The world of decentralized finance (DeFi) is rapidly evolving, offering numerous opportunities for both lenders and borrowers. One of the most exciting developments in this space is Peer-to-Peer (P2P) token lending and borrowing. This innovative financial model allows individuals to lend and borrow cryptocurrency directly from each other without the need for traditional intermediaries. In this article, we’ll delve into what P2P lending and borrowing entail, their advantages and disadvantages, and how you can get involved.

P2P Lending and Borrowing Protocol

What is P2P Lending and Borrowing?

P2P lending and borrowing in the crypto sector operate similarly to traditional P2P financial systems but leverage blockchain technology for enhanced transparency, security, and efficiency. Here’s how it works:

- Lenders: Individuals can lend their idle cryptocurrencies to others in exchange for interest payments. This can be done by placing offers on a P2P lending platform.

- Borrowers: Individuals or entities can borrow cryptocurrencies by providing collateral. They agree to repay the loan with interest within a specified period.

Platforms like Texture, Rain.fi and many protocols on the Solana blockchain facilitate these transactions, providing an interface for users to connect their wallets, set terms, and execute smart contracts that automate and secure the process.

Advantages of P2P Lending and Borrowing

Decentralization:

- No Intermediaries: Transactions occur directly between users, reducing the need for banks or other financial institutions.

- Lower Fees: With fewer intermediaries, transaction fees are typically lower compared to traditional finance.

Accessibility:

- Global Reach: Anyone with an internet connection and a crypto wallet can participate, providing financial services to those without access to traditional banking.

- Financial Inclusion: Enables the unbanked or underbanked to access loans and earn interest on their assets.

Flexibility:

- Customized Terms: Users can negotiate interest rates, loan durations, and other terms to fit their needs.

- Variety of Assets: Supports a wide range of cryptocurrencies and tokens, offering diverse investment opportunities.

Earning Potential:

- Higher Returns: Lenders can earn higher interest rates compared to traditional savings accounts.

- Passive Income: Lenders can generate passive income from their idle crypto assets.

Transparency and Security:

- Smart Contracts: Ensure that the terms of the agreement are automatically enforced, reducing the risk of fraud.

- Immutable Records: All transactions are recorded on the blockchain, providing a transparent and tamper-proof ledger.

Weaknesses of P2P Lending and Borrowing

Volatility:

- Market Fluctuations: The value of cryptocurrencies can be highly volatile, affecting both the collateral and the loaned assets.

- Risk of Liquidation: Sharp declines in collateral value can trigger liquidations, leading to potential losses for borrowers.

Regulatory Uncertainty:

- Legal Risks: The regulatory landscape for crypto and DeFi varies by region and can change, impacting the legality and operation of P2P platforms.

- Lack of Consumer Protection: Unlike traditional banks, P2P platforms may not offer the same level of protection in case of disputes.

Security Risks:

- Smart Contract Vulnerabilities: Bugs or vulnerabilities in smart contracts can be exploited by hackers.

- Platform Reliability: The security and reliability of the P2P platform itself are crucial. Users must choose well-audited and reputable platforms.

Liquidity Issues:

- Lock-up Periods: Funds lent out are often locked for the loan term, reducing liquidity for the lender.

- Demand Fluctuations: The availability of borrowers and lenders can vary, affecting the ease of finding suitable matches.

Complexity:

- Technical Knowledge Required: Navigating and using P2P lending platforms can be complex for non-technical users.

- Risk Management: Effective participation requires understanding and managing the associated risks.

Getting Started with P2P Lending and Borrowing

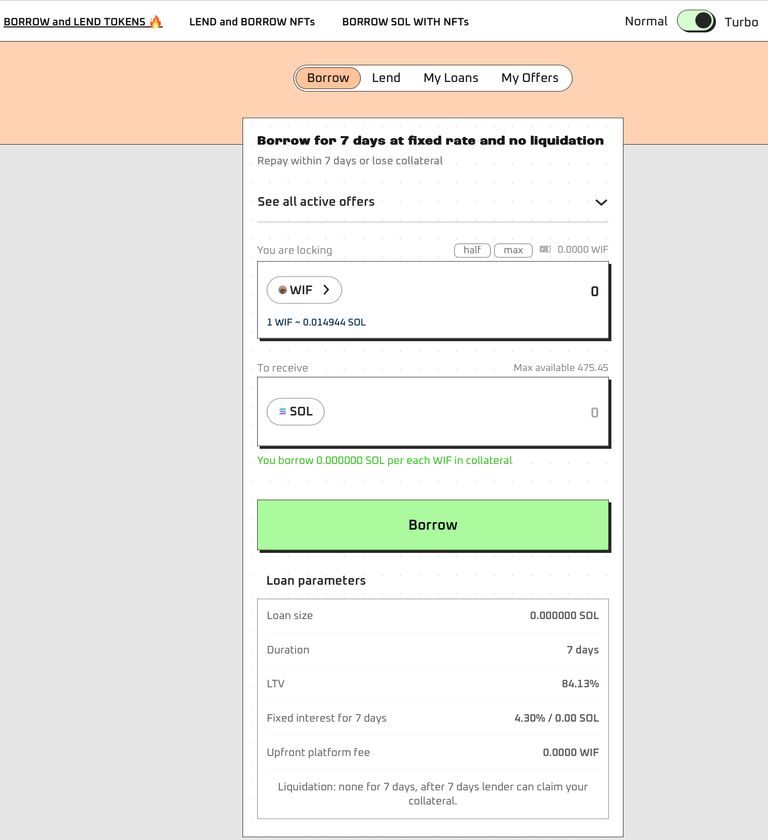

To participate in P2P lending and borrowing on platforms like Texture:

- Connect Your Wallet: Begin by connecting your crypto wallet to the P2P platform.

- Choose Your Role: Decide whether you want to lend or borrow.

- Lenders: Select the cryptocurrency to lend, set your interest rates and loan terms, and place your offer.

- Borrowers: Select the cryptocurrency you need, provide collateral, and agree to the lender’s terms.

- Execute Smart Contracts: Use the platform’s interface to execute smart contracts that enforce the terms of the loan agreement.

- Monitor and Manage: Regularly monitor your loans and manage your positions to mitigate risks.

P2P token lending and borrowing offer a promising avenue for maximizing the utility and profitability of your crypto assets.

While the advantages such as decentralization, higher returns, and financial inclusion are compelling, it’s crucial to be aware of the risks involved, including market volatility, regulatory uncertainty, and security issues

By staying informed and carefully managing your investments, you can effectively leverage P2P lending and borrowing to enhance your financial portfolio.