A lot of traders that are venturing into the crypto industry often get confused whenever these two words crypto staking and crypto saving are mention to them or when they come across it. However, today in this post, I will breaking the two words down in such away that you will understand and even go ahead and carryout staking on your Binance exchange. Let's get straight to the lesson without wasting time as e de hot....

What Is Crypto Staking?

Crypto Staking is simply a means by which a trader contribute to a blockchain network, that involves locking of his/her cryptocurrencies away for a certain period of time. When you stake your cryptocurrency you will be allow to earn rewards on your holdings. We can see that staking is another means of earning more of the same crypto that you're currently holding. However, the rewards that is earn from staking cryptocurrency is measures according to the amount of crypto that you stake, this means that the higher your stake, the more higher your rewards will be.

Binance exchange is a popular crypto exchange that is widely used across the globe and its offers a staking service known as Locked Staking.

The Binance locked staking,enable you to lock the cryptocurrency that you want to stake for a certain period of time which allows you to earn rewards. Once you have staked on the locked staking, your cryptos will be locked and you would not be able to have access to the cryptocurrency that you have staked until the staking period that you chose is over.

Trying how to stake for the first time may seem a little bit confusing for you, but don't be afraid for it's very easy once you have done it you will discover how simple the process is.

Here is a step by step guide on how to stake your crypto on Binance exchange.

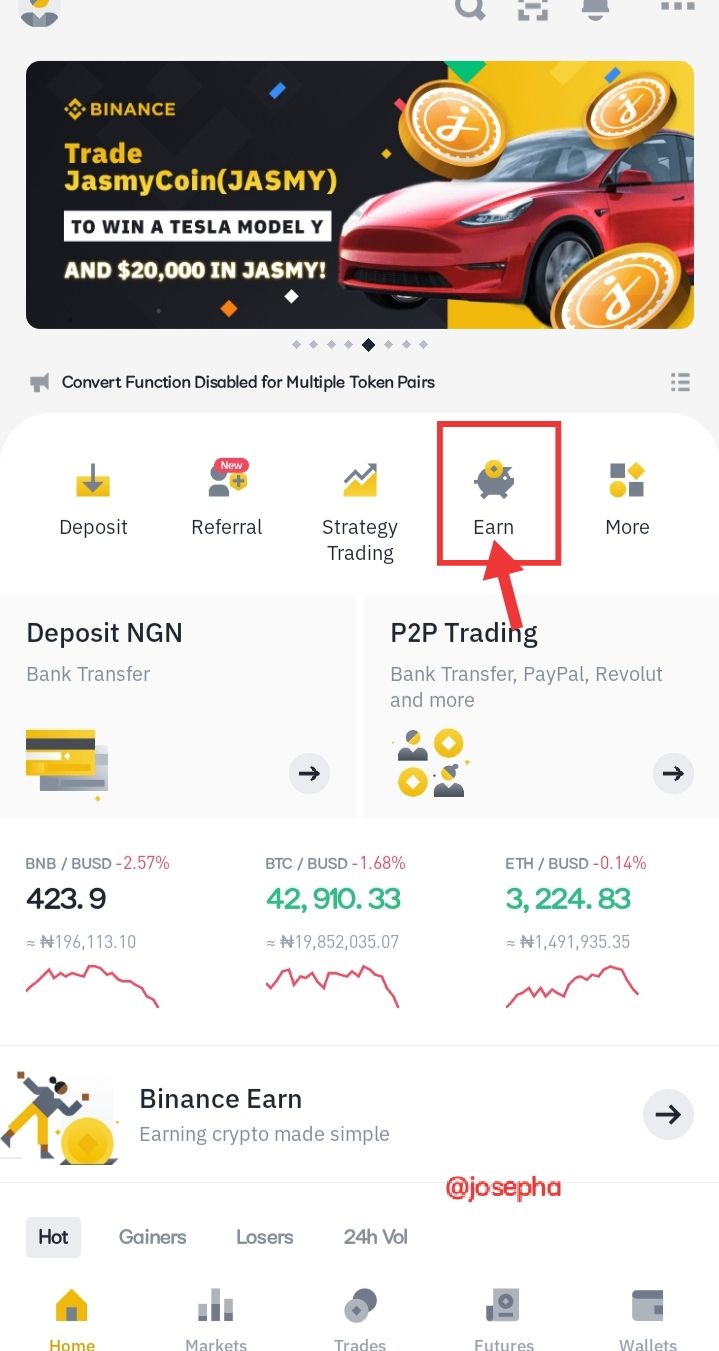

Step 1: Open your Binance App, and on the Homepage, click on "Binance Earn"

