What Many People Ignore in Staking and Yield Farming

Back in the old days whenever someone said HODL my reply was why not just stake instead and earn some interest? That is true if the coin we stake will go up in value. However, many people did not think of what happen if the coin value go down? For example, you have 100 coins worth $1 each ($100 worth) with interest annual percentage rate (APR) 30% a year:

- With APR 30% you will have 100 + 30 = 130 coins at the end of the year.

- If the price drops more than APR 30%, you lose for example 130 coins costs $0.6 (price drops by 40%) is worth 130 * 0.6 = $78. Profit/loss $78 - $100 = -$22

- If the price drops slightly below APR you still win for example 130 coins costs $0.8 (price drops by 20%) is worth 130 * 0.8 = $104. Profit/loss $104 - $100 = $4

- If the price stays you win ofcourse. 30% APR is $130 where profit/loss $130 - $100 = $30.

- If the price goes up is the best situation. Not only your investment when up but you also earned interest. Still the best investment is ofcourse the one with the highest profit. For example, which do you prefer? Buy Fairmoon on 30th March 2021 or buy and stake Ape Swap Banana?

- I bought 200 Ape Swap Banana at $0.5 ($100 worth of investment) and the APR on its pool is 266%, and then the price goes up to $1. 200 Banana 266% is 532 Banana so the total is 200 + 532 = 732 then * $1 which all worth $732 and the profit/loss is $732 - $100 = $632.

- Buy $100 Fairmoon at $0.00015 on March 30, 2021 where we will get 666666 Fairmoon. 3 days later, the price goes up to $0.02 which is $0.02 - $0.00015 = $0.01985, divided by $0.00015 = 132 then time 100% = 13200%. Anyway the 666666 Fairmoon * $0.02 is now worth $13333 where the profit/loss = $13333 - $100 = $13233.

- Comparing both profit, buying Fairmoon early $13233 - $632 = $12601 more profitable than buying and staking Apeswap Banana. (Disclaimer: this is just historical example and not financial advice for example if Apeswap Banana will go up to $20, 732 * $20 = 14640, ofcourse it is better to buy and stake Apeswap Banana)

Issue With Many New Players

Now, the problem is the new players in crypto. For old timer like us, we are used to do our own research (DYOR) such as check the fundamentals, check the sentiments, and finally check the technical analysis of a coin. If there is potential, then buy the coin. Majority of new players probably does not bother doing there own research and even if they did, we still wonder if they are able to handle the volatility of the market. 10% - 20% up and down a day is normal in crypto but those new players most likely will have a heart attack after seeing their investment (or gamble) down by 10% the next day and panic sell. The day later, they cry because their gamble that they sold went up by 50%. When I became known to be in crypto, most of the people who came to me want to give me money and use them to invest in crypto on their behalf.

- Learning to invest in cryptocurrency takes time for those who are not computer literate.

- Some are just to lazy to learn and just want to leave their money to me hoping to profit together.

The Safe Plan I Found

Therefore, for these people, I search some plans of low risk investments in crypto and one of the answer I found is yield farming using stable fiat coin. Yield farming in crypto is providing liquidity and get rewarded in fees plus some tokens. It is called farming because the coins we plant generates crops. For those of you who still do not understand, just think of it as a certificate of deposit (COD) that generates interest in another currency for example we deposit Dollar and we get interest in Yuan. Like staking, yield farming is not profitable if the interest does not cover the loss of the asset's value (the coin goes down in price). However, there are farms now where we do not need to risk our investment in volatile coins but use fiat stable coins as the seeds to grow some yields.

Yield farming started during the decentralized finance (DeFi) craze in 2020. For example, we can just supply some dollar stable coins such USDC and DAI and earn interest plus farming their COMP token. Why did I not start back then but only now? The fees on Ethereum became crazily expensive for for average people. Imagine paying $50 to deposit then another $50 to withdraw. This is because of Ethereum scalability issue with only a dozens of transaction per second because they are focusing more on decentralization and security. The more users came, the more users wait and they do not like waiting so what do they do? Rich people who farms hundred thousands of dollars, millions of dollars, are willing to pay thousands of dollars of fee. A thousand dollar is like a snack to them. What about average people like us? We are only willing the pay a few dollars and how long must me wait until a miner serve us? Maybe forever because there are always people willing to pay more?

Good news for average people like us this year there are Layer 2 Ethereums and other alternatives such as Binance Smart Chain, Avalanche, and Wan Chain that ranges the fee from almost 0 to most expensive as 20 cents. We can profit in farming with only just a hundred dollar. Other than that, what are these stable coin farming are useful for?

