In a move that could significantly reshape the regulatory landscape for cryptocurrencies and financial markets, former President Donald Trump is reportedly considering Dan Gallagher, Robinhood's Chief Legal Officer, as a potential replacement for current SEC Chairman Gary Gensler. This development, if it materializes, could mark a dramatic shift in the SEC's approach to crypto regulation and broader financial oversight.

Trump Eyes Robinhood's Dan Gallagher for SEC Chair

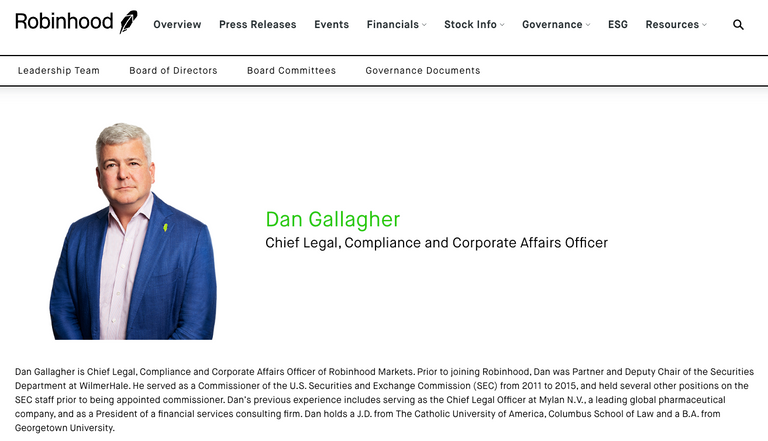

The Man Behind the Consideration

Dan Gallagher is no stranger to the SEC. He served as a commissioner from 2011 to 2015, gaining valuable experience and insights into the agency's operations. His current role at Robinhood, overseeing legal, compliance, and corporate affairs, puts him at the forefront of the evolving fintech and crypto landscape.

Gallagher's potential nomination is particularly intriguing given Robinhood's recent clashes with the SEC. The company faced a $65 million settlement in 2020 over order routing practices and is currently under scrutiny for potentially operating as an unregistered broker-dealer in the crypto space.

A New Direction for Crypto Regulation?

Gallagher has been vocal about his disagreements with the SEC's current approach to crypto regulation. He argues that the agency's aggressive enforcement actions against crypto firms are misguided and stifling innovation. In his own words, "Shooting at the good guys is a really bad policy."

If appointed, Gallagher could push for:

- Tailored rules for the crypto industry

- A baseline registration system for crypto exchanges and brokers

- A shift from enforcement-heavy tactics to more collaborative regulation

This approach could provide much-needed clarity for the crypto industry, which has long operated in a regulatory gray area.

Implications for the Market

A Gallagher-led SEC could have far-reaching implications:

- Crypto Market Boost: A more crypto-friendly SEC could encourage innovation and investment in the sector.

- IPO and SPAC Landscape: Gallagher's pro-business stance might lead to relaxed oversight of IPOs and SPACs.

- Regulatory Balance: The SEC's composition could shift, potentially leading to a more market-friendly approach across the board.

However, critics argue that a less stringent regulatory environment could expose investors to greater risks, especially in volatile markets like crypto.

The Bigger Picture

Gallagher's potential nomination reflects a broader trend of the "revolving door" between government and industry. While this brings valuable real-world experience to regulatory roles, it also raises concerns about conflicts of interest.

The consideration of Gallagher aligns with Trump's campaign promises to shake up financial regulation. It's part of a larger strategy to differentiate his potential administration from the current one, especially in areas like cryptocurrency where there's significant public interest and debate.

What's Next?

It's important to note that this is still speculative. The actual appointment depends on several factors, including the outcome of the 2024 election. If nominated, Gallagher would face a rigorous confirmation process, where his industry ties and regulatory philosophy would be closely scrutinized.

For investors and market participants, this potential change signals the need to stay alert to shifting regulatory winds. A Gallagher-led SEC could create new opportunities in crypto and fintech, but it might also bring unforeseen challenges.

As we move closer to the 2024 election, keep an eye on statements from both the Trump campaign and potential SEC chair candidates. Their views on key issues like crypto regulation, market oversight, and investor protection will be crucial in shaping the future of U.S. financial markets.

In the ever-evolving world of finance and technology, adaptability remains key. Whether it's Gallagher or another candidate at the helm, the SEC's direction in the coming years will play a pivotal role in shaping the investment landscape.