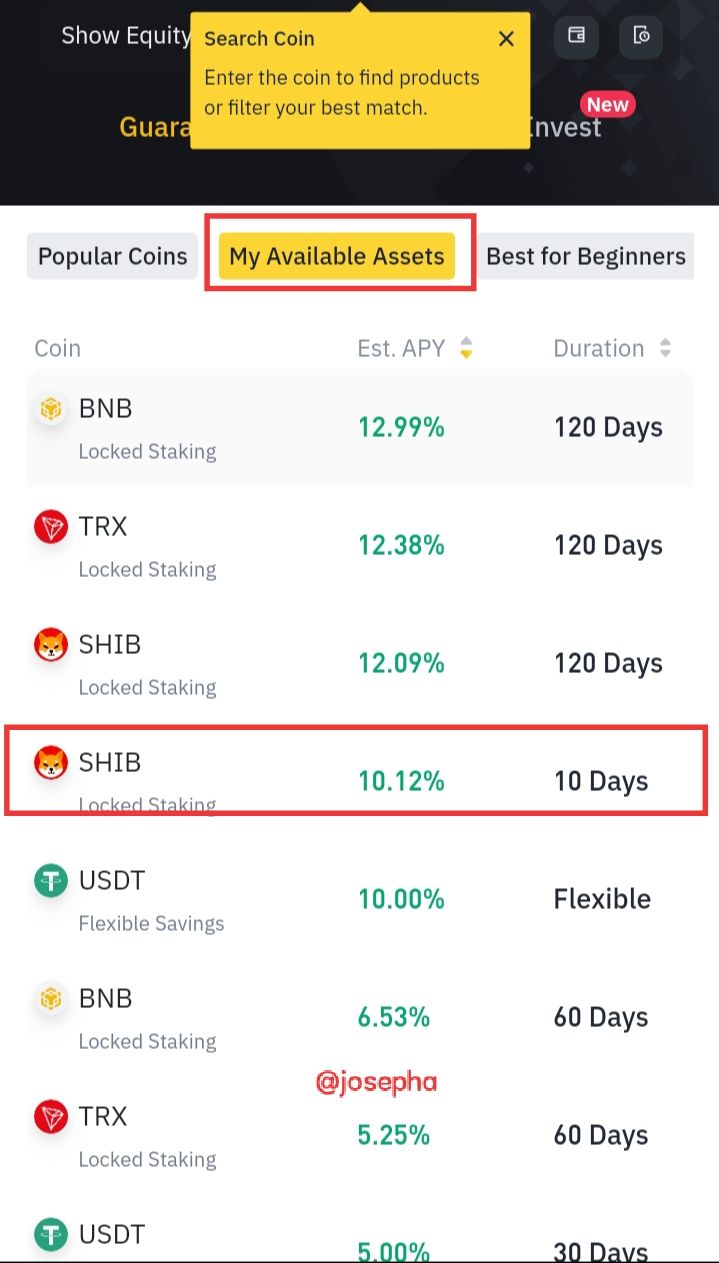

Step 2: Filter Available Staking Option and find the coin you want to stake.