- Generate yields on our stable coins while we are doing our own research (DOOR) waiting for our next investment.

- Lower risk plan for high net worth individuals with better returns than the traditional financial system. If you are living in developed countries, you will be lucky finding a deposit interest rate of 1% and if you are not lucky, the interest rate is negative meaning that you are losing money instead. In developing countries, you may find 5% of interest rate. In mutual funds and government bonds, you are lucky if you can find 10% APR. Today's yield farming using fiat stable coin cryptocurrency guarantees a rate above 10% where for now I saw 20% - 100% APY.

- A safe plan for other people who wants to put their money in you because they are too lazy to do crypto themselves. Before I found this safe plan, I always reject them because crypto trading is more risky than stock trading. Although I won thousands of dollars but there are bear markets where I lose thousands of dollars as well. Now with these low risk plans that I found, I am starting my investment firms for those who kept bugging me to take their money and help them invest it.

- Face it, the world we are living now almost everything is valued in fiat such as USD. Not only we buy goods and services using USD but most of us earn our wages in USD which is why eventhough I like the term 1 BTC = 1 BTC but it is too selfish to use. Not all people can earn in BTC and even if they can, not all of us can use BTC to buy foods and drinks. Lets be realistic that most of us do not measure the value of a coin in BTC nor XAU but measure them in USD. If the value in USD goes down is a loss and if the value in USD goes up is a profit. Then what about yield farming using fiat stable coins? Theoretically, we can never lose because the coin value remains stable to the USD and we earn interest plus yield unless the fees are high.

