SOURCE

When it comes to investing, our generation has access to a variety of options that were unimaginable just a decade ago. Cryptocurrencies, NFTs, and robo-advisors have revolutionized the financial landscape, offering fresh opportunities for building wealth. However, amid all the hype surrounding these digital assets, it's essential to recognize that some investment options have stood the test of time—like precious metals, including silver and gold. So, where do these classic assets fit in a modern investment strategy, especially for younger investors? Let’s take a closer look.

Gold and silver might seem like relics from the past, but their value has endured across centuries. These metals are often regarded as safe havens during times of economic uncertainty or inflation. Unlike other investments that might lose value in a turbulent market, precious metals tend to hold their worth, providing a financial safety net. In an era where the price of cryptocurrencies can surge one day and plummet the next, precious metals offer a level of stability—a reliable anchor in a volatile investment environment.

SOURCE

The modern appeal of silver and gold is rooted in their versatility, but not all forms of investment in these metals are created equal. While you can invest in gold or silver through exchange-traded funds (ETFs) or mining stocks, the most secure and reliable way to hold these assets is in their physical form. Owning physical gold or silver, such as bars or coins, gives you something tangible—a piece of security that you actually possess. This physical ownership is crucial because it eliminates the risks associated with paper contracts and digital representations of precious metals, which can be subject to counterparty risk or market manipulation. Having the actual metal in your hands provides peace of mind and ensures that your investment is truly yours, free from the complexities and potential pitfalls of the financial markets.

At first glance, precious metals and cryptocurrencies might appear to be worlds apart, but together they can form a balanced and resilient investment strategy. Gold and silver provide stability, serving as a hedge against inflation and economic downturns, while cryptocurrencies offer the potential for high returns, albeit with significant risk. By holding both types of assets, you can balance out the volatility of your crypto investments with the steadiness of physical precious metals. This combination also enhances diversification, which is key to any solid investment strategy. A portfolio that includes both physical precious metals and cryptocurrencies can help reduce risk and improve your chances of long-term success. Additionally, since cryptocurrencies can be highly sensitive to market news and events, precious metals often remain stable or even increase in value when the crypto market takes a hit, offering a hedge against sudden market swings.

SOURCE

If you’re new to investing in precious metals, it’s wise to start small, but with a focus on physical ownership. Consider the role you want these assets to play in your overall investment strategy. Are you seeking a long-term store of value, a hedge against inflation, or simply a way to diversify your portfolio? Once you have a clear goal in mind, explore ways to invest directly in physical metals. Like any investment, precious metals come with their own risks—prices can fluctuate, so it’s important to do your research or consult with a financial advisor before diving in. However, the advantage of holding the metal itself lies in its intrinsic value, independent of any paper contract or market mechanism.

SOURCE

In today’s fast-paced financial world, it’s easy to be swept up in the excitement of new digital assets. However, that doesn’t mean we should overlook the enduring value of physical precious metals. By combining the old with the new—silver, gold, and crypto—you can create a well-rounded and resilient investment strategy that stands the test of time. Whether you’re just starting your investment journey or looking to diversify, focusing on the security and reliability of physical precious metals can lead to smarter, more secure financial decisions.

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If your struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

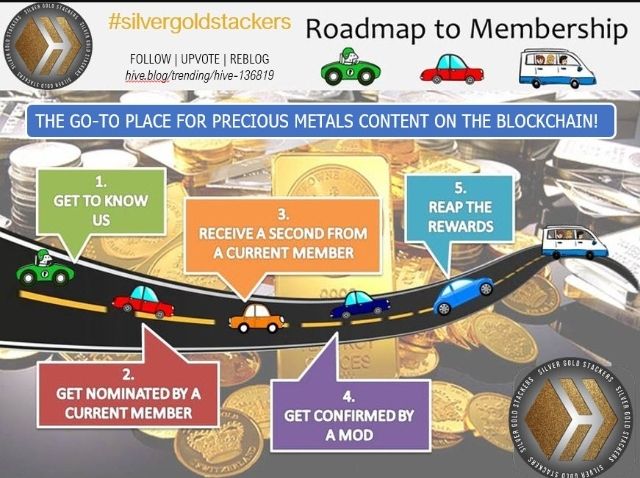

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.