Ethereum merge which involves the transition of the blockchain from proof of work to proof of stake is set to occur a few days from now while we await this historical moment in the crypto space I've shared some technical risk that may likely happen during the last twelve minutes of migration known as the replay attack where bad actors duplicate chain transactions and lure users to sell their real assets. Chances of having replay going sideways during the merge are very low as more Ethereum core developers are closely looking out for any bug or attack which will be immediately fixed in the course, users are asked not no interact with the chain during those twelve minutes to be on the safe side.

Short-term and long term-term problem

Technical risks could be one of the few problems during the ethereum merge, there is a more intriguing problem that seems to elude a lot of users while we are all focusing on pending technical risks.

Short-term problems can be categorized under technical risk that could occur during and after the merge, such problems could take time for troubleshooting to get fix and get the blockchain running properly in a couple of hours.

The long-term problem is what happens after merge success where a certain category of users will be allowed to validate transaction on the chain such problem can not be overlooked

Politics of Ethereum

Post merge ethereum will no longer be created using mining rigs that require computers to solve difficult puzzles using intensive energy, rather new Ethereum will be created using Staking protocol where locking up a certain amount of ethereum by validators will approve the creation of a new ethereum token, it is rather known a large amount of ethereum will be required by stakers in other to participate in the staking pool and earn ethereum from block validation.

This also means that staking requires a large amount of capital which gives little room for small investors to fully participate in the staking pool according to ethereum. org to participate and become a validator on the chain one needs to lock up 32 ETH which is approximately $53k depending on ethereum market price.

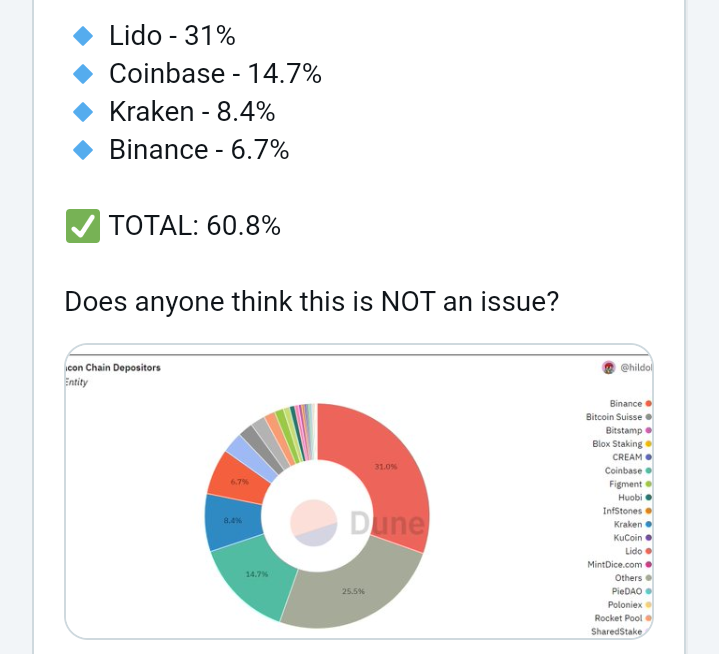

Large, centralized firms have already provided over 66% of all staked ETH.

source

With more centralized exchanges like binance and coinbase taking the lion's share in ethereum staking users are concerned about these changes, why a decentralized blockchain like the ethereum network allows most of its validation on a centralized exchange? Shifting control to centralized firms.

What are your thoughts on ethereum staking do you feel it's okay for a large centralized firm to take control of the validation process?