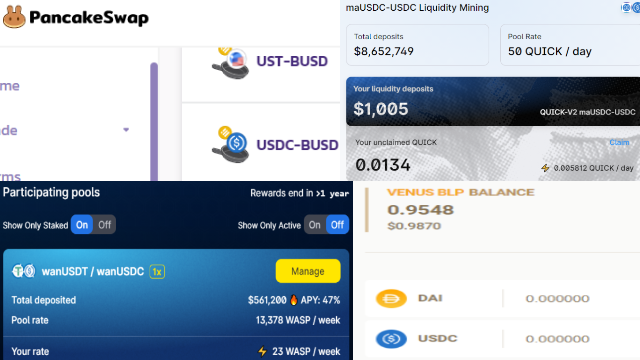

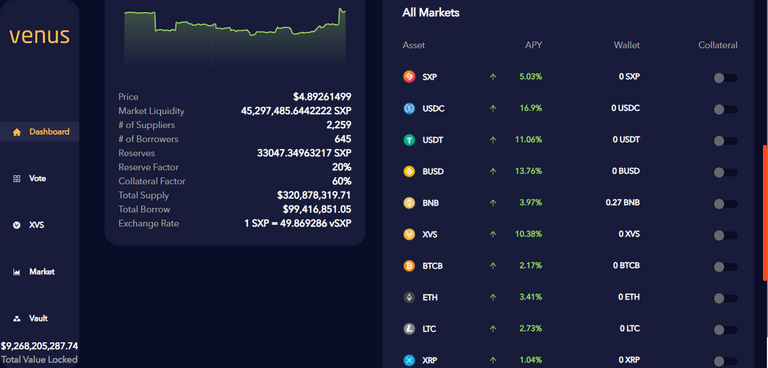

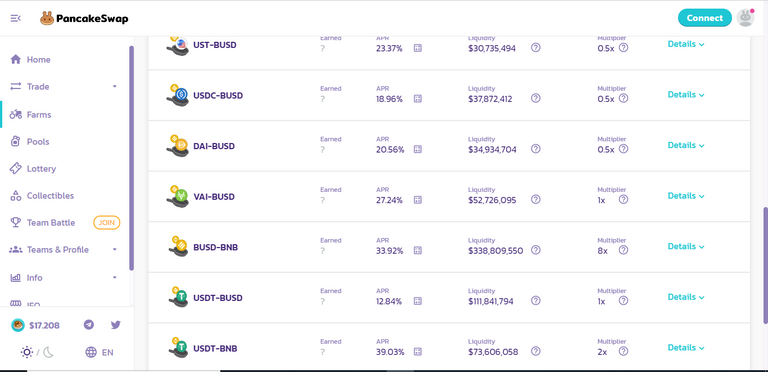

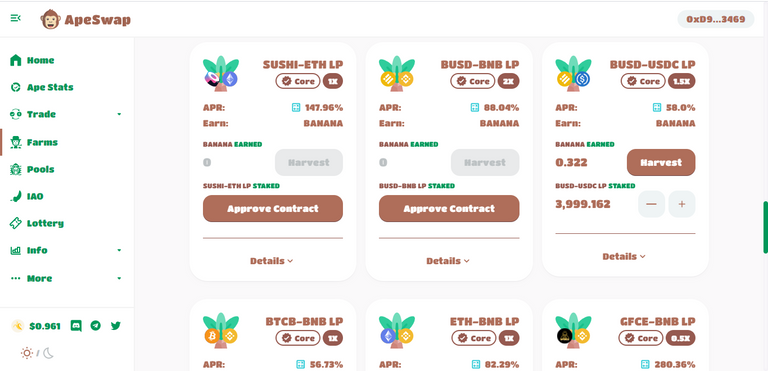

Before I continue, while the calculator shows no risk because it is USD generating interest and yield but becareful with the platform because malicious platform can steal our money. For now top well known platforms such as Venus Protocol, Pancake Swap, and Ape Swap are reliable and maybe some other audited platforms as well such as Conveyor Belt. Other than that, becareful of other platform for example Turtle DEX was said to be rug pulled where people putting their money there lost them.

