Decentralized Finance (DeFi) has opened up a world of opportunities for investors, offering various financial services on blockchain networks.

However, DeFi also comes with inherent risks that can lead to significant losses if not properly managed. In this article, I will discuss the most common DeFi risks and provide practical some of examples to help you better understand and resonate with these challenges.

Poly Network suffered 2nd largest DeFi exploit

1. Smart Contract Vulnerabilities

DeFi platforms rely on smart contracts, which can have bugs or vulnerabilities that hackers can exploit. For instance, in 2021, the Poly Network suffered a $600 million hack due to a smart contract vulnerability. To mitigate this risk:

- Diversify your investments across different DeFi platforms and assets.

- Research and understand the DeFi platforms you're using, including their security measures, risk management practices, and track record. For example, look for platforms that have undergone multiple audits and have a strong community of developers.

- Use hardware wallets and other security measures to protect your assets.

2. Market Volatility

Cryptocurrency markets are highly volatile, and sudden price drops can lead to liquidations and significant losses for users, especially those using leverage or borrowing assets. In May 2021, a sudden market crash led to widespread liquidations on DeFi platforms, causing substantial losses for many users. To minimize this risk:

- Only invest what you can afford to lose.

- Consider your risk tolerance when using leverage or borrowing assets. For instance, if you're risk-averse, avoid using high leverage or borrowing assets with high volatility.

- Set up price alerts and use stop-loss orders to monitor the value of your collateral and borrowed assets.

3. Oracle Manipulation

DeFi platforms often rely on oracles to provide accurate price data. However, oracles can be manipulated, leading to incorrect price feeds and potential losses for users. In 2020, the bZx platform suffered a $1 million loss due to oracle manipulation. To protect yourself:

- Stay informed about the oracle solutions used by the DeFi platforms you're using. For instance, look for platforms that use multiple oracles or have robust oracle security measures.

- Consider using DeFi platforms that employ decentralized oracle solutions, such as Pyth or Chainlink.

4. Regulatory Risks

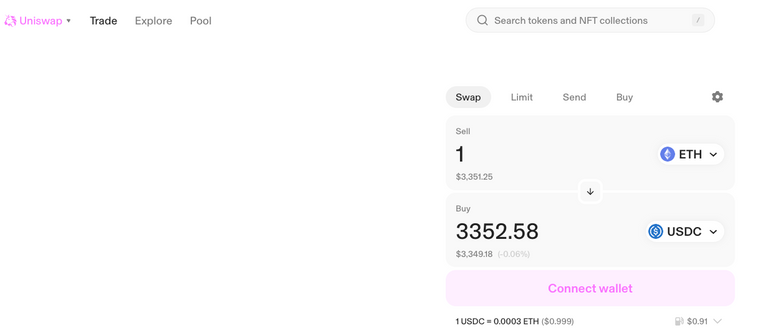

The regulatory landscape for cryptocurrencies and DeFi is still evolving, and there's a risk that new regulations could negatively impact DeFi platforms and their users. In 2021, the U.S. Securities and Exchange Commission (SEC) charged the DeFi platform Uniswap with failing to register as a national securities exchange. To stay ahead of regulatory changes:

- Stay informed about regulatory developments and their potential impact on DeFi. For instance, follow industry news and regulatory updates from reputable sources.

- Consider using DeFi platforms that prioritize compliance and have a clear understanding of the regulatory environment.

Uniswap

Uniswap

5. Centralization Risks

While DeFi aims to be decentralized, some platforms may have centralized components, such as admin keys or centralized oracles, which can introduce single points of failure and increase the risk of hacks or manipulation. In 2020, the DeFi platform dForce suffered a $25 million hack due to a centralized component. To minimize this risk:

- Research the level of decentralization of the DeFi platforms you're using. For instance, look for platforms that have a clear plan for reducing centralization over time.

- Prefer platforms that prioritize decentralization and have a strong community of developers and users.

6. Liquidity Risks

DeFi platforms rely on liquidity to function correctly. However, liquidity can be unpredictable, and sudden withdrawals or market events can lead to liquidity crises and significant losses for users. In 2020, the DeFi platform Yam Finance suffered a liquidity crisis due to a bug in its smart contract. To mitigate this risk:

- Monitor the liquidity of the DeFi platforms you're using. For instance, look for platforms with high liquidity and a strong track record of maintaining liquidity.

- Consider using DeFi aggregators to find the best rates and conditions across multiple platforms.

7. User Errors

DeFi platforms can be complex, and users may make mistakes when interacting with them, such as sending assets to the wrong address or using the wrong network. In 2021, a user accidentally sent $1.3 million worth of Ethereum to a wrong address on the DeFi platform Uniswap. To avoid user errors:

- Double-check all transactions and ensure you're using the correct network and address.

- Familiarize yourself with the user interface and features of the DeFi platforms you're using. For instance, practice using the platform with small amounts before making larger transactions.

8. Avoiding Liquidation and Maximizing Profit

To avoid liquidation and maximize profit in DeFi, consider the following strategies:

- Maintain a healthy loan-to-value (LTV) ratio. For example, aim for an LTV ratio below 50% to reduce the risk of liquidation.

- Use stablecoins for borrowing. Borrow USDC OR EURC instead of volatile cryptocurrencies.

- Diversify your collateral. Use a mix of different cryptocurrencies as collateral to reduce the risk of liquidation due to price volatility in a single asset.

- Set up price alerts and use stop-loss orders.

- Leverage cautiously. Use leverage only when you have a solid understanding of the risks involved and a clear strategy for managing your positions.

- Monitor gas fees in case of EVM chains. Use tools like GasNow or EthGasStation to monitor gas fees and optimize your transactions.

- Stay informed about market conditions. Follow industry news and market updates from reputable sources.

By understanding and addressing these DeFi risks, investors can make more informed decisions and better protect their assets in the ever-evolving DeFi landscape. Remember, the key to successful DeFi investing is to stay informed, be cautious, and always prioritize security and risk management.