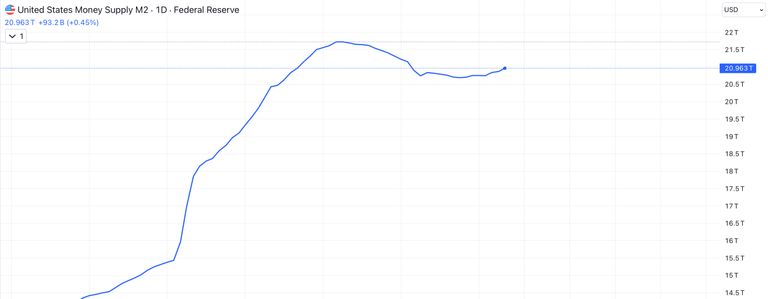

Understanding the correlation between global M2 money supply and the cryptocurrency markets is crucial for making informed investment decisions. Historically, the global M2 money supply, which encompasses cash in circulation, deposit currency, time deposits, and household savings deposits, has been a significant indicator for crypto market trends. This relationship has been evident in major bull runs such as those in 2017 and 2021.

Historical Context

The global M2 money supply has traditionally been a leading indicator for the cryptocurrency market cap. As global liquidity increases, investors have more capital to allocate towards riskier assets, including cryptocurrencies. This influx of liquidity drives up the market cap of digital assets, reflecting a strong positive correlation between M2 money supply growth and crypto market expansions.

Current Divergence

Recently, however, a notable deviation has emerged. In October 2023, the year-on-year change in global M2 money supply began to decline, while the cryptocurrency market cap continued to rise. This anomaly is primarily attributed to bullish news surrounding Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Funds (ETFs), which have spurred significant market optimism and investment.

Analysis

Historical Dependence on Liquidity: Historically, ample liquidity provided by a growing M2 money supply has fueled crypto market growth. Increased liquidity allows for more investment in riskier assets, driving market expansion.

Recent Deviation: The current divergence, driven by positive ETF news, indicates that specific market events can disrupt the usual correlation between M2 money supply and crypto markets. This suggests that while liquidity remains fundamental, other factors can temporarily dominate market sentiment.

Future Implications: It is crucial to assess whether this deviation is sustainable or if it will correct itself. Should global liquidity continue to decline, it may eventually constrain crypto market growth unless offset by other positive market developments.

Investment Strategy

For investors, the recent trends highlight the importance of balancing short-term opportunities with long-term macroeconomic conditions. While ETF approvals and other bullish events can drive short-term gains, the underlying macroeconomic environment continues to play a critical role. Therefore, staying informed about both specific market events and broader economic trends is essential for making well-rounded investment decisions.

Conclusion

The historical correlation between global M2 money supply and cryptocurrency markets underscores the importance of macroeconomic liquidity. While recent deviations due to positive ETF news suggest that other factors can also influence market trends, investors should remain cautious and informed. Balancing the immediate impacts of market-specific events with the broader economic context will be key to navigating future investment landscapes effectively.

By staying updated with these insights, our investment community can better understand the dynamics at play and make more informed decisions in the evolving crypto market landscape.