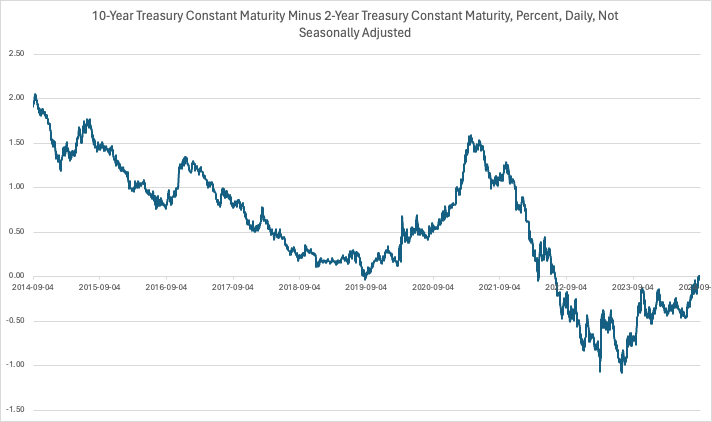

Recently, there’s been increasing buzz in the financial community around the 10-year and 2-year Treasury yield curve, with tweets like “10-year, 2-year very close to uninvert” sparking concern among investors. Let’s break down what this means, why it's important, and how it could impact your investment strategy.

What is the Yield Curve?

The yield curve is a graph that plots the interest rates (yields) of bonds with equal credit quality but different maturity dates. In a normal yield curve, long-term bonds (like the 10-year) have higher yields than short-term bonds (like the 2-year). This makes sense because holding a bond for a longer period involves greater risk, so investors demand higher returns.

However, sometimes the yield curve inverts, meaning short-term bonds offer higher yields than long-term ones. When this happens, it's often interpreted as a signal that investors expect weaker economic growth in the near future. Historically, an inverted yield curve has been one of the most reliable predictors of a recession.

What Does "Uninversion" Mean?

The term uninversion refers to the process of the yield curve returning to a normal shape, where long-term rates become higher than short-term rates again. While this may sound like a positive development, it’s often viewed with caution because uninversion typically occurs right before the economy enters a recession.

In other words, an inverted yield curve signals that a recession might be on the horizon, but when the curve uninverts, it can signal that we’re even closer to that economic downturn.

Why Should Investors Be Concerned?

1. Recession Predictor

Historically, every major recession in the U.S. has been preceded by an inverted yield curve. When the curve uninverts, it can serve as a confirmation that we’re heading into the later stages of an economic cycle. For equity investors, this could mean more volatility in the stock market and weaker corporate earnings.

2. Interest Rate Changes

The Federal Reserve typically cuts interest rates to stimulate the economy when a recession is imminent. This leads to the yield curve uninverting as short-term rates fall. While lower interest rates can provide temporary support to the stock market, they often signal weaker economic conditions ahead.

3. Stock Market Volatility

The period after an inversion, as the curve begins to uninvert, is often marked by heightened volatility in equity markets. Companies may start to experience slower earnings growth, consumer demand might weaken, and investors could shift from riskier assets (stocks) to safer investments (bonds or defensive stocks).

4. Shifting Economic Sentiment

Bond investors expect weaker economic growth or a potential recession, which is reflected in the narrowing difference between short-term and long-term yields. Uninversion could suggest a broader consensus that the Federal Reserve will need to step in with monetary easing, often a late-stage economic cycle maneuver.

What Could Happen Next?

Potential Rate Cuts: If the curve uninverts, it could signal that the Federal Reserve might consider loosening monetary policy (cutting rates). Rate cuts can support the stock market in the short term, but they are typically used to mitigate an economic downturn.

Slowdown in Growth: As the curve uninverts, economic activity may start to slow. Businesses might cut back on investments, and consumer spending could decline as recession concerns grow.

Stock Market Impacts: The stock market might experience heightened volatility. Sectors sensitive to economic growth, such as technology and consumer discretionary, could underperform. On the other hand, defensive sectors like utilities, healthcare, and consumer staples might see better performance as investors seek stability.

What Should Investors Do?

As the yield curve approaches uninversion, it’s important for investors to be prepared for potential economic turbulence. Here are some strategies to consider:

Reassess Risk: Evaluate your portfolio's exposure to high-risk assets. Consider reducing positions in growth stocks and sectors that are sensitive to economic slowdowns.

Focus on Defensive Sectors: Defensive sectors, such as utilities, consumer staples, and healthcare, tend to perform better during times of economic uncertainty.

Monitor Central Bank Actions: Keep an eye on Federal Reserve decisions regarding interest rates. If they begin cutting rates, it could signal more significant economic trouble ahead.

Hedge for Volatility: Consider using hedging strategies like options or increasing your exposure to bonds, which typically perform better in times of economic uncertainty.

The yield curve is a powerful tool for understanding where the economy may be headed. While the curve approaching uninversion might sound positive at first, it often signals that we’re nearing the later stages of the economic cycle. As investors, it’s crucial to stay vigilant, reassess your portfolio, and consider shifting to more defensive positions to protect against potential economic downturns.

Harry Potter Library (HPL) Community

Please join the HPL community. You will get upvotes for your posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: [해리포터의 도서관 (Harry Potter Library, HPL)](https://steemit.com/hive-140602/@harryji/ab7uv-harry-potter-library-hpl