HQLAᵡ, the distributed ledger-based tokenization platform, has executed its first agency securities lending transaction between BNY Mellon and Goldman Sachs, both investors in the company.

The 35-day term transaction was for hundreds of millions of dollars.

The primary purpose of HQLAᵡ is to save money for big banks that have to keep high quality liquid assets (HQLA) for Basel III balance sheet compliance.

To date, the platform has allowed banks to swap HQLA between each other to get the right mix of assets on a delivery versus delivery basis.

It is also enabling agency securities lending.

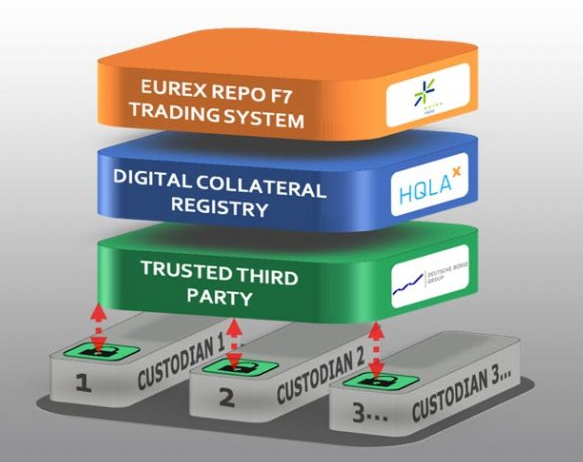

The challenge is that trading assets has long settlement times as the securities are moved between different custodians.

Instead, HQLAᵡ tokenizes the securities held at the original custodian enabling the asset to be traded and settled, without moving it.

It relies on the Deutsche Börse acting as a trusted third party between the custodians and the digital collateral registry – the register of tokens.

For agency securities lending, each digital collateral record (DCR) has an associated ISIN.

Hence the securities represented by the DCR can be lent and digitally settled without moving custodian.

These DCRs or tokens can also be used as collateral with participating Triparty Agents.

And many of the biggest Triparty Agents and custodians are connected to HQLAᵡ: Clearstream, Euroclear, JP Morgan, BNY Mellon, BNP Paribas and Citi.

“Agency securities lending activity represents the single biggest source of liquidity for the collateral upgrade market, so welcoming BNY Mellon as a liquidity provider to our platform represents a tipping point for recurring, scalable volumes on our platform,” said Guido Stroemer, co-founder and CEO of HQLAᵡ.

Meanwhile, HQLAᵡ uses the Corda enterprise blockchain.

At its most recent funding round in January 2021, it raised €14.4 million ($14.75m) from BNY Mellon, Goldman Sachs, BNP Paribas Securities Services, Citigroup and Deutsche Börse Group. JP Morgan joined later.

In other major news in the sector, EquiLend, the institution-backed securities lending provider that processes $2.8 trillion in trades monthly, also plans to adopt blockchain as a single source of truth to reduce reconciliation breaks.

B2B sector has had its own development and evolution on blockchain and tokenization. Up to now, this development has had its progress with some of big traditional richest financial institutions. Could it be assembled with recent B2C crypto sectors or would it have its own sector to be developed?

Source: Ledger Insight

Congratulations, your post has been upvoted by @r2cornell, which is the curating account for @R2cornell's Discord Community.