The Liquid Self-Stake by Marinade product is a new way for validators to unlock their self-staked SOL and still conserve an amount of stake delegated to their validator.

https://marinade.finance/app/staking/

Validators will be able to deposit their stake account and inform Marinade that they'd like to receive the stake back to their validator.

Upon submission, the Marinade team will be in contact and generate a unique link to be used by the validator to deposit the stake account with Marinade. The validator will deposit the stake account and receive mSOL, but will only be able to use it in a list of whitelisted options.

If the validator moves the mSOL off whitelisted options, the proportional guaranteed stake delegated by Marinade to the validator would be removed and reallocated.

There is an upper limit on the % of Marinade's total TVL that can be used to redirect stake to validators using this product. This limit is set to 30% of the total TVL and is a parameter governed by the DAO.

If the TVL of this product grows higher than 30% of Marinade's total TVL, validators would begin to receive less stake than what they deposited, and a part of this stake would be distributed through the delegation strategy and the validators gauges.

What is the Benefit?

Users of this product will be able to:

Receive mSOL and receive some guaranteed stake from Marinade's delegation strategyUse this mSOL as collateral on a lending platform (Solend for example), if desired.

Borrow against those mSOL and unlock this capital in DeFi for additional yields, if desired.

The validator can decide to sell or unstake a part of their mSOL at any time. If this mSOL amount is partially or completely sold, the guaranteed stake delegated by Marinade would be automatically removed and distributed amongst the Marinade stake pool using the stake bot algorithm.

In the meantime, their validator node still has a sizable amount of stake directed back to it and due to this product, the validator is able to make full use of their previously locked funds.

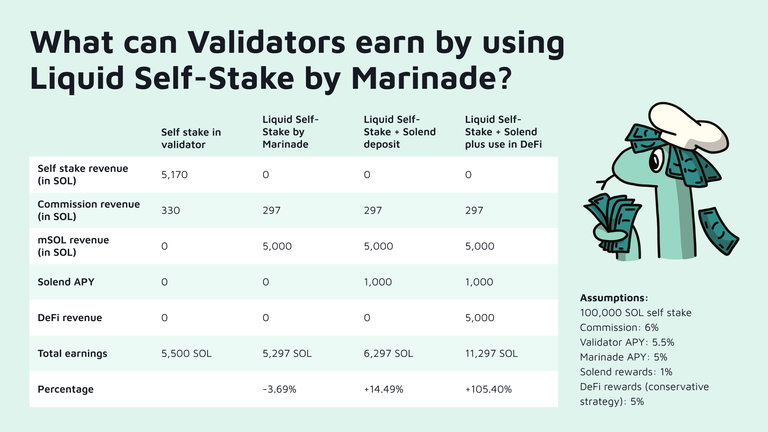

With mSOL APY and an additional APY of 1% added to those mSOL via Solend, the estimated returns for a validator would be greater than their estimated returns when self-staking. This holds true even if only 30% (the minimum) of the original stake account deposited is returned to the validator node by Marinade, as most of the gains are returned from mSOL and DeFi lending APYs.

For example, even if a validator were to only receive 30% of its initial stake back, it would still be a potentially profitable endeavor while re-distributing 70% of the stake to smaller validators, which contributes to the decentralizion of the network.

What are the whitelisted options?

Currently, the whitelisted options are the following:

- Holding mSOL in your wallet

- Deposit mSOL as collateral on Solend

In the application form, you'll find a field to ask/require other options if you'd need them. Marinade will be able to add options as they are requested as long as they can be used to monitor the ownership of the mSOL.

Who can use the Liquid self-stake product?

This product is mainly aimed at validators with a self-stake (in the form of a stake account delegated to their own validator node) of at least 10k SOL.

In order to be eligible, the validator must have a commission of 10% max and an average APY over the last 10 epochs greater than 5%.

How to participate?

If you are a validator with self stake and want to use this product, please fill out . The Marinade team will then reach out to you with a unique link to use when you deposit the stake account.