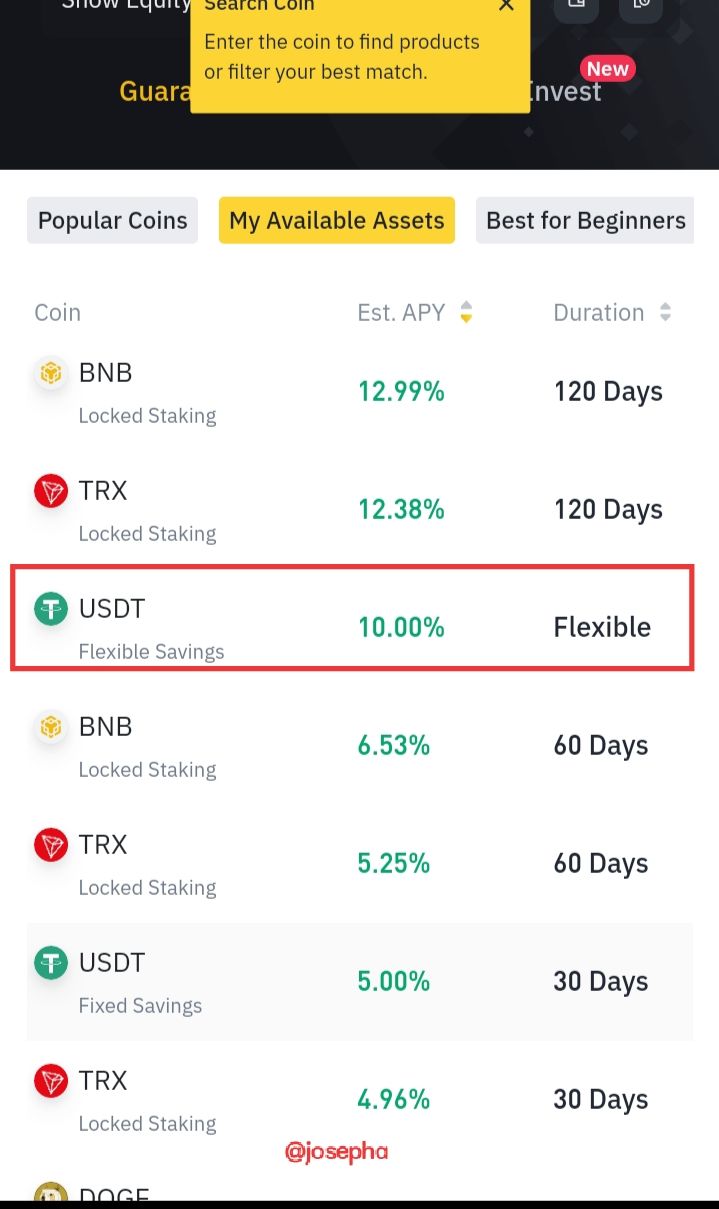

[In the "Locked Staking" panel, you will see at the top "Popular coins,My Available Assets" and "Best for Beginners."]. Click on My Available Assets and Select your staking coin (I.e SHIBA). You can click on Expand to see the list of your other available coin.

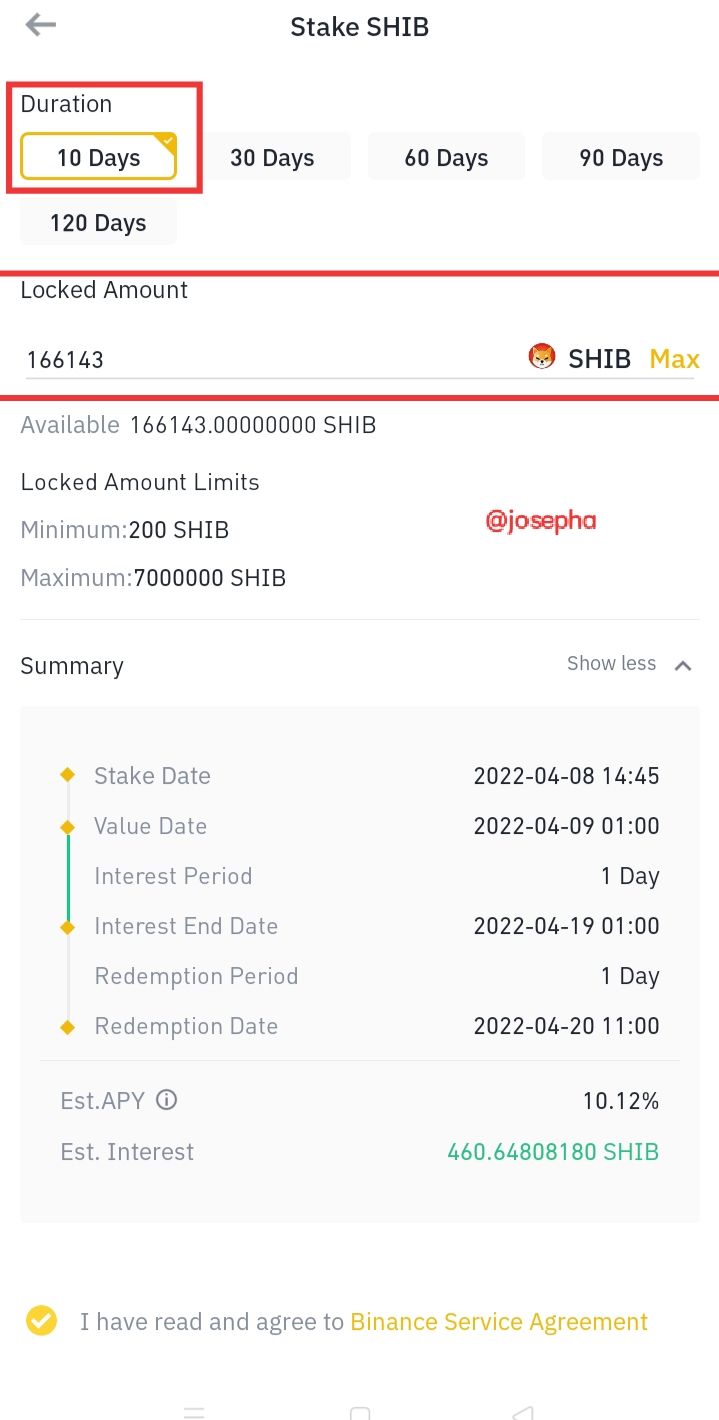

Step 3: Select Your Staking Duration (i.e in my case 10 Duration).

