Saturday saw nearly $2 billion in liquidations as the market tumbled to a two-month low.

Bitcoin saw one of its worst trading days on Saturday morning as the price continued its downward trend. The price had managed to hold steady above $50,000 on Friday. However, Saturday morning saw a large sell-off, triggering a cascade of liquidations at the same time.

Bitcoin hits two-month low

The bitcoin sell-off continued on Saturday morning in an accelerated manner as the price experienced a massive drop towards $42,000 on Binance. The price of bitcoin experienced a correction of approximately 40% from its all-time highs before seeing a slight recovery to around $48,000 at time of writing.

Source: Tradingview

Altcoins follow bitcoin’s decline

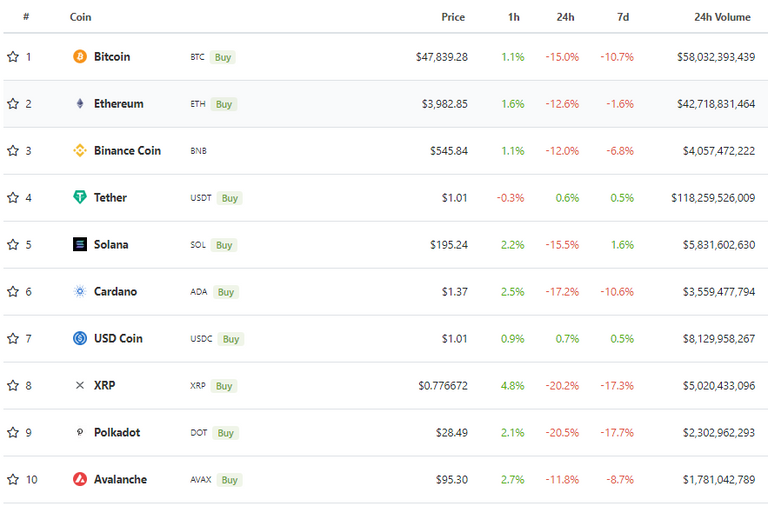

The price saw bitcoin drop to a two-month low, which ultimately triggered a market-wide sell-off on most altcoins. Similarly to bitcoin, major caps such as ethereum and Binance coin both experienced similar drops. The entire top 10 excluding stable coins, saw losses of up to 20%.

Source: Coingecko

Mass liquidations as market tumbles

The recent price activity has not fared well for traders. Over the course of the last twelve hours, the market experienced over $1.8 billion in liquidations. More alarming, is that $1.56 billion of that came within the last four hours.

According to Coinglass, over 80% of the liquidations were on long positions. With bitcoin claiming well over 60% of those liquidations. Ethereum saw over $388 million in liquidations while Cardano (ADA) was the next biggest altcoin with over $50 million in liquidations.

Binance and Okex accounted for approximately 53% of all liquidations across exchanges. While the market was slowly recovering, Binance CEO Changpeng ‘CZ’ Zhao had little to say, but tweeted “We are still here, buidling.” While FTX exchange CEO Sam Bankman-Fried adding “Yikes I chose a bad day to be flying.”

Possible reasons for the market dump

The market dump on a Saturday came as an unexpected time for market activity. The Saturday morning price dump appears to have taken many traders by surprise.

The recent announcement of the latest Covid-19 strain appears to be an underlying factor to the market’s recent bearish sentiment. However, after a week of the Omicron virus being detected. This price action appears to have been led by something else. CNBC host of Crypto Trader, Ran NeuNer, added his insight into the possible reasons for the dump. The host added several possibilities on Twitter, including “Too much leverage for too long. Evergrande potential default again! Stock Market nervous about Omicron and FED accelerated tapering. Biden has a cold.” he stated.

Total market cap still up 250% in 2021

It should be noted that even though bitcoin has declined nearly 30% since it’s all-time high nearly one month ago, the overall market capitalization is still up 250% since the beginning of 2021.With bitcoin up over 150% since January. While corrections are expected, the likelihood of an extended bull run could have seen complacency in the market sentiment which led to over-extended long positions.

Source: Tradingview

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.