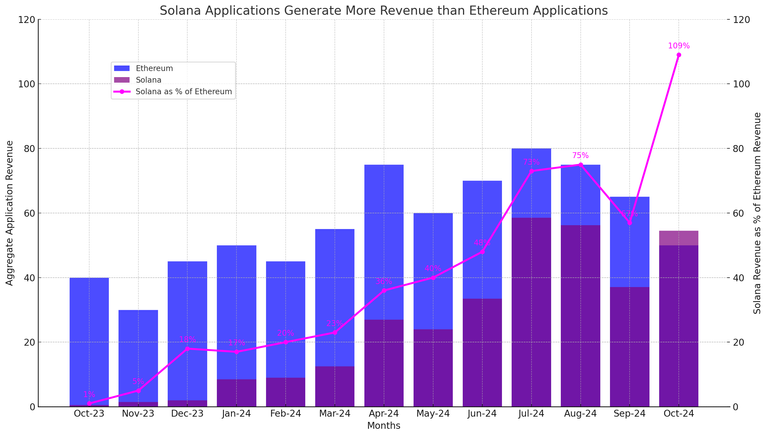

Aggregate Application Revenue of Ethereum and Solana, Source: Syncracy

Why TVL Alone Doesn't Define Success in Blockchain

For years, TVL has been a popular metric to measure the health of blockchain projects. However, focusing only on TVL can overlook critical indicators of true value, such as revenue generation and sustainable business models. Many projects, especially within Ethereum and various Layer 2 (L2) chains, seem heavily VC-backed, prioritizing rapid fund accumulation and inflated TVL figures rather than real value creation.

The Problem with TVL-Focused Projects

VC-backed projects often receive significant funding to create large pools of staked assets. This capital is then displayed as part of the project’s TVL, creating an illusion of popularity and liquidity. However, these assets are often not actively generating meaningful revenue. TVL in these cases is an attractive number but doesn’t always reflect user engagement, profitability, or the creation of useful services within the ecosystem.

Some protocols leverage TVL to attract even more VC funding, relying on growth hype rather than sustainable economics. Such an approach can lead to a bubble, with high TVL numbers but minimal value for users, little to no revenue, and fragile business models.

Solana's Focus on Revenue as an Indicator of True Value

Recent developments show that Solana’s ecosystem is surpassing Ethereum in terms of revenue generation from dApps. By focusing on total revenue instead of just TVL, Solana is creating an environment where dApps must prove their profitability and relevance to users. This approach attracts developers who want to build viable businesses rather than merely inflate metrics.

Revenue generation reflects real use cases, user satisfaction, and sustainable demand. It showcases that users are willing to pay for services, indicating a healthy cycle of capital flow. Unlike artificially inflated TVL numbers, revenue shows that these platforms have utility that users value enough to pay for.

VC-Driven Hype vs. Sustainable Growth

Ethereum and its Layer 2 solutions have become popular with VCs due to their established ecosystems. However, this reliance on external funding risks sustainability. Projects funded by VCs might prioritize high TVL and token price increases, but lack a clear path to long-term profitability. When VCs exit, the project can struggle if it lacks a solid revenue base.

In contrast, Solana’s revenue-first focus implies that the ecosystem is building a business model capable of surviving independently. This approach discourages the “pump-and-dump” cycle often seen with purely TVL-focused projects and attracts long-term, value-driven developers and users.

Wrap-Up: Revenue as the New Metric for Blockchain Success

While TVL offers a snapshot of funds circulating within a blockchain, revenue provides a far better measure of real adoption and value. Solana’s recent surpassing of Ethereum in revenue generated demonstrates that focusing on business fundamentals rather than inflating TVL might be the future of sustainable blockchain growth. As the blockchain industry matures, revenue-based models are likely to outlast those built solely on speculative metrics, setting the stage for a more stable and value-driven future in the space.

By emphasizing sustainable revenue and real economic activity, projects can ensure they’re not just surviving on hype, but actually providing value that users are willing to pay for. For investors, this shift from TVL to revenue is crucial for identifying ecosystems and projects with long-term potential.

¡Queremos leerte!

Entra y publica tus artículos con nosotros.

Vota por el witness @cosmicboy123