Note: You can also change your Staking "Duration" in the next step (4)

Also to this as time goes on you can check the coins that are available in the panel since they are changing frequently according to availability.

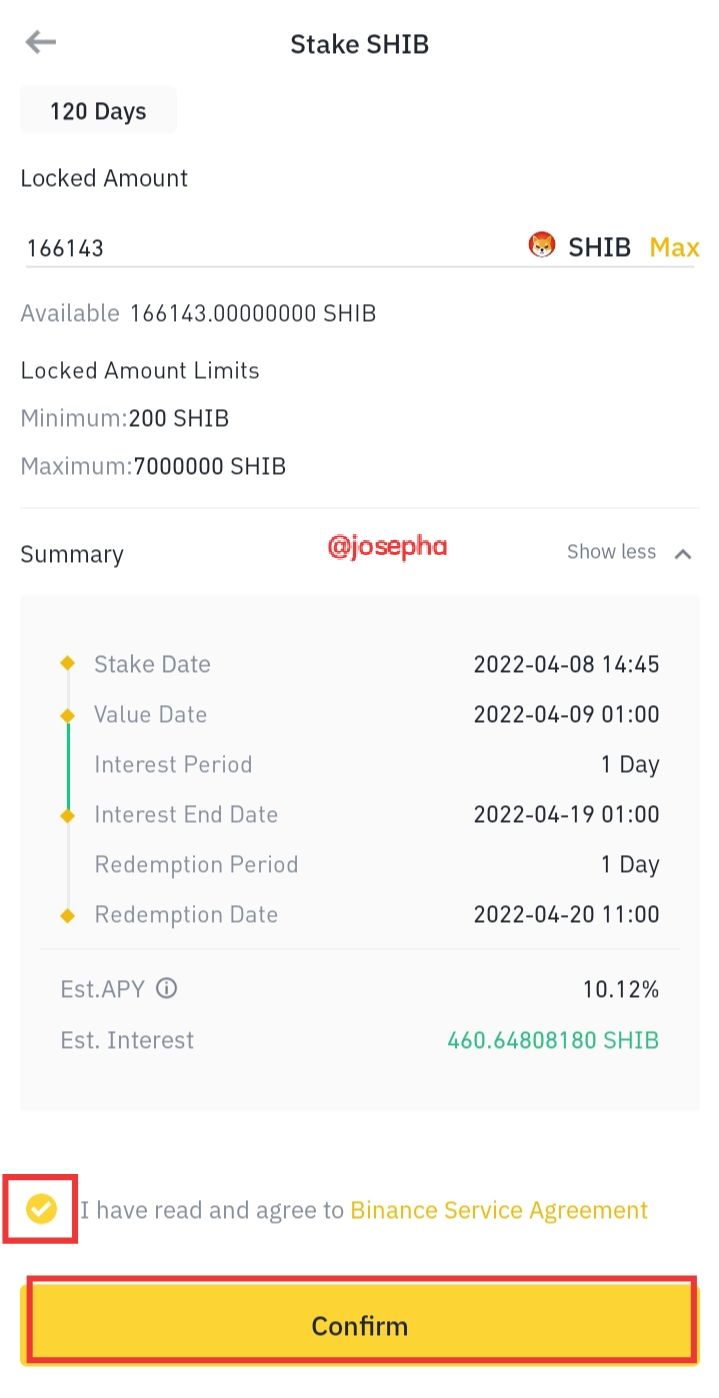

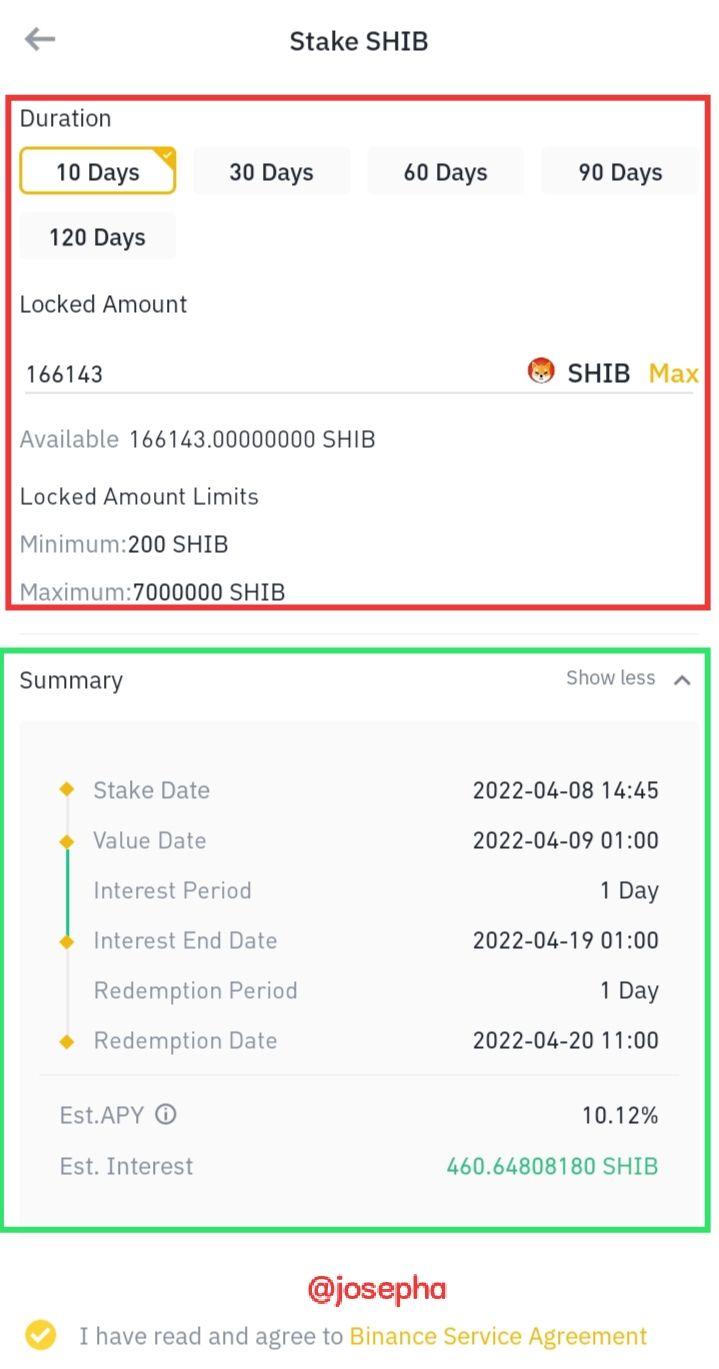

Step 4: Review your Staking Parameters and Stake by entering the Locked Amount accept the "Binance Service Agreement". After you have Accept BSA then click on "Confirm".

|  |

|---|

|  |

|---|

Note: At the top of the panel which I have indicated with red is where you can select "Duration" and "Locked Amount". Currently, at the time of writing this Binance only offers 4 timeframes for staking: 10Days, 30Days, 60Days and 90Days. Make sure that you have the minimum locked amount that is required for your desirable coin.

At the summary which I have indicated with green we can see information like;

- Stake Date: This is the Date and Time that the staking occurs.

- Value Date: This is the actual time that staking starts.

- Interest Period: This is the time between accrued interest earn and distribution.

- Interest End Date: This is the particular time that staking will stops.

- Redemption: This is the date that let you know the time of redemption of the coin at the end or beginning of the staking.

- Eat. APY: This shows you the estimated % of annual interest that will be earn at the end of the staking.

- Earn Interest: The value of interest you are going to earn at the end of the staking of your asset.

Before looking at how to Redeem your locked coins back to your spot wallet take note of this;

- Note that in Binance the locked coin will be allocated back to your spot wallet account as soon as the redemption is completed and sometime because of time difference the process of transferring the coins backed to your spot Wallet may take about 72 hours (3days).

And secondly, when you are redeeming your coin back to your wallet without the maturity date you may not get all the rewards that you are suppose to earn as interest. However to redeem coin back open your Binance app and click on Wallet.

