Investing in on-chain leveraged liquid staking product can offer both significant opportunities and risks.

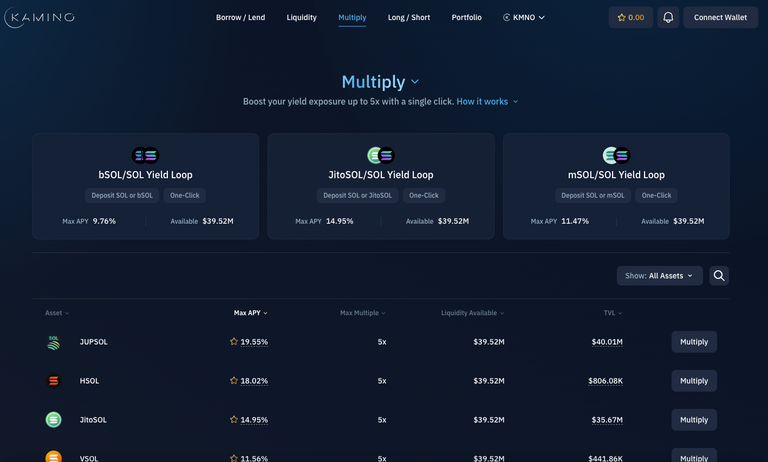

Kamini Finance

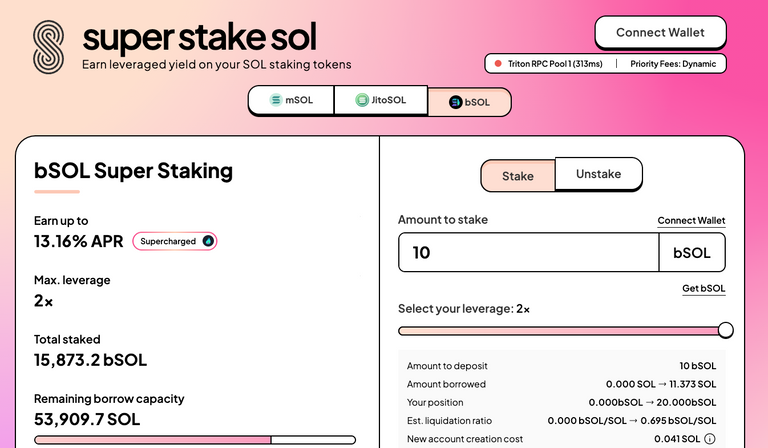

Super Stake SOL

Super Stake SOL

Opportunities

- Higher Yields: Leveraged liquid staking allows you to earn enhanced staking rewards by borrowing additional funds to increase your staked amount.

- Compounding Rewards: With leveraged staking, the compounded effect of staking rewards can potentially increase your overall return.

- Liquidity: Unlike traditional staking, liquid staking allows you to maintain liquidity, as you receive a derivative token representing your staked assets which you can trade or use in DeFi.

- Market Exposure: Leveraging enables greater market exposure, potentially leading to higher profits if the market moves favorably.

Risks

- Liquidation Risk: If the value of your staked assets falls significantly, you may face liquidation, losing your leveraged position.

- Interest Rates: Borrowing funds to leverage your staking position incurs interest, which can erode your profits if not managed properly.

- Smart Contract Risk: Leveraged liquid staking relies on smart contracts, which can be vulnerable to bugs or exploits.

- Market Volatility: The cryptocurrency market is highly volatile, and price fluctuations can impact your leveraged positions significantly.

Strategies to Maximize Profit and Avoid Liquidation

- Monitor LTV (Loan-to-Value) Ratio: Regularly check your LTV ratio and ensure it remains within safe limits. Consider repaying part of your loan or adding more collateral if the LTV ratio approaches the liquidation threshold.

- Diversify: Spread your investments across different assets or staking platforms to mitigate risk.

- Use Stop-Loss Mechanisms: Implement automated stop-loss orders to liquidate a portion of your position if prices drop significantly.

- Stay Informed: Keep up-to-date with market trends, platform updates, and interest rate changes to make informed decisions.

- Stable Collateral: If possible, use more stable assets as collateral to reduce the risk of liquidation due to market volatility.

Liquidation Details

If liquidation occurs:

- Position Liquidation: Your leveraged position will be forcibly closed, and the staked assets will be sold to repay the borrowed amount.

- Partial Recovery: Depending on the platform and the market conditions, you might recover a portion of your initial investment after liquidation. The exact amount depends on how much of your collateral was sold to cover the debt.

- Fees and Penalties: There may be additional fees or penalties associated with the liquidation process, further reducing the amount you can recover.

Steps to Take in Case of Liquidation

- Review Transaction History: Check the transaction details to understand the extent of the liquidation and the remaining assets.

- Evaluate Remaining Assets: Assess the remaining funds and consider rebalancing or reinvesting to recover losses.

- Plan Recovery Strategy: Develop a strategy to mitigate future risks, possibly by lowering leverage, diversifying investments, or using risk management tools.

By understanding these aspects, you can better navigate the opportunities and risks associated with Solana's on-chain leveraged liquid staking.