Polygon/Matic

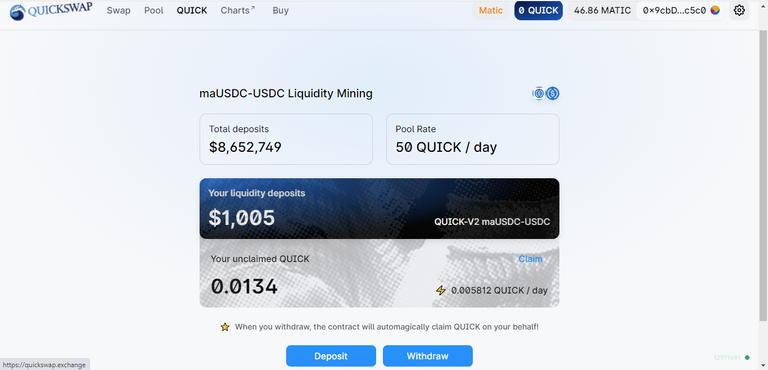

Quick Swap when $150/QUICK

- maUSDC-USDC: 31.58% in QUICK

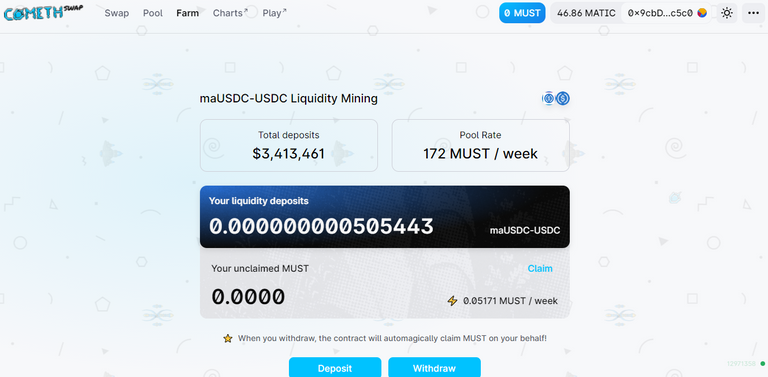

Cometh Swap when $199/MUST

- maUSDC-USDC: 51% in MUST

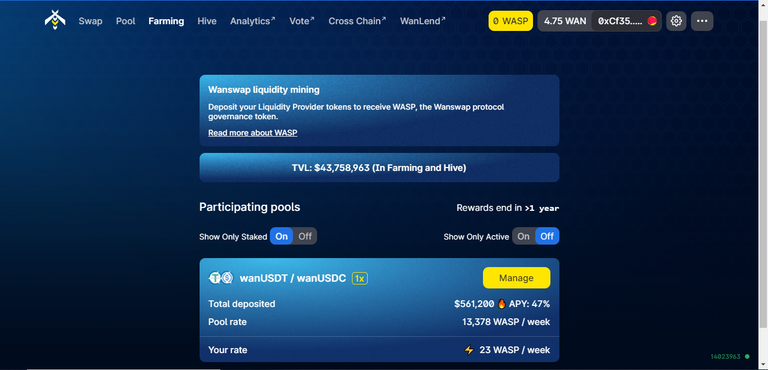

Wan Chain

Wan Swap when $0.379/WASP

- wanUSDT-wanUSDC: 47% in WASP

Binance Smart Chain

Venus Protocol when $79.63/XVS

- USDC: 9.56%

- USDT: 4.1%

- DAI: 5.73%

- BUSD: 9.71%

Pancake Swap when $17.5/CAKE

- USDC-BUSD: 19.2% * 0.5 in CAKE

- USDT-BUSD: 12.89% * 0.5 in CAKE

- DAI-BUSD: 20.56% * 0.5 in CAKE

- VAI-BUSD: 27.46% * 0.5 in CAKE

- UST-BUSD: 24.19% * 0.5 in CAKE

Ape Swap when $1/BANANA