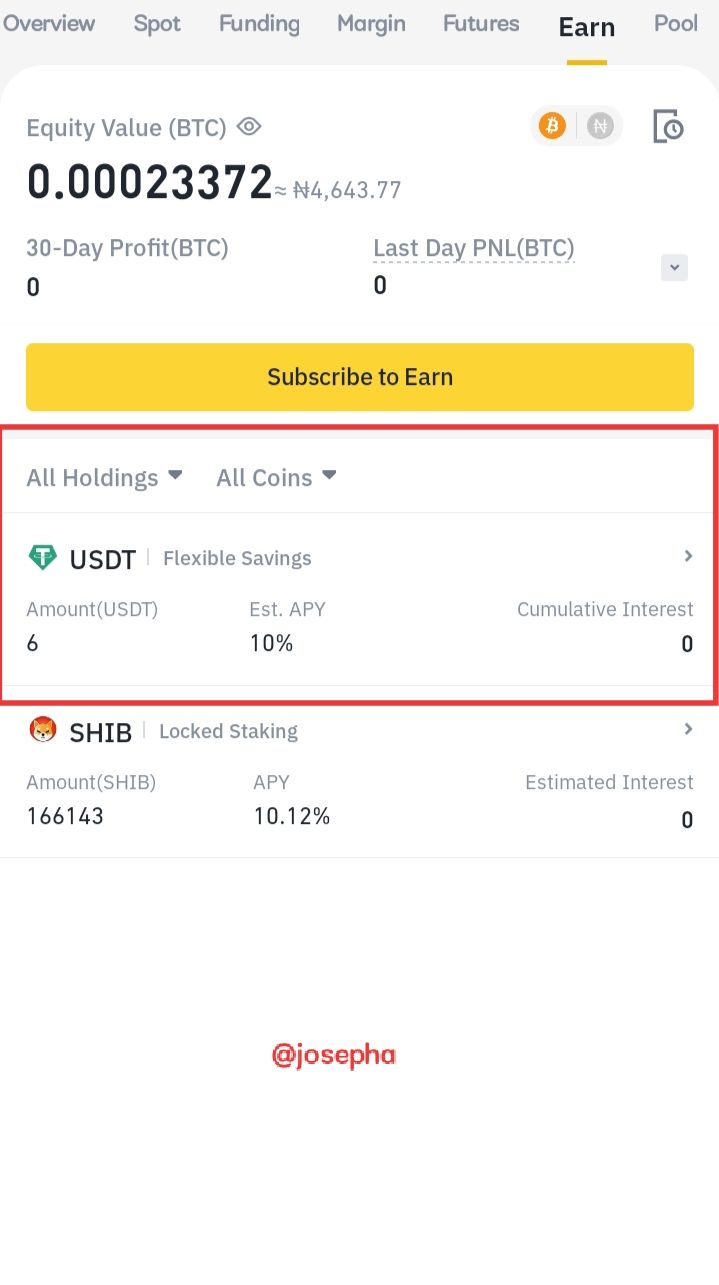

Once you have click on wallet, click on Earn. and choose the asset that you wish to redeem by clicking on it to view the balance.

At the balance page click on "Redeem."

Now since we have understand, Locked Staking and how to carryout locked staking let's take a brief look at "Flexible Saving".

Flexible Saving is the type of savings that allows you to withdraw your staked funds at anytime that you wish. It's just like your savings account that you have with banks that allows your to withdraw your money at any point in time. In flexible savings you can earn your interest on the asset that is held on the Binance plaform,with an access to deposit more or withdraw your holdings at any point in time that you wish to. However, in flexible savings that interest rate is lower compared to that of locked staking and your reward will only be paid at the ends of the lock up period.

How to stake on Binance flexible savings

The same procedure that is used in locked staking is equally used here;

Step 1: Login into your Binance App, and on the Homepage, click on "Binance Earn"

Step 2: Filter Available Staking Option and find the coin you want to stake.

[In the "Locked Staking" panel, you will see at the top "Popular coins,My Available Assets" and "Best for Beginners."]. Click on My Available Assets and Select the asset with Flexible Saving (I.e USDT). You can click on Expand to see the list of your other available coin.

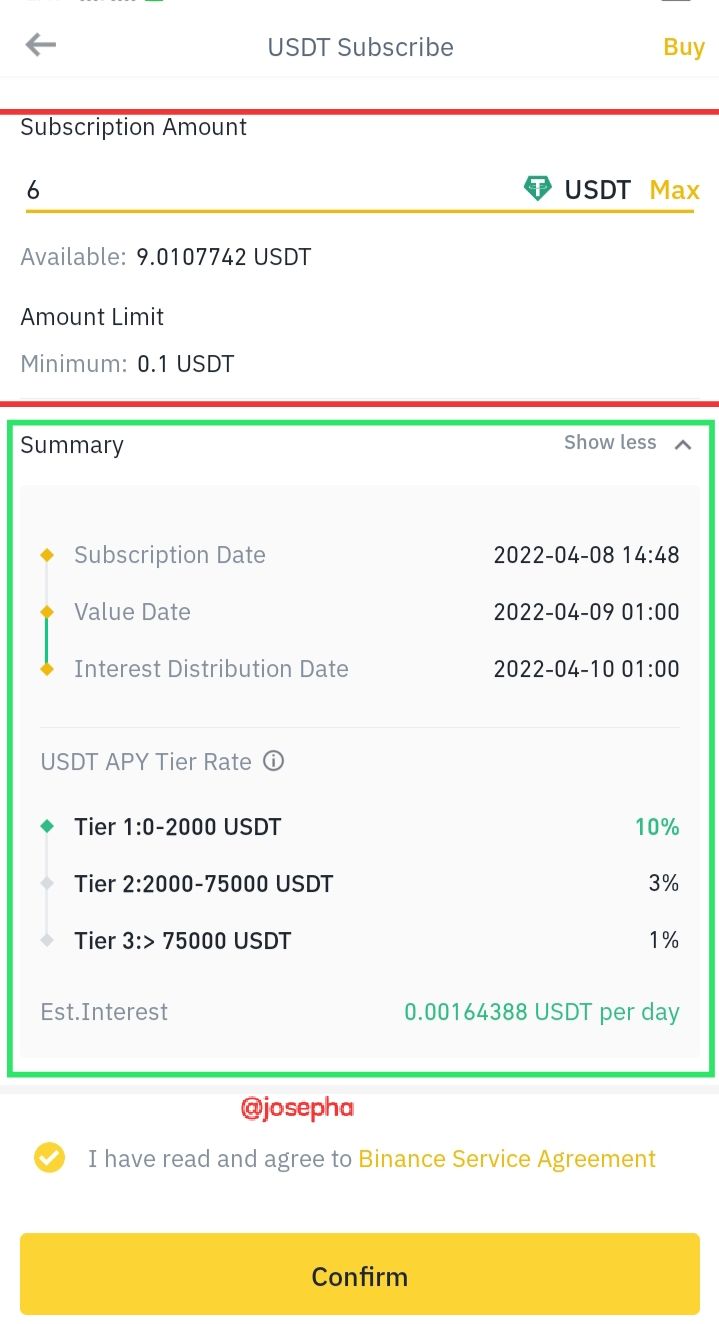

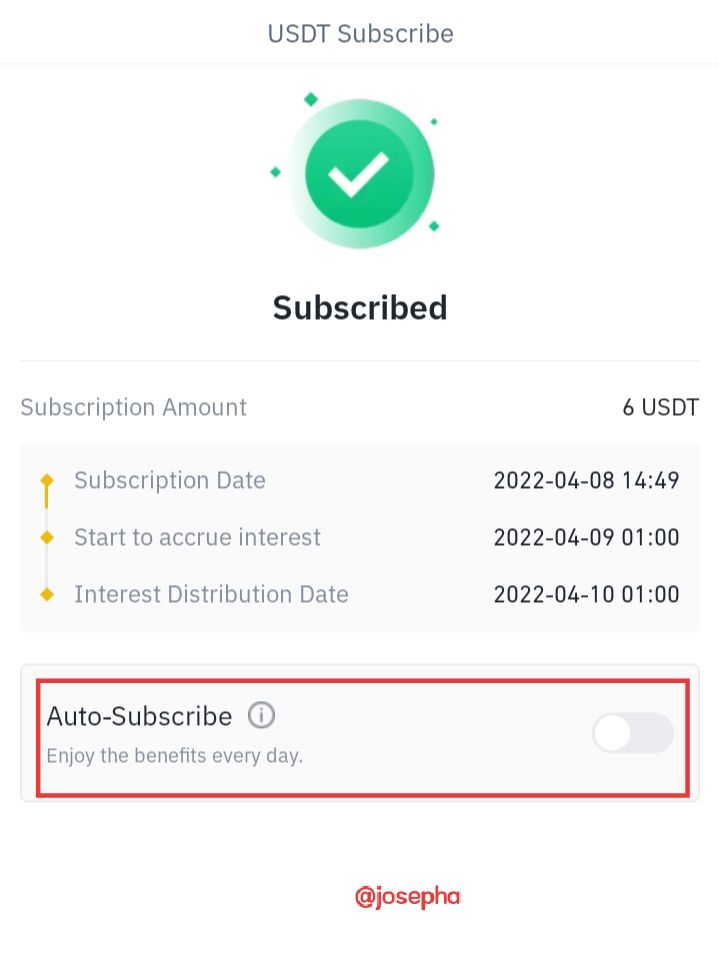

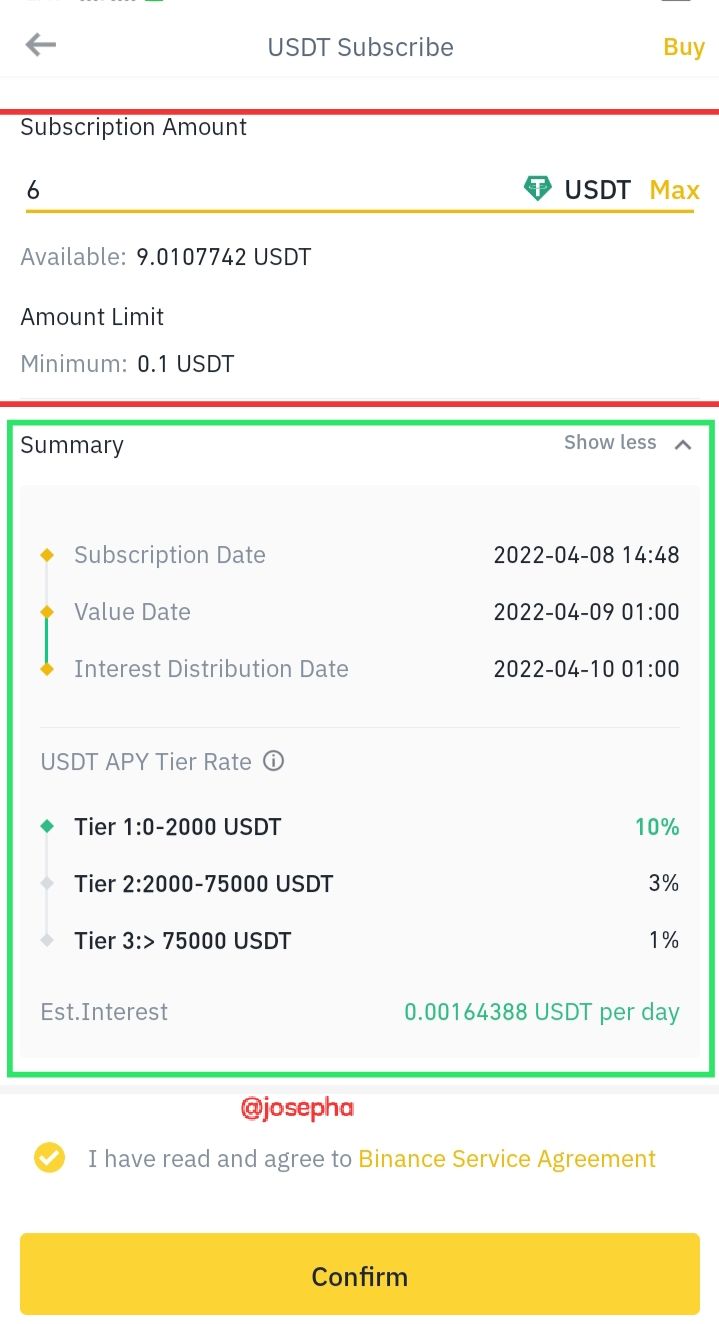

Step 4: Review your Staking Parameters and Stake by entering the Subscription Amount accept the "Binance Service Agreement". After you have Accept BSA then click on "Confirm".

The Auto-Subscribe, when you turn its on means whenever your purchase the asset it will automatically be transferred to your savings including the interest that you have earn.

|  |

|---|

|  |

|---|

Note: The Subscription contains the following information:

- Subscription Amount: This where you will know the total amount of subscription coin that you want to save.

- Value Date: This is the actual time that savings starts.

- Interest Distribution Date: The date that your interest will be earn and distributed to you.

Now since we have now known how Both Locked Staking and Flexible Savings Works. Let's take a looks at their advantages and disadvantages below:

| S/N | Advantages of Staking and Saving | Disadvantages of Staking and Savings |

|---|---|---|

| 1 | Staking is a good way of earning interest on your cryptocurrency without doing anything | When the asset rise after you have staked it you might not be opportune to sell it at that moment |

| 2 | Staking and Savings offer you the possibility to earn more rewards than holding your asset | The duration of time is long and when you redeem your asset earlier than the lock-up/savings time you may not earn interest. |

| 3 | Binance staking/savings are both free no fees | some assets required staking high amount as minimum |

Conclusion:

In this post, I have discussed about crypto staking using Binance locked staking and as an example, where we learned the steps that is used in staking and in addition to that we learn about flexible savings and the steps that we can follow to carryout flexible savings.

Your questions are highly welcome in the comments section below.