In the ever-evolving world of cryptocurrency, market-making strategies are crucial for ensuring liquidity and stability. One such advanced strategy is delta-neutral market making, which aims to profit from the bid-ask spread while minimizing exposure to price fluctuations. Let's delve into what delta-neutral market making is, its benefits, risks, and how you, as an individual investor, can participate in this strategy.

Delta Neutral Market Making

What is Delta Neutral Market Making?

Delta-neutral market making involves creating a portfolio where the total delta (sensitivity to price changes in the underlying asset) is zero. This means that the portfolio's value remains unaffected by small movements in the price of the underlying asset. Market makers utilize this strategy to earn profits from the bid-ask spread while managing risk effectively.

Benefits of Delta Neutral Market Making

Risk Management:

- By maintaining a neutral delta, the strategy minimizes the impact of price volatility on the portfolio, providing a stable income from trading activities.

Profit from Volatility:

- Market makers can capture the bid-ask spread in volatile markets, generating profits regardless of the price direction.

Liquidity Provision:

- This strategy helps provide liquidity to the market, enhancing trading efficiency and reducing price slippage.

Mitigating Risks

While delta-neutral market making offers substantial benefits, it also carries risks, especially during periods of high price volatility. Here are some strategies to mitigate these risks:

Hedging with Derivatives:

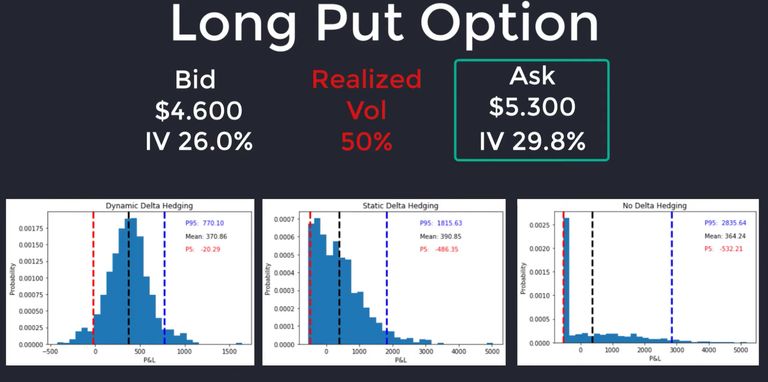

- Utilize options and futures contracts to hedge against significant price movements. For instance, buying put options can protect against downside risk.

Diversification:

- Spread investments across multiple assets to reduce the impact of volatility in any single asset. Combining delta-neutral strategies with other market-neutral strategies can further reduce risk.

Risk Management Tools:

- Implement stop-loss orders to automatically close positions at a certain loss threshold. Monitor market volatility indicators to make informed decisions and adjust positions accordingly.

Participating as an Individual Investor

Using DeFi Platforms:

- Automated Market Makers (AMMs): Platforms like Raydium, Meteora, Uniswap, Orca allow individuals to provide liquidity and earn fees. While not purely delta-neutral, these platforms offer low-risk ways to earn returns on crypto holdings.

- Liquidity Pools: Participate in liquidity pools on DeFi platforms that use algorithms to maintain market neutrality.

Supporting Tools and Methods:

- Trading Bots: Utilize trading bots like Hummingbot to automate the process of maintaining delta neutrality. These bots adjust positions automatically based on market conditions.

- Portfolio Management Software: Use software tools like Shrimpy or CoinStats to manage and track your portfolio, helping you monitor your delta exposure and make necessary adjustments.

Education and Research:

- Enroll in courses and tutorials that cover delta-neutral strategies and market making. Platforms like Coursera, Udemy, and Binance Academy offer valuable resources.

- Join online communities and forums such as Reddit's r/algotrading or Bitcointalk to learn from experienced traders and share insights.

Potential Side Effects

Increased Complexity:

- Delta-neutral strategies require continuous monitoring and adjustments, which can be complex and time-consuming, especially for individual traders without automated systems.

Liquidity Risks:

- During periods of extreme volatility, liquidity can dry up, making it difficult to execute trades at desired prices. This can lead to slippage and increased costs.

Cost of Hedging:

- Hedging with options and futures can be expensive, particularly in volatile markets. The costs associated with buying protection can reduce overall returns.

Delta-neutral market making strategies can be highly effective for managing risk and earning consistent profits, especially in volatile crypto markets. By leveraging hedging techniques, diversifying assets, and utilizing automated tools and DeFi platforms, individual investors can participate in these strategies and mitigate associated risks. Continuous education and engagement with trading communities can also provide valuable insights and support.