- USDC-BUSD: 58.79% * 1.5 in BANANA

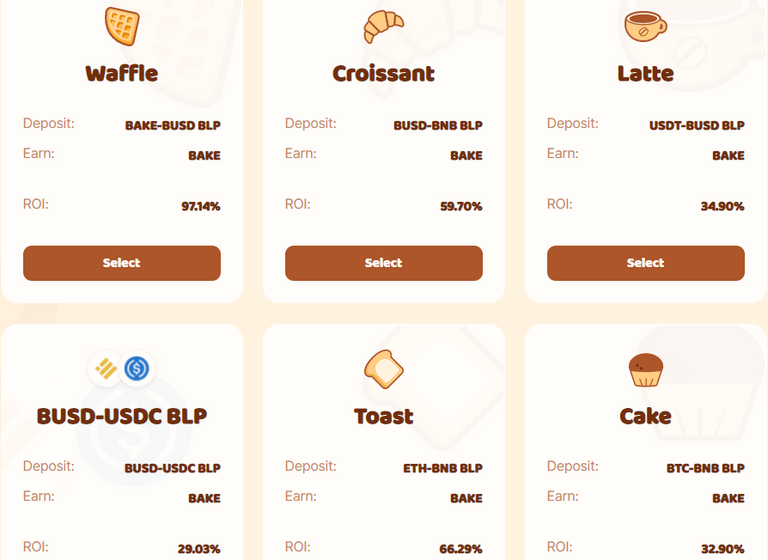

Bakery Swap when $1/BAKE

- BUSD-USDC: 29.03% in BAKE

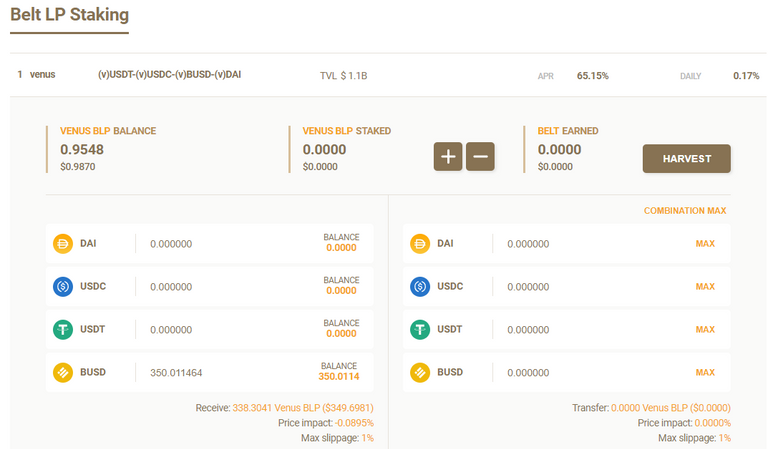

Conveyor Belt when $100/BELT

- BUSD, USDC, USDT, DAI: 65.95% in BELT

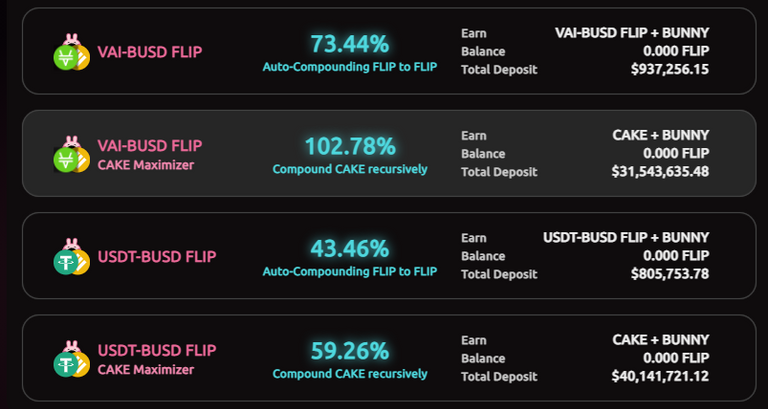

Pancake Bunny when $264/BUNNY

- VAI-BUSD: 73.44% in BUNNY

- VAI-BUSD Cake Maximizer: 102.78% in CAKE and BUNNY

- USDT-BUSD: 43.46% in BUNNY

- USDT-BUSD: 29.66% in KEBAB

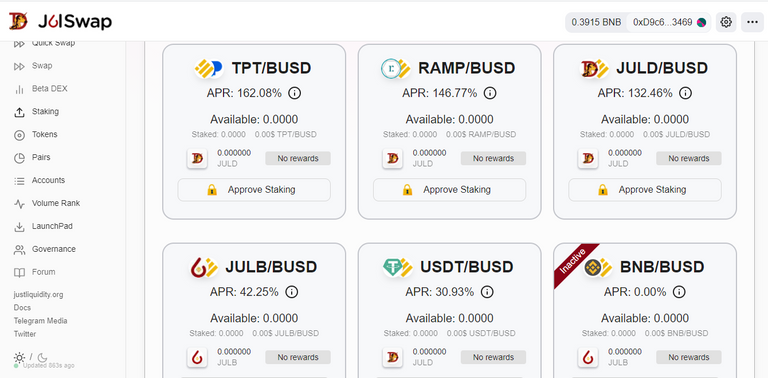

JulSwap when $0.15/JULD

- USDT-BUSD: 30.93% in JULD

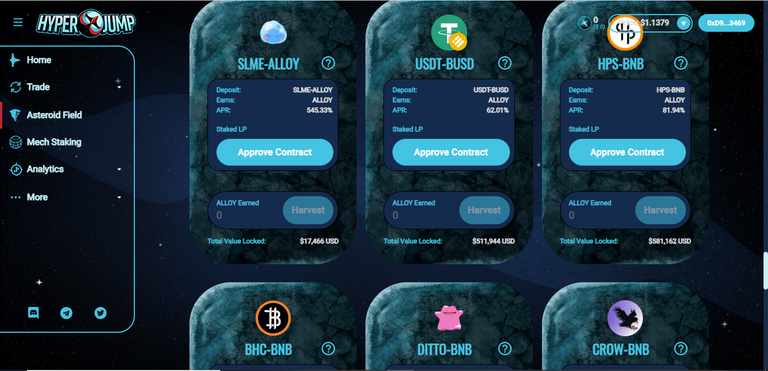

Hyperjump when $1.2/ALLOY

- USDT-BUSD: 62.01% in ALLOY

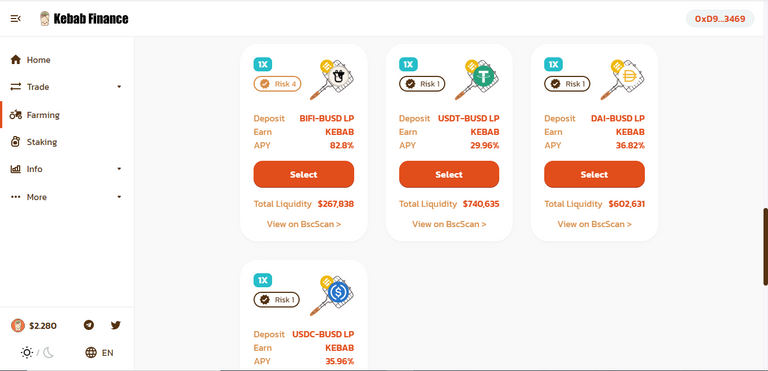

