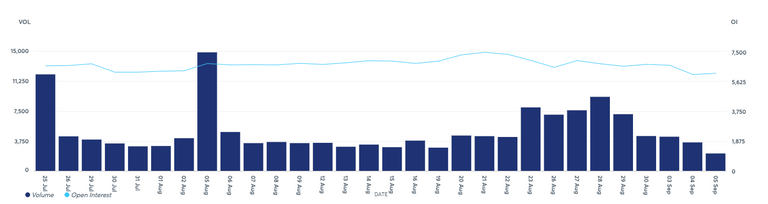

Ether Futures - Volume & Open Interest, CME

In a surprising turn of events, the cryptocurrency market has witnessed a significant shift in trading patterns, particularly concerning Ethereum.

Recent data reveals a notable decline in Ether futures trading volume on the Chicago Mercantile Exchange (CME), coinciding with the underwhelming performance of newly launched Ether ETFs.

Key Developments

- CME Ether Futures Volume: Trading volume plummeted by 28.7% to $14.8 billion in August 2024, marking the lowest level since December 2023.

- Ether Options: A sharp 37% decrease to $567 million was observed in Ether options trading.

- ETF Launch Impact: The decline follows the introduction of spot Ether ETFs in the United States in late July 2024.

- Price Performance: Ether's price dropped more than 22% to $2,512 in August, its largest monthly percentage decline since June 2022.

Market Analysis

The cryptocurrency landscape appears to be undergoing a significant transformation. The launch of spot Ether ETFs in the U.S. was anticipated to boost institutional interest in Ethereum.

However, the market response has been lukewarm at best. CCData, a respected digital asset analytics firm based in London, suggests that this reduction in trading volumes for ETH-related instruments points to a lack of institutional enthusiasm for Ether.

Broader Market Context

It's crucial to note that the timing of the U.S. spot Ether ETF launch coincided with a downturn in technology stocks. Given Ether's high beta of approximately 2.7, it's particularly susceptible to significant losses during risk-averse periods. This vulnerability may have contributed to the current market sentiment.

Shift Towards Bitcoin

Interestingly, while Ether struggles, Bitcoin seems to be gaining favor among investors:

- Bitcoin futures traded on CME increased by 3.74% to $104 billion in August.

- However, BTC options volume did see a 13.5% decrease to $2.5 billion.

This shift towards Bitcoin globally indicates a more cautious approach by cryptocurrency investors. The movement towards higher market capitalization assets like Bitcoin reflects a preference for perceived stability in uncertain market conditions.

Implications for Investors

Risk Aversion: The current trend suggests a market-wide move towards less speculative positions, favoring established cryptocurrencies over smaller, more volatile options.

ETF Performance: The underwhelming response to Ether ETFs may prompt a reevaluation of how cryptocurrency exposure is packaged for traditional investors.

Market Maturity: This shift could indicate a maturing market where investors are becoming more discerning and risk-aware.

As the crypto market continues to evolve, these developments underscore the importance of staying informed and adaptable. While Ether faces current challenges, it's essential to remember that the cryptocurrency market is known for its volatility and rapid changes. Investors should continue to monitor these trends closely and adjust their strategies accordingly.

Remember, this information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consider your risk tolerance before making investment decisions in the cryptocurrency market.