UNDERSTANDING CRYPTOCORRELATION

Cryptocurrency correlation is the relationship in direction between two or more cryptocurrencies, with the Bitcoin being the usual benchmark for such correlation. The correlation coefficient between two variables is measured on a scale of 1 to -1. The closer the correlation coefficients to the value of 1, the more positive the correlation between the variables or assets of comparison, and the closer it is to the value of -1, the more negative is the correlation between assets of comparison.

Cryptocurrencies can either be positively, negatively or randomly correlated (no correlation). A positive correlation entails that the movement of a coin in one direction means the same for another. For a negative or inverse correlation, movement in the direction of a coin means an opposite movement in direction of another coin. Random correlation means that there is no known relationship between the coins of interest. At the time of writing, Bitcoin is positively correlated with the first ten coins by market capitalization and mostly correlated with Huobi BTC (0.906), Ren BTC(0.900), Avalanche (0.887), and APENFT (0.897). It is most negatively correlated with Cosmos (-0.336), Osmosis money (-0.342), Liquity USD (-0.403), Magic Internet Money (-0.455), and Terra (-0.583). Bitcoin extends to be positively correlated with the first 100coins by market cap exclusive of all stable coins because they have a relatively fixed value, thus making them less volatile assets.

It serves as a reserve currency for most exchanges - Bitcoin has the highest market capitalization, thus exerting high influence over alternative coins.

Self-Fulfilling Prophecy, where people having a mental pre-association between Bitcoin and altcoins actually initiate what they anticipate because of emotions such as fear and greed.

Altcoins are measured in value against BTC as a form of hedge. The correlation between Bitcoin and altcoins has grown stronger over time. As of 2016, the positive correlation between Bitcoin and other cryptocurrencies scarcely equaled 0.8 unlike what is obtainable today among crypto coins, where the correlation between bitcoin and other coins reach as high as 0.9.

With proper knowledge of the correlation between cryptocurrencies, a trader can explore the lagging difference between cryptos that are correlated. This knowledge can aid a trader in making good trading entry decisions.

It enables traders to manage their positions on different trades.

Such knowledge enables a trader to properly diversify their crypto portfolio to mitigate loss and maximize profit. A trader or investor who wants to diversify their crypto portfolio should know that it may not be in their best interest to invest in assets that have either only a positive or negative correlation with bitcoin.

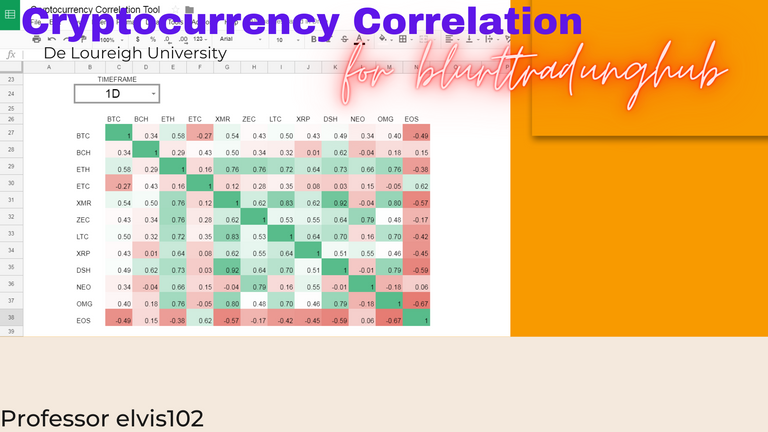

Below are some links to sites where you can check the correlation between two or more assets of choice.

https://charts.coinmetrics.io/correlations/

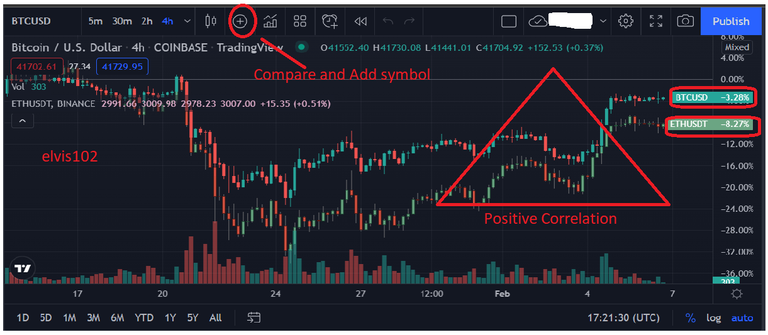

You can also use the Compare and Symbol tool on Tradingviewto compare the relationship between two or more assets.

.

.

There are factors that traders take into consideration when delving into the world of financial markets and correlation is not that should be overlooked as it provides useful information that sheds light on price prediction and other important areas of financial analysis.

This knowledge is particularly very useful to an investor who wishes to properly diversify their financial portfolio (cryptocurrencies, stocks, and futures) because they can avoid the mistake of indirectly putting all their eggs into the same basket.

Cryptocurrency remains a risky investment that is affected by a wide range of factors. Some of these factors are peculiar to certain cryptocurrencies, therefore even the strongest correlation between two assets can be altered. Thank you for reading.

Assignment

1 What do you understand by crypto correlation?

2 Briefly explain two reasons for crypto correlation

3 List three cryptocurrencies that are currently inversely correlated to Bitcoin.

Good Luck!

RULES

1 #blurttradinghub should be your first tag for easy recognization followed by your country tag e.g #blurtnigeria.

2 Introductory post is compulsory.

3 100 blurt power is required

4 Content should not be less than 250 words

5 Reblurt compulsory

6 Please avoid plagiarism

7 All materials/images from the web should be properly sourced.

8 Submit the link to your assignment in the comment section.

10 Entries close on Saturday 12th January by 11:59pm (GMT+1).

:::Discord :::Whatsapp:::Telegram :::