As an investor, understanding market trends and identifying the right moments to enter or exit a position is crucial.

One powerful tool to aid in this process is the On-Balance Volume (OBV) indicator. Here, we’ll delve into the technical and mathematical aspects of OBV, its practical uses, and how you can effectively incorporate it into your trading strategy to maximize profits and minimize losses.

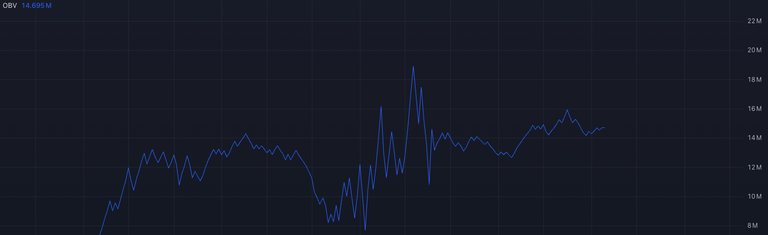

OBV

What is On-Balance Volume (OBV)?

**OBV is a momentum indicator that uses volume flow to predict changes in stock price. The basic premise of OBV is that volume precedes price movement, meaning that a rise or fall in volume often leads to a corresponding increase or decrease in price.

OBV Calculation

The OBV is calculated by cumulatively adding or subtracting the volume based on the direction of the price movement.

Understanding Volume and Accumulation/Distribution

Volume: Total number of shares or contracts traded in a security during a given period. It provides insight into the strength of a price move.

Accumulation/Distribution (A/D): Attempts to measure the cumulative flow of money into and out of a security, factoring in both price and volume to determine whether a stock is being accumulated (bought) or distributed (sold).

Practical Usage of OBV

Trend Confirmation:

- Rising OBV: Indicates volume is increasing on up days, suggesting accumulation. Supports a bullish trend.

- Falling OBV: Indicates volume is increasing on down days, suggesting distribution. Supports a bearish trend.

Divergence:

- Bullish Divergence: OBV is rising while the price is falling or sideways. Suggests that volume supports higher prices, potentially indicating an upcoming price increase.

- Bearish Divergence: OBV is falling while the price is rising or sideways. Suggests that volume supports lower prices, potentially indicating an upcoming price decrease.

Breakouts and Confirmations:

- OBV can confirm breakouts. If a price breaks out of a range and OBV moves in the same direction, it adds confidence to the breakout’s validity.

Real Usage Cases

Example 1 - Trend Confirmation:

- If Bitcoin (BTC) is in an uptrend and OBV is also rising, it confirms the strength of the uptrend, indicating strong buying interest and the likelihood of continued upward movement.

Example 2 - Divergence:

- If BTC price is making higher highs, but OBV is making lower highs, this bearish divergence could indicate a potential reversal. Consider taking profits or setting stop-loss orders to protect against a downturn.

Example 3 - Breakout Confirmation:

- If BTC breaks above a key resistance level and OBV shows a significant uptick, it confirms the breakout’s validity, suggesting a strong move higher. This could be a good time to enter a long position.

Maximizing Profit and Minimizing Loss with OBV

Combine with Other Indicators:

- Use OBV alongside other technical indicators like Moving Averages, RSI, or MACD for a comprehensive market view.

Look for Divergences:

- Pay attention to OBV divergences as they can provide early warnings of potential trend reversals.

Use in Conjunction with Support and Resistance Levels:

- Confirm breakouts or breakdowns at key support and resistance levels with OBV to increase the reliability of your trades.

Monitor Volume Spikes:

- Large spikes in OBV can indicate significant buying or selling pressure, often preceding major price moves.

Regular Analysis:

- Regularly analyze OBV trends and changes in conjunction with price movements to stay ahead of potential market shifts.

OBV is a valuable tool for traders, offering insights into volume trends and confirming price movements. By understanding its technical foundation and practical applications, you can use OBV to enhance your trading strategy, maximize profits, and minimize potential losses. Always consider using OBV as part of a broader analysis framework to make well-informed trading decisions.