Kebab Finance when $2.25/KEBAB

- USDC-BUSD: 35.61% in KEBAB

- USDT-BUSD: 29.66% in KEBAB

- DAI-BUSD: 36.47% in KEBAB

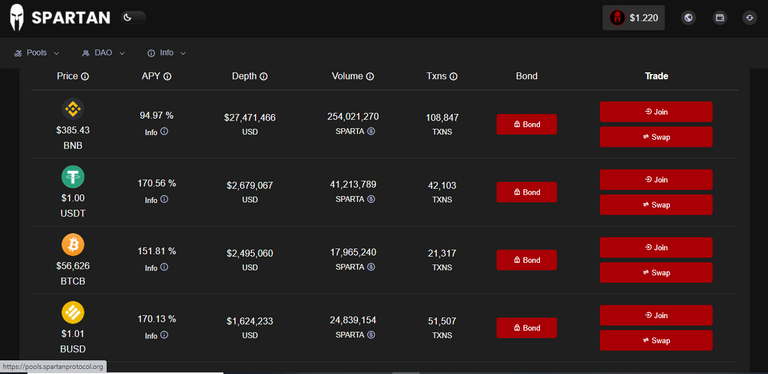

Spartan Protocol when $1.22/SPARTAN

- BUSD: 170.13% in SPARTAN

- USDT: 170.56% in SPARTAN

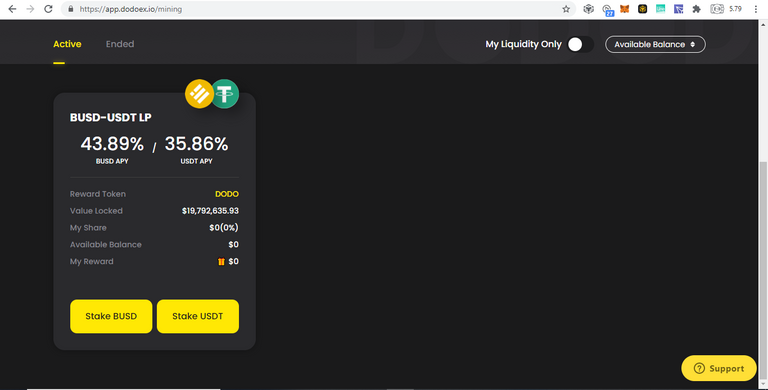

DODO when $3.7/DODO

- BUSD-USDT: 40% in DODO

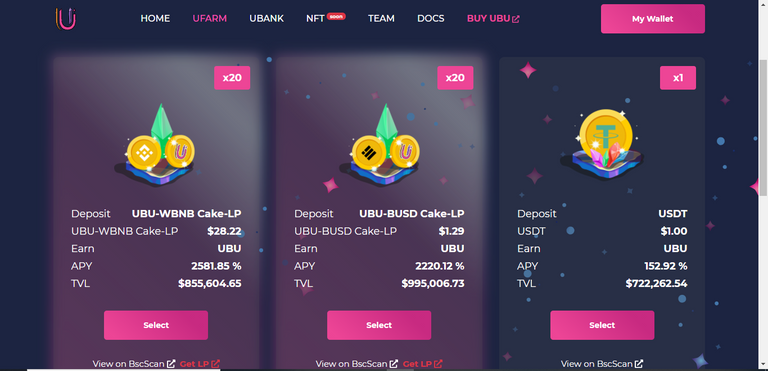

UBU Finance when $0.38/UBU

- USDT: 152.92% in UBU

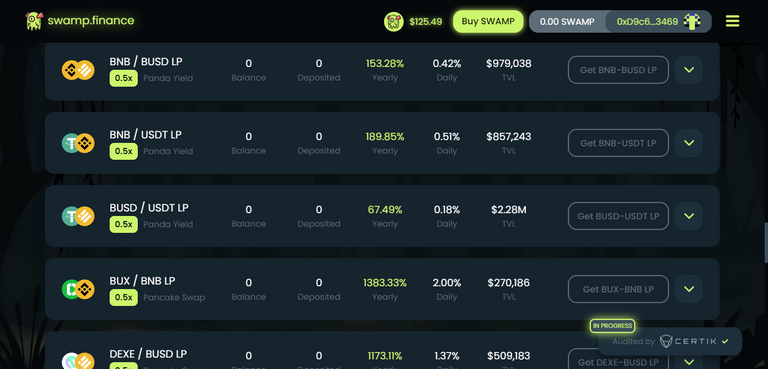

Swamp when $124/SWAMP

- USDT-BUSD: 67.49% * 0.5 in SWAMP

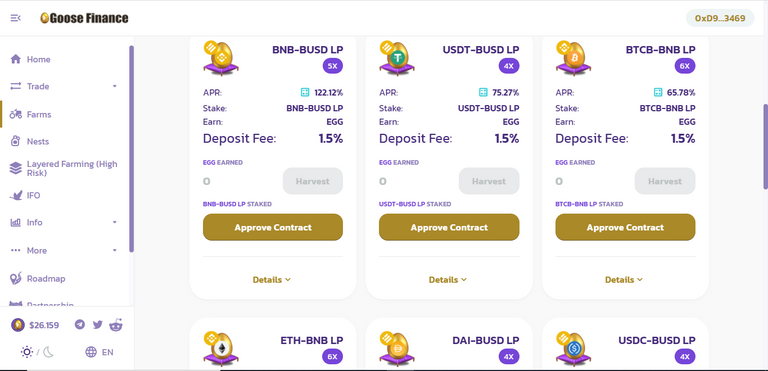

Goose Finance when $26.159/EGG

- USDT-BUSD: 75.25% * 4 in EGG (Deposit Fee 1.5%)

