In the dynamic world of cryptocurrency, liquid staking has emerged as a game-changer, with Lido Finance leading the charge. However, recent developments have reshaped the landscape, particularly in the Solana ecosystem. Let's explore the current state of Lido, its relationship with Solana, and the broader implications for liquid staking tokens (LSTs).

Marinade Finance

Lido Finance

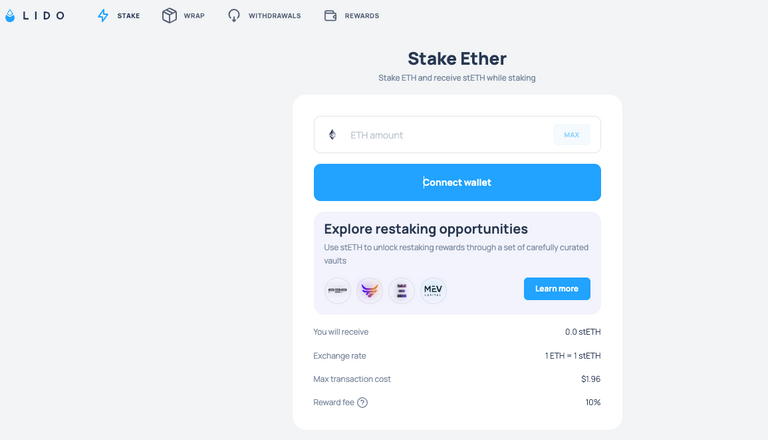

Lido's Changing Position

Lido Finance, once a multi-chain liquid staking protocol, has recently made significant changes to its strategy. Most notably, Lido has discontinued its Solana staking product following a DAO vote where over 92% of the community chose to end the service. This move marks a shift in focus, with Lido doubling down on its dominant position in Ethereum liquid staking while maintaining support for networks like Polygon and Polkadot.

Lido's Revenue Breakdown

While exact figures aren't publicly available, Lido's revenue structure is multifaceted. The largest slice of the pie likely comes from protocol fees, estimated at 10% of staking rewards. Maximal Extractable Value (MEV) has become an increasingly important revenue stream, especially on Ethereum post-Merge. Lido also generates income through treasury management and strategic partnerships within the ecosystem.

An estimated breakdown might look something like this: Protocol fees contributing 60-70%, MEV bringing in 20-30%, treasury management adding 5-10%, and partnerships rounding out the final 1-5%. These figures, of course, are subject to market conditions and can fluctuate.

- Estimated breakdown (subject to market conditions)

- Protocol Fees: 60-70%

- MEV: 20-30%

- Treasury Management: 5-10%

- Partnerships: 1-5%

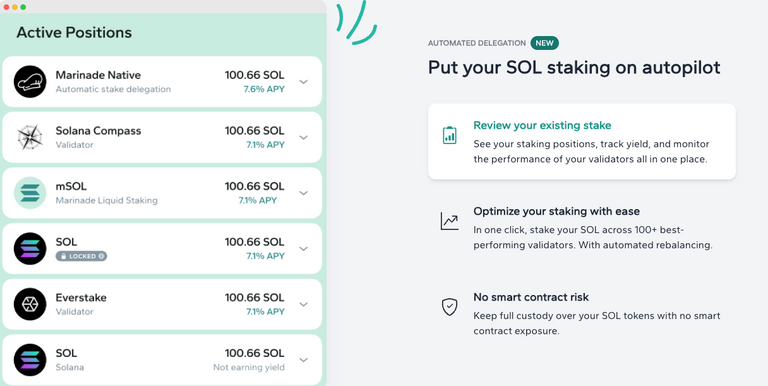

The Solana LST Ecosystem

With Lido's exit, the Solana liquid staking landscape has evolved significantly. The ecosystem now boasts a more diverse range of LST providers, many of which offer competitive advantages such as lower fees and higher yields compared to Lido's previous offering. Some Solana LST protocols have also emphasized greater validator diversity, potentially enhancing network security and decentralization.

Comparing Lido to Solana LSTs

While Lido and Solana LSTs share the basic concept of liquid staking, there are notable differences in their approaches. Some Solana LSTs offer more decentralized validator selection processes and competitive fee structures that could potentially offer better yields for users. The governance models also differ, with some Solana LSTs providing alternative levels of user participation compared to Lido's DAO structure.

Investment Considerations

For investors considering liquid staking options:

- Diversification: With Lido's exit from Solana, consider diversifying across multiple LST providers and blockchains.

- Ecosystem Growth: Evaluate the growth potential of different blockchain ecosystems and their LST offerings.

- Yield Comparison: Compare yields and fee structures across different LST providers.

- Security and Decentralization: Assess the security measures and level of decentralization of each LST protocol.

- Revenue Models: Consider the sustainability and potential growth of revenue models for different LST providers.

The liquid staking landscape is in a state of flux, with Lido's strategic shifts and the growth of alternative LST ecosystems like Solana's creating both opportunities and challenges for investors. While Lido remains a significant player in the Ethereum ecosystem with its diverse revenue structure, the proliferation of LST options across different blockchains offers a new paradigm for liquid staking.

As always, thorough research and careful consideration of risk factors are essential when engaging with any cryptocurrency investment, including liquid staking tokens. The evolving nature of this space demands ongoing attention and adaptability from investors looking to capitalize on the potential of liquid staking.