Bitcoin (BTC) has just broken out from the $51,200 resistance area, reaching its highest price since May. It is potentially trading in a bullish impulse.

There are still two potential long-term wave counts at play. However, both short-term counts predict that BTC will continue increasing toward the $57,000 resistance area.

BTC bullish count

Currently, there are two primary potential wave counts for BTC. The first indicates that a new bullish impulse began on June 22.

If correct, BTC is currently in wave five (orange) of said impulse. The sub-wave count for the extended wave three is shown in black in the chart below.

The most likely target for the top of the upward move is between $57,500 and $59,500. This target range is found by a confluence of Fib targets. These include:

- 4.21 extension of wave one (orange).

- 1.61 projection of wave one (black).

- 0.618 projection of waves 1-3 (orange).

In addition to this, it’s also a horizontal resistance area.

In the longer term, the count suggests that cycle wave four (red) has ended. In this case, BTC has already begun the fifth and final cycle wave.

The only issue with this count is the extremely shallow wave four, which failed to even reach the 0.382 Fib retracement support level or complete a fourth wave pullback.

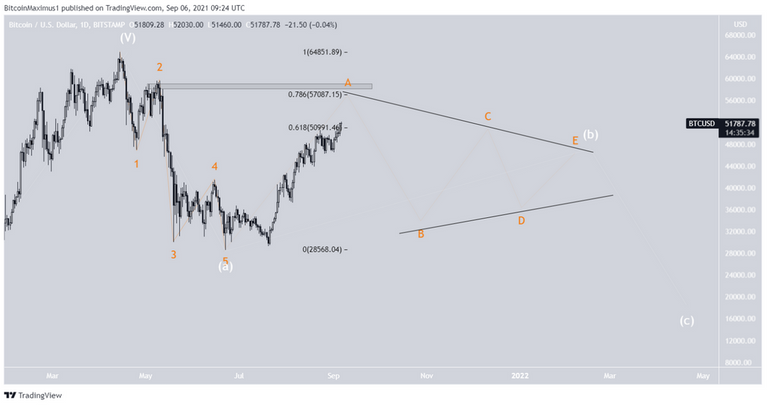

BTC corrective count

The corrective count suggests that BTC is still in a B corrective wave (white). The sub-wave count is shown in orange.

Due to the extreme extension, it’s only possible that the corrective wave develops into a triangle formation.

However, the short-term movement would be the same as in the bullish count, in which BTC reaches a high near $57,000.

However, the future movement would be different, since the corrective count suggests consolidation for a period of time before another drop.

In the longer-term count, the proposed move would complete part of cycle wave four (orange), which would eventually lead to another drop.

While the short-term count is somewhat unusual due to the extreme extension, the longer-term count fits better with EW rules.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.