- USDC-BUSD: 60.37% * 4 in EGG (Deposit Fee 1.5%)

- DAI-BUSD: 95.26% * 4 in EGG (Deposit Fee 1.5%)

- BUSD: 77.61% * 2 in EGG (Deposit Fee 1.5%)

- USDT: 79.64% in EGG (Deposit Fee 1.5%)

- USDC: 80.50% in EGG (Deposit Fee 1.5%)

- DAI: 86.22% in EGG (Deposit Fee 1.5%)

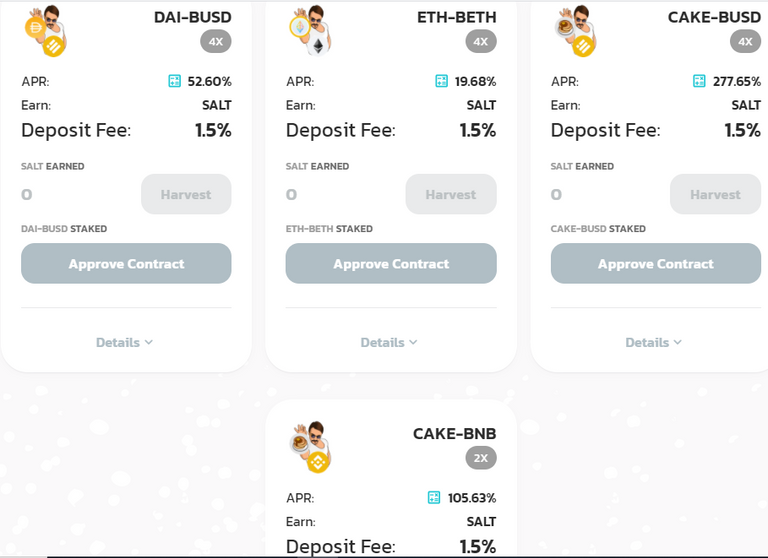

Salt Swap when $0.369/SALT

- DAI-BUSD: 52.6% * 4 in SALT (Deposit Fee 1.5%)

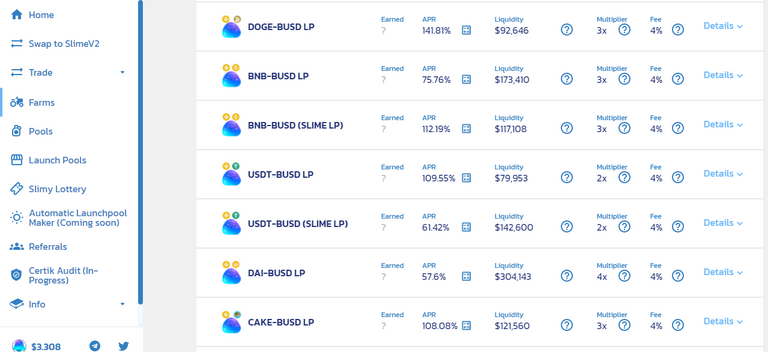

Slime Finance when $3.304/SLIME

- USDT-BUSD: 109.54% * 2 in SLIME (Deposit Fee 4%)

- USDT-BUSD Slime LP: 61.42% * 2 in SLIME (Deposit Fee 4%)

- DAI-BUSD: 57.58% * 2 in SLIME (Deposit Fee 4%)

- BUSD: 65.07% * 1.5 in SLIME (Deposit Fee 4%)

- USDT: 62.91% in SLIME (Deposit Fee 4%)

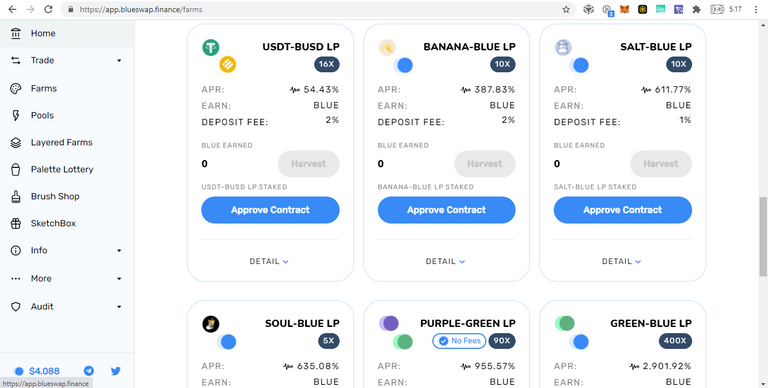

Blue Finance when $4/BLUE

- USDT-BUSD: 54.43% * 16 in BLUE (Deposit Fee 2%)

