About Lido

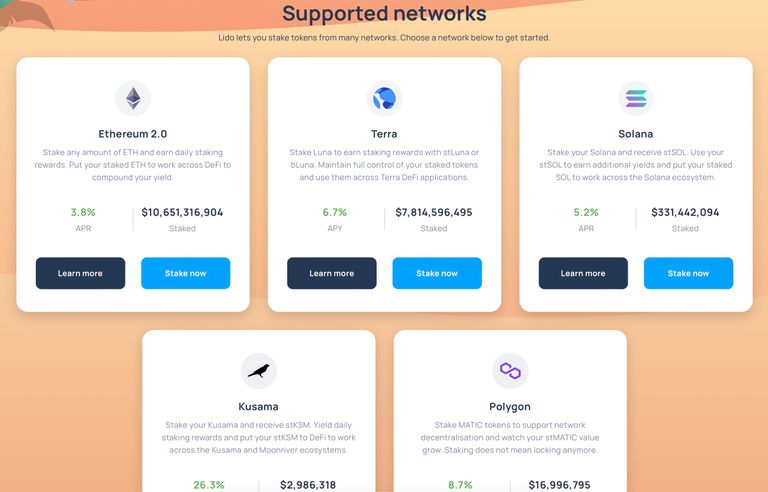

Lido is a liquid staking platform on Ethereum and now spread its coverage to other smart contract platforms such as Solana, Terra, Kusama, Polkadot.

Users can deposit their staking asset into the Lido smart contract and receive an IOU(I Owe You) derivative known as a Lido-staked asset (stAsset).

Staking

The liquid staking derivative can be exchanged 1:1 with the protocol for the underlying staked asset subject to the network's withdrawal period, or it can be sold in the open market, where it usually trades at the same price as the base asset.

Through this, users can earn staking yields without the significant investment of running a node or sacrificing liquidity to protocol-enforced lock-ups.

Fee

Lido deducts a portion of staking yield (typically 10%) as a fee before passing the rest on to stAsset holders.

Protocol Fee Split

- Supported validators: 50%

- Lido treasury: 50%

Lido’s fee model makes it possible to apply a valuation model to estimate the fundamental value of the LDO token

LDO Token

LDO is the governance token for Lido DAO. It controls key parameters for Lido, including fee structure, validator selection, incentives, insurance, and the Lido treasury.

- The founding members: 64% (1-year lock and 1-year vesting period, December 17, 2022)

-The founders of the protocol, early investors, and validators): Their tokens will fully vest on - The DAO treasury: 36%.

-DAO sold 10% of the total supply to investors such as Paradigm, Three Arrows Capital, and Alameda Research to diversify its treasury.

After these transactions, the DAO treasury currently holds 177 million LDO tokens (17.7% of supply), 20,900 ETH, and 3,600 stETH.

Expansion

Lido was created to provide liquid staking for Ethereum 2.0 and has become its largest staking provider with a 28% market share. It has also branched out to provide services to other proof-of-stake (PoS) chains such as Terra, Solana, Kusama, and Polygon. Lido is likely to continue to increase its coverage to include other PoS networks like Polkadot

LIDO, Is it good?

It is well and smartly organized ecology and token backed by strong investors and finance/crypto specialists. That doesn’t mean it would be helpful for all humankind to make our lives better.

It just started to earn money gathering money from private crypto investors or dreamers.

Maybe the benefit of this protocol would be on our hands. LIDO DAO just mange and maximize its benefit to operate without any trouble.

Don’t believe so much, just try to use that.

Source: MessariI