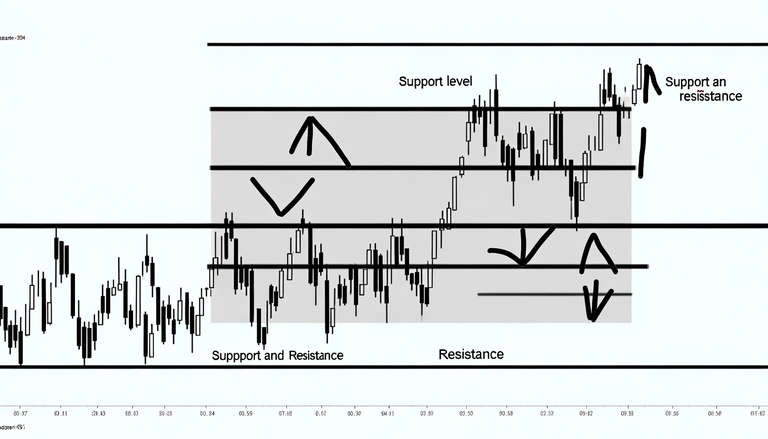

Support and resistance levels are fundamental concepts in technical analysis, applicable to trading in various markets, including cryptocurrencies. These levels are identified by multiple touches of price without a breakthrough, indicating areas where the price has historically faced upward or downward pressure.

Support and Resistance Levels

Support and Resistance Levels

Identifying Support and Resistance Levels

Historical Price Levels: Review past price action to find where the price has stopped and changed direction. These are potential support and resistance areas.

Round Numbers: Psychological price levels, often with round numbers (e.g., $10,000 for Bitcoin), can serve as support or resistance due to human psychology and order clustering.

Moving Averages: Moving averages can act as dynamic support and resistance levels. Prices often bounce off moving averages or break through them with significant volume.

Trend Lines: Drawing lines along price highs or lows can show sloping support or resistance.

Volume Profiles: High trading volume can reinforce the strength of a support or resistance level. Look for peaks in volume at certain price levels.

Technical Indicators: Indicators like the Fibonacci retracement or pivot points can provide additional support and resistance levels.

Candlestick Patterns: Certain patterns can indicate potential support or resistance, such as pin bars or engulfing candles at key levels.

Application in Crypto Trading

Crypto markets operate 24/7, which means support and resistance levels can be tested and formed at any time, making them dynamic.

- Monitor Continuously: Keep an eye on the market around the clock, or use tools that alert you when levels are approached or breached.

- Consider Volatility: Crypto markets are often more volatile than traditional markets, so support and resistance levels might be less consistent.

- Adjust for Market Sentiment: News and social media can have a pronounced impact on crypto prices, so integrate market sentiment analysis into your trading.

Building a Strategy

Knowing support and resistance is one thing; trading them effectively is another. A basic strategy might involve buying near support levels with a stop loss just below and selling near resistance or shorting with a stop just above.

However, a break of support or resistance might signal a trend change, so be prepared to adjust your strategy accordingly.

While support and resistance levels are useful tools, they are not infallible. False breaks can occur, and these levels should be used in conjunction with other indicators and analysis methods for the best results. Always consider risk management and never risk more than I can afford to lose, especially in the highly volatile crypto market.