- BUSD: 83.92% * 16 in BLUE (Deposit Fee 4%)

- BUSD Purple Layer: 275.35% * 12 in PURPLE (Deposit Fee 4%)

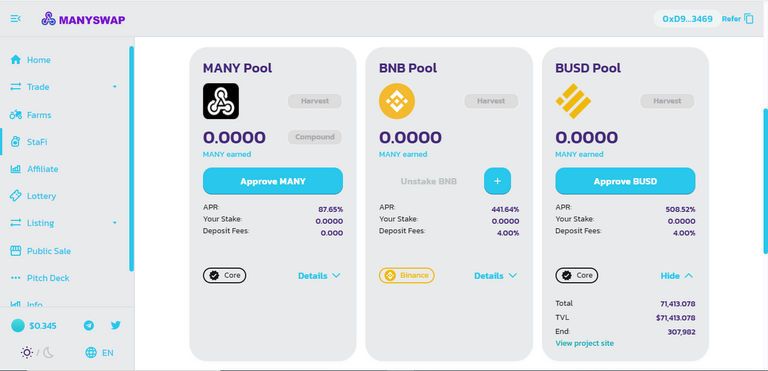

Many Swap when $0.28/MANY

- BUSD: 508.52% in MANY (Deposit Fee 4%)

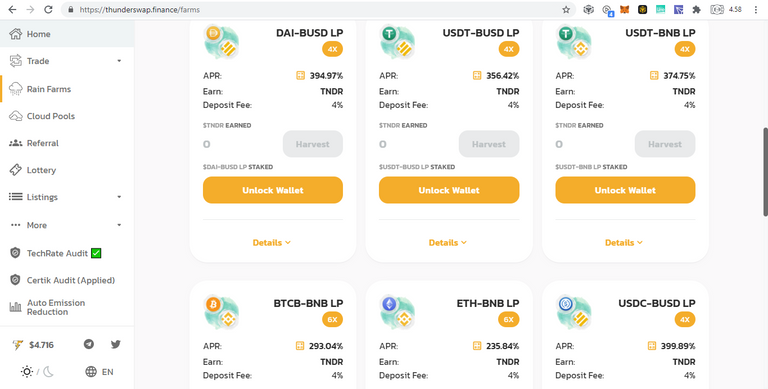

Thunder Swap when $4.77/THUNDER

- DAI-BUSD: 394% in THUNDER (Deposit Fee 4%)

- USDT-BUSD: 356% in THUNDER (Deposit Fee 4%)

- USDC-BUSD: 399% in THUNDER (Deposit Fee 4%)

More Platforms Will Definitely Come

Leave a comment if you know more platforms and I will include them in the next post.

Mirrors

- https://www.publish0x.com/0fajarpurnama0/low-risk-yield-farming-using-fiat-stable-coins-early-2021-xwqzmrz?a=4oeEw0Yb0B&tid=blurt

- https://0darkking0.blogspot.com/2021/04/low-risk-yield-farming-using-fiat.html

- https://0fajarpurnama0.medium.com/low-risk-yield-farming-using-fiat-stable-coins-early-2021-9f0dbdab9edc

- https://0fajarpurnama0.github.io/cryptocurrency/2021/04/14/low-risk-yield-farming-fiat-stable-coin-2021

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/low-risk-yield-farming-fiat-stable-coin-2021

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/low-risk-yield-farming-using-fiat-stable-coins-early-2021

- http://0fajarpurnama0.weebly.com/blog/low-risk-yield-farming-using-fiat-stable-coins-early-2021

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/225-low-risk-yield-farming-using-fiat-stable-coins-early-2021

- https://read.cash/@FajarPurnama/low-risk-yield-farming-using-fiat-stable-coins-early-2021-9853454e

- https://www.uptrennd.com/post-detail/low-risk-yield-farming-using-fiat-stable-coins-early-2021~ODg1NDQw

- https://trybe.one/low-risk-yield-farming-using-fiat-stable-coins-early-2021

- https://www.floyx.com/article/0fajarpurnama0/low-risk-yield-farming-using-fiat-stable-coins-ear-000146d31c

- https://markethive.com/0fajarpurnama0/blog/lowriskyieldfarmingusingfiatstablecoinsearly2021

Are these all DeFi platforms?