Could not owning Bitcoin be the same as betting against it?

If Bitcoin is to become the international settlement layer and preferred store of value going forward, not owning it now will effectively be the same as being short it.

Sure there are alternative ways to benefit from bitcoin being all of the above, like owning other cryptocurrencies that also do well, however, that's not really what we are talking about here.

We are talking about ignoring bitcoin in lieu of other more traditional financial investments.

Either Michael Saylor or Anthony Pompliano (I can't remember which) recently said something along the lines of "not owning bitcoin is effectively the same as being short bitcoin".

As I mentioned above, they don't mean in literal terms, but in theoretical terms.

If you decide to skip buying bitcoin and instead hold dollars, and the dollar loses 10% of it's value against bitcoin, then anyone not holding bitcoin just lost 10% of their purchasing power.

Notice how I priced dollars in bitcoin instead of bitcoin in dollars? Yea that may become a thing at some point...

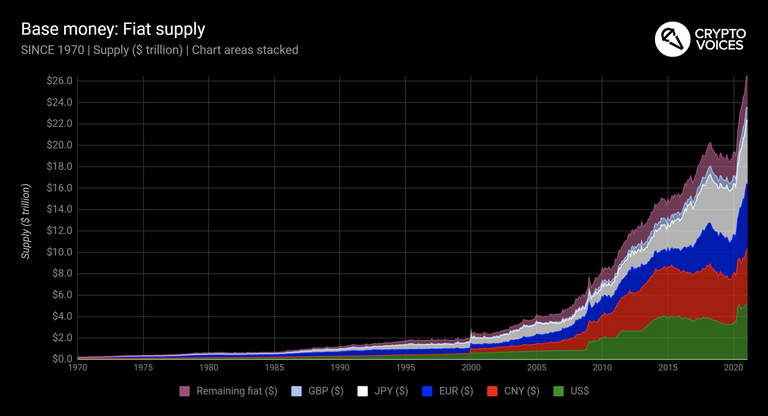

Anyways, to truly understand why that quote isn't as crazy as it initially sounds and to really hammer home that point, here's a chart of the total fiat money supply over the last couple decades:

(Source:

While this isn't technically the total fiat money supply, it's a chart of the top 30 floating currencies, which are used by 113 different countries and accounts for roughly 95% of total global GDP.

Pretty shocking the amount and rate of supply increase eh?

Why Bitcoin matters...

The above chart is a perfect and clear representation of why bitcoin matters and why it is needed in the first place.

The rate of increase has been truly alarming starting in about the year 2000, and really taking off around 2008.

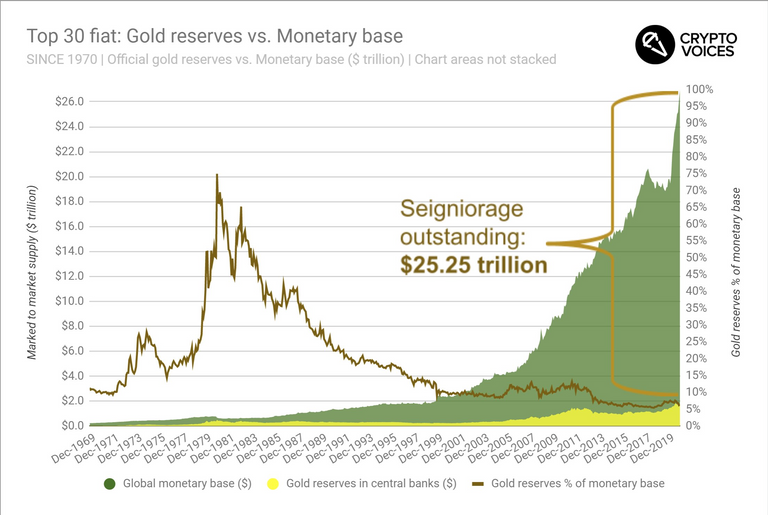

Gold had long been used as the means of backing in order to keep fiat money in check but that backing has been lacking for some time now.

In fact, central bank holdings of gold have actually been increasing for years but the rate of money supply has been far outpacing it...

Check it out:

(Source:

As you can see, the central bank total gold holds has increase from 1980, but in percentage terms compared to the total money supply, it has fallen off a cliff.

From 1980 until now, the percent of the money supply backed by gold has fallen from almost 80% to now almost 5%.

In crypto and laymen's terms, money printers go brrrrr.

There is literally no indication that this trend of increasing fiat money supplies changing any time soon and that is precisely why bitcoin is needed and matters in the first place.

While cash/fiat may work for payments, they don't work at all for preserving wealth.

There are a number of assets that preserve wealth, in fact just about everything priced in dollars technically can be a store of value, but very few things have the security of the bitcoin network, the immutability it offers, the ease of transfer, and the fixed supply all rolled into one.

When you combine it all together it makes for literally the perfect store of value and anyone not owning it is effectively short it.

Stay informed my friends.

-Doc

Whatever I’m gonna sell all the rest of mine and be super short bitcoin! It’s not for everyone all the time! I have that right if I wanna be short that is my prerogative!

Not sure why that hive curation trail is not upvoting you automatically yet!