts, but realistic. Years of fierce war on cryptocurrency have been futile, regulators aren’t giving up but cryptocurrency has continued to grow. Shadowy super coders are coming out on top.

Organic marketing? Something news of bans has done effortlessly for cryptocurrency. The people are more glued to the government; when the government talk about cryptocurrency, the people listen. Positive or negative, the governments’ tone sometimes doesn’t determine the people’s perception. Most Baby boomers and Gen Xers first came across cryptocurrency on government websites, they occupy a good position in the crypto space currently. Surprise? Not at all, it’s obvious that current governance and financial system is riddled by imperfections. People seek alternatives, cryptocurrency and blockchain technology present better opportunities. Governments’ actions expose the people to these opportunities, on a closer look ‘it’s not as bad as they made it look’.

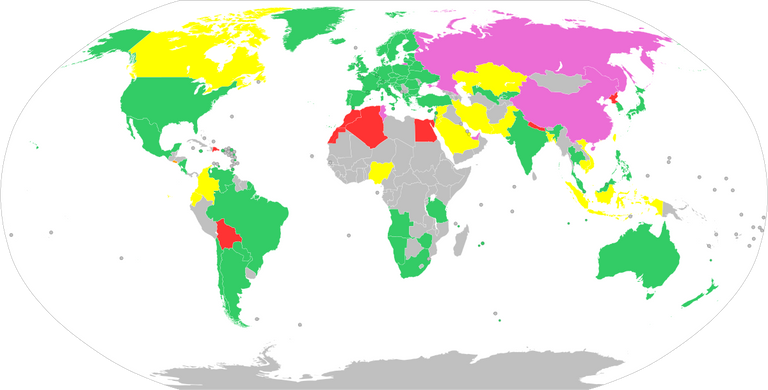

Legality of bitcoin by country. Source

Cryptocurrency’s rise was never billed to be an easy journey, the turbulence is part of an important transition. Relative to its competitors, decentralization is still in its early stage and has enough room to grow. With clever minds piloting its growth, it stands a chance of penetrating the global financial, political and even religious system; actually, it’s safe to say that it’s already done so. But this is just the beginning of a very long journey. Regulations have an effect different what majority presume, they have, in fact contributed positively to current milestones; this is expected to continue.

Read our article on bitcoin’s chances of fixing the world’s economy.

Cryptocurrency Scripts is transforming into a community of enthusiastic cryptocurrency and blockchain believers! Join the Adventure!

Would you love to read similar articles?

Follow us on Twitter

Follow us on Medium

Follow us on Publish0x