During crypto winter, DeFi seemed to be satagnated in growth.

But based on last crypto funding report from Messari, from last June, DeFi investment rose again. And many investors and crypto users predict DeFi will survive and evolve more to threat TradFi.

But still much untertainty and a lack of information and knowledge make DeFi and DEX difficult to approach.

It is required to know basic points and start from small stable investment.

Risk of Using DEX

1. Smart contract vulnerabilities

Some protocols are still under development phase and somtimes contain uncertain points that come from short history of usage. Not fully proven yet.

So, there are always the possibilities of exploit in the smart contract. We can see the cases of recent Ethereum bridge Nomad and Near hacking and Terra/Luna chain vulnerability.

To mitigate these risks, it is required to see if DEX uses proven token-swap protocol and audited by crypto security firm.

2. Divergence loss (impermanent loss)

As token prices diverge from their prices at deposit, your liquidity becomes lower in value when compared to its value if tokens were held outside the pool.

Depending on volatility, your liquidity stake may become lower than your deposit when you withdraw. Large price swings could cause liquidity providers to lose money.

Generally, the risk of divergence loss is amplified in high APY pools.

Loss in value due to simple changes in asset values is not divergence loss.

3. Private Key Stolen

Private Key may be stolen by a variety hacking methods. Coldwallet is top priority way to be safe and reliable wallets are highly recommended. Metamaks in Ethereum and Phantom/Solflare in Solana are reliable wallets.

Recently Slope wallet users' private keys were hacked and SPL and ERC-20 token were stolen that came from loose security management by wallet provider.

Which curves do your trading pools use?

Most of DEX liquidity pools use the Constant Product curve (x * y = k) that is popularized by Uniswap, as well as the stable curve popularized by curve.fi for Stablecoin pools (currently USDC/USDT).

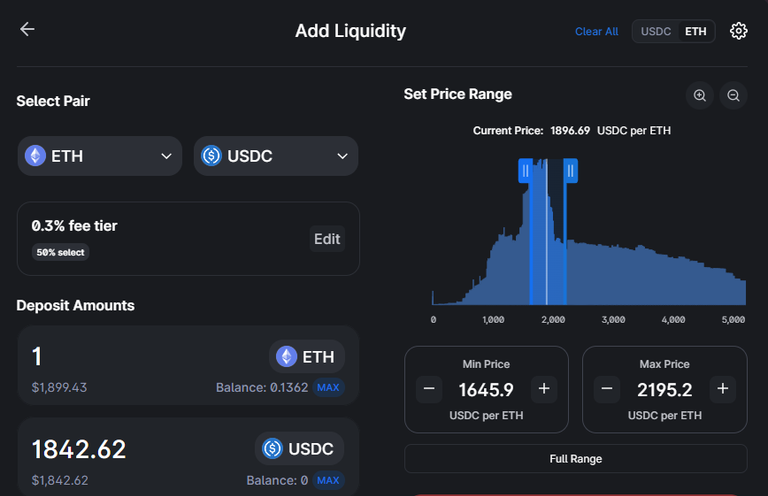

Risks and Incentives of Concentrated Liquidity pools (Uniswap V3 type)

Unlike standard pools, liquidity providers in concentrated liquidity pool will compete for trading fees and token emissions, which are divided among liquidity providers according to the parameters of their deposits.

Due to the structure of Concentrated Liquidity and Leverage, users who set a tighter price range, around the current token price will receive a higher share of fees and incentives. They are, on the other hand, more vulnerable to Divergence Loss (also known as Impermanent Loss or IL).