Swedish National Bank Needs 'Market Entertainers' to Join Next Phase of CBDC Pilot

Sweden's focal Riksbank is moving forward with its e-krona pilot project, and has laid out the following stages it needs to take – putting it on target to turn into the main European country to carry out a national bank computerized cash (CBDC).

The Riksbank has been bullish about issuance, yet will in any case need to persuade legislators in the nation to allow it the lawful forces to continue with its arrangements. In any case, in another "stage one" report from the bank, portrayed by Bloomberg as "basically the most developed investigation of a post-cash period to be attempted by a significant, western economy," the Riksbank discussed how it was utilizing R3's Corda blockchain stage and circulated record innovation advancements.

Presently the Riksbank says it will go through in any event one more year investigating specialized arrangements subsequent to expanding its current agreement with Accenture.

During that time, it will look to do the accompanying:

Include "market entertainers" – apparently private area firms and business banks – which will be welcome to partake to check whether their inside frameworks can be effectively incorporated with the model CBDC

Create disconnected usefulness, an element previously being incorporated into the Chinese advanced yuan, and a central issue for openness

Grow more stockpiling arrangements, which could include outsider CBDC wallet suppliers, like business banks

Build up a more proficient installments framework and incorporate with existing retail location (PoS) terminals

Lift execution and versatility

Assess and break down its CBDC's exhibition and organization framework progress, a stage that will include the "division of duty among members"

Bloomberg cited Mithra Sundberg, the top of the Riksbank unit accused of directing the pilot, as expressing that the bank has "took a gander at the specialized prospects of having the option to charge revenue," albeit conceivable "money related strategy repercussions" have not yet been analyzed.

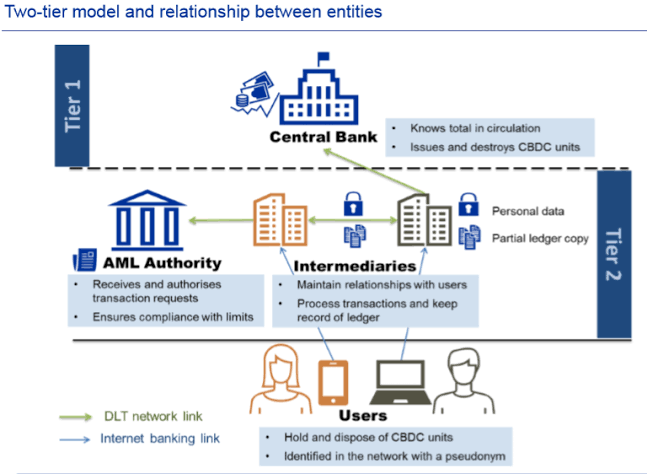

The Riksbank CBDC model is a two-level methodology whereby it would issue, recover and annihilate tokens as it sees fit, with mediators (in particular business banks and installments suppliers) conveying the CBDC to the two organizations and people.

The report's creators gave off an impression of being mindful of the possibly prickly client information related issues liable to lie ahead. Pundits of CBDCs in different nations say they are stressed a lot of their spending secrecy will be undermined by such undertakings.

Congratulations, your post has been curated by @r2cornell-curate.

Our Discord Server and community is located at: https://discord.gg/H2X2EAp

Congratulations! This post has been upvoted by the @blurtcurator communal account,

You can request a vote every 12 hours from the #getupvote channel in the official Blurt Discord.Don't wait to join ,lots